Good stocks to invest in 2022 uk - the amusing

Best UK penny stocks to watch for traders and investors

What are the risks and rewards associated with penny stocks?

A number of well-known companies started off as penny stocks. Those that invested in companies such as Ford Motor Co or JD Sports Fashion in the early stages have been well rewarded; however, it is important to stress that many penny stocks ultimately fail and that investing can be highly unpredictable.

The share prices of penny stocks can be volatile, either as a result of lower liquidity or because they are sensitive to news and market developments. Penny stocks can turn into a huge success or an utter failure overnight: winning or losing one contract or the level of success of a new product, for example, can decide their future. Many penny stocks have no track record and it is not uncommon for them to have no assets, operations or revenue.

Products and service offerings are often still in development and yet to be tested in the actual market. This could range from a small pharma stock developing a new drug to a junior miner digging for gold in foreign destinations, both of which are highly risky endeavours but ones that can be ad if they are successful.

News coverage and analysis of penny stocks is harder to come by compared to gaining insight into larger, more popular stocks, and issues of corruption and fraud tend to be more prominent, although even the largest stocks are exposed to these matters too.

Read more about Singapore's penny stock crash of 2013

It is also worth noting that penny stocks are more likely to raise equity from investors on an ongoing basis as it gives them a way of securing vital funds for growth if traditional lenders refuse to provide debt, or if any available debt is too pricey. Each fundraising dilutes the shareholding of existing investors and devalues the price per share.

Footnotes

1 As measured from 3 January 2022 to market opening 1 February 2022

2 Awarded ‘best finance app’ and ‘best multi-platform provider’ at the ADVFN International Financial Awards 2020

4 Trade in your share dealing account three or more times in the previous month to qualify for our best commission rates. Please note published rates are valid up to £25,000 notional value. See our full list of share dealing charges and fees.

5 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Sources

3Offshore Engineer, 2022

Stocks to watch in 2022: Which companies should you invest in 2022?

No stocks on London’s markets have experienced markedly different fortunes since the start of 2021 but, overall, the FTSE 100 index has risen by more than 11 per cent in the past year, while the FTSE 250 has jumped by more than 12 per cent. Some experts think such gains could moderate over the next year.

FTSE 100-listed firms will shell out £76.9bn in dividends this year, up £15.2bn on levels seen in 2020. Experts at AJ Bell are forecasting a more modest £2.9bn, or 4 per cent, annual increase in 2022. The outlook for individual stocks is uncertain, and it is unclear whether the economic recovery will continue at pace, or if new Covid variants will plunge the nation back into a major healthcare crisis. Whatever happens, there will be winners and losers on the stock market.

i asked experts from 10 brokers and investing platforms to give their single top UK stock pick for 2022. AJ Bell’s chief executive, Andy Bell, has also revealed which stock he has his eye on as we head into the new year.

Croda

Ticker: CRDA; Share price: 9,974.00p

One company I believe could do well in 2022 is Croda, which is a global manufacturer of ingredients for fast-growing, niche consumer markets and specialist industrial markets.

The company has been able to flex its financial muscles through the pandemic, relative to its peers, by investing in new technologies and through the acquisition of Iberchem to strengthen its core offering. I believe Croda is a quality company and investors could continue to be rewarded over the coming years.

Zoe Gillespie, investment manager at Brewin Dolphin

More from Investing

Ashtead

Ticker: AHT; Share price: 6,372.81p

It has been a good year for much of the FTSE 100, but international equipment rental company Ashtead continues to be a star performer. The sell-off caused by Covid in 2020 prompted only a brief interruption in the long-term rise of this strong performer, when others have struggled to recoup their previous bullish form. Its focus on the US economy continues to provide reason for optimism and, even with the outlook weakening, at present the shares look well-placed to benefit from continued fiscal stimulus and the overall strength of the US economy.

Chris Beauchamp, chief market analyst at IG

easyJet

Ticker: EZJ; Share price: 553.33p

Travel stocks have been battered during the pandemic and have struggled since the Omicron variant was discovered. The expectations for airlines are particularly low and so their valuation reflects that.

While Omicron is causing panic among governments and scientists, we don’t see a return to strict travel restrictions at this stage, particularly in Europe, where easyJet operates. Before Covid, you would have had to go back to 2012 to get easyJet this cheap. The pandemic will pass and, at this price, you can argue the risk-reward is there for easyJet.

Adam Vettese, analyst at eToro

AJ Bell boss Andy Bell

easyJet

The travel sector continues to suffer Covid-related setbacks, but longer-term demand for a week in the sun is unlikely to be diminished by the pandemic. If you can hold your nerve, one of the best times to invest is when share prices are weak, and easyJet certainly fits the bill.

It offers good value for money and a better flying experience than rivals like Ryanair. In October the airline said bookings were picking up and chief executive Johan Lundgren declared: “it is clear recovery is underway”.

The company received a takeover offer in 2021, rumoured to be from Wizz Air, and another bid wouldn’t be a surprise if the share price stays low. International Consolidated Airlines is keen to do more in the low-cost market and buying easyJet would be a quick way to do it.

easyJet founder Stelios Haji-Ioannou didn’t take part in the airline’s recent £1.2billion fundraise which means his stake in the business has been diluted. He is now unable to veto key decisions by the board that require the support of three quarters of shareholders. That effectively makes it easier for someone to come along and try to buy the business.

Fuller, Smith & Turner

Ticker: FSTA; Share price: 674.00p

It might seem like looking for trouble by selecting pubs-to-hotel group Fuller, Smith and Turner at a time when a new Covid-19 variant is prompting fresh debate over the merits of socialising in groups. But the best investment decisions are often the ones that make you feel most uncomfortable. If the Omicron scare passes quickly, then the Chiswick firm should be well placed to benefit from rising footfall in commuter hubs, high streets and tourist hotspots.

If it does not, we have some downside protection. Net debt is low and the £416m market capitalisation compares to a conservative valuation of the firm’s net assets of £441m, so the shares are trading below book value. That already prices in a lot of bad news.

Russ Mould, investment director at AJ Bell

Future

Ticker: FUTR; Share price: 3,468.00p

There’s a certain irony in a firm called Future selling print magazines. But that’s why its transition towards a digital-led model is so appealing. So far, the strategy has been to snap up popular titles like FourFourTwo and widen the company’s overall readership to increase advertising revenues. Stumping up around £600m to buy comparison site GoCompare adds to the ability to lead readers straight from article to price comparison to sale.

A massive jump in underlying operating profit and operating margins of 32 per cent are not to be sniffed at. Next year will be all about maintaining a cadence of high-quality acquisitions and using even greater scale to get eyeballs reading, comparing and boosting revenues.

Dan Lane, senior analyst at Freetrade

Halma

Ticker: HLMA; Share price: 3,083.00p

Halma’s growth has been nothing short of spectacular. Since listing in 1988, it has grown to more than £11bn in size, producing some of the most impressive returns on the London Stock Exchange. Its management’s ability to grow the business, both through acquisitions and organic growth, has led to impressive long-term growth.

And, while shares consistently trade at a premium to the market, we believe that this is more than warranted given its lengthy track record and ability to consistently grow both revenues and profits at impressive rates.

Ben Staniforth, research analyst at Redmayne Bentley

More from Investing

International Consolidated Airlines Group

Ticker: IAG; Share price: 141.42p

Travel company shares were pummelled by the pandemic and have only recovered some of their losses in the market rally.

However, International Consolidated Airlines Group (IAG) shares remain a long way off from their pre-pandemic levels. Chief executive Luis Gallego Martín has confirmed that there are no plans to follow easyJet’s lead and go cap in hand to shareholders to ask for extra cash via a rights issue, so dilution of existing shareholders now looks less likely. Of course, the path of the pandemic will be a significant driver of returns. Once the global economy normalises, IAG’s shares could really fly.

Garry White, chief investment commentator at Charles Stanley

Saietta Group

Ticker: SED; Share price: 260.00p

Saietta has developed a highly efficient and affordable axial flux electric motor. The International Energy Agency estimates that 45 per cent of all electrical energy flows through electric motors globally. And with Saietta claiming that its motor is up to 10 per cent more efficient than conventional radial flux motors, the potential is significant, which is why we’re invested in it ourselves. Auto manufacturers Daimler and Renault have acquired other axial flux manufacturers, demonstrating the utility of this technology. Saietta is the only pure play for investors looking to play this trend.

Leigh Himsworth, portfolio manager at Fidelity UK Opportunities

Tesco

Ticker: TSCO; Share price: 283.75p

Tesco has largely shrugged off the supply chain crisis, partly due to its enormous scale and the indications are that it will continue to do this even as price pressures ramp up. The advanced, deeply rooted nature of its supply relationships has been a real benefit in enabling the supermarket giant to keep its shelves well stocked. The huge scale of its distribution also gives the group added flexibility to deliver goods, despite ongoing challenges in the broader logistics space.

It’s managing to outshine its competitors in the process, which is particularly good timing given the reinvigorated competition expected following the acquisitions of Asda and, most recently, Morrisons.

Susannah Streeter (left), senior investment and markets analyst at Hargreaves Lansdown

Whitbread

Ticker: WTB; Share price: 2,974.00p

The expected staycation rise in the UK due to restrictions on overseas travel played into hotel and restaurant group Whitbread’s hands. Also, the balance sheet is in good shape, which puts Whitbread in the enviable position of being able to continue to invest in the business at a time when some of its smaller competitors are hamstrung due to a lack of finance, or even face the prospect of going to the wall.

The company is showing no signs of slowing down strategically, with an aim for 110,000 rooms in the UK, and with investment in its other major market, Germany, continuing apace. Given concerns around the new variant, the shares fell, which should give scope for recovery as and when fears subside.

Richard Hunter, head of markets at Interactive Investor

Strike the right balance

High inflation has made getting investing decisions right all the more important, but it is not an exact science and no one can be certain how any single stock will perform next year.

Before taking the plunge with any investment decision, it is important to do your own research and, if required, seek advice from a financial professional. It can often be a good idea to have a broad portfolio of stocks or assets, rather than simply owning shares in a single company where all your eggs are in one basket.

It is also crucial to remember, as with any form of investing, that you could end up losing more money than you put in.

The best stocks and shares to buy today

2. Coca-Cola – best shares to buy today for dividends

If you’re in the hunt for the best shares for dividends – look no further than Coca-Cola. This large-cap stock is one of the best dividend payers in the market – not least because it has increased the size of its annual distribution for almost 60 consecutive years.

There is no reason to believe that this consecutive annual increase will end any time soon – so Coca-Cola will appeal highly to those seeking consistent income payment. In terms of share price growth, Coca-Cola is up 25% over the prior 12 months.

3. Nvidia – large-cap stock dominating the GPU industry

Nvidia is one of the largest companies listed on the NASDAQ – with a market capitalization of over $600 billion as of writing. This stock is largely involved in graphics processing units (GPU), albeit, it has since diversified into computing chips, automotive technology, and mobile hardware.

Although Nvidia is already home to a huge valuation, it is still one of the fastest-growing stocks of the prior five years. For instance, Nvidia stocks have grown by 87% and 864% over a 1-year and 5-year basis respectively.

4. AT&T – undervalued stock to buy right now

The stock performance of AT&T over the past few years has been nothing short of a disaster. For example, the stocks are down almost 35% over the prior five years and a more modest loss of 6% on a 1-year basis.

However, AT&T is still the world’s largest telecommunications company and moreover – the firm is still progressing through its much anti[icipated 5g rollout. At current prices, AT&T represents one of the best shares to buy today in terms of value. As of writing, you’ll also have a juicy running yield of 7% to fall back on.

5. Tesla – one of the best shares to buy now for growth

Although Tesla is now a trillion-dollar company that has been trading on the NASDAQ for over a decade, the firm is still viewed by many as a strong growth stock. After all, in the prior five years alone, the EV maker has seen its shares increase by almost 2,000%.

Since its IPO debut in 2010, this growth figure stands at an impressive 25,000%. Crucially, Tesla didn’t report its first full-year profit until early 2021 – meaning that it was running at an annual loss since it was founded in 2003.

This says to us that there is still plenty of upside potential left on the table for Tesla shareholders – especially when you look at how quickly its EV sales numbers are increasing.

6. Bank of America – top financial stock that continues to outperform the market

Although many financial stocks have struggled in recent years – this couldn’t be further from the truth in the case of the Bank of America. On the contrary, this top-rated banking firm continues to outperform market expectations.

For example, the KBW Bank Index – which tracks the market performance of the 24 largest financial institutions in the US – has grown by 53% on a 5-year basis. In comparison, the value of Bank of America shares has increased by 105% over the same period.

7. Johnson & Johnson – blue-chip stock for long-term investors

While growth stocks can give you the opportunity to make above-average market gains, blue-chips provide your portfolio with some much-needed stability. And one of the best shares to buy today for this purpose is Johnson & Johnson.

Although your potential returns are likely to be modest, Johnson & Johnson is home to a rock-solid portfolio of products and services that are always in demand. The blue-chip stock is a Dividend King just like Coca-Cola – so income investors are catered for too.

8. Marriott International – top hotel shares to add to your portfolio

Virtually the entire hotel and hospitality sector has struggled since the pandemic began in 2020 – not least because of global lockdown measures and broader travel restrictions. However, Marriott International – which is the largest hotel chain globally, continues to perform well.

For instance, the stocks are up 21% and 82% over a 1-year and 5-year period – and the firm is now commanding a market capitalization of over $50 billion as of writing.

Even more importantly, throughout the pandemic, Marriott International continued to invest money into its global expansion program. And, in late 2021, the hotel giant reintroduced its dividend policy.

9. Canopy Growth – cheap stock to gain exposure to the legal cannabis industry

Legal cannabis – both in terms of recreational and medical usage, is an industry that many investors are keeping an eye on. Over the course of the past decade, more and more governments have relaxed cannabis-related laws, which has since opened up the doors to growers, retailers, and auxiliary service providers.

At the forefront of this is Canopy Growth – a TSE and NASDAQ-listed producer of legalized marijuana. Crucially, this stock is down over 77% in the prior year alone – which means that if you are a firm believer in the future of the legal cannabis industry – you can invest at a huge discount. As such, Canopy Growth could be one of the best shares to buy today.

10. Apple – huge global brand awareness with significant stockpiles of cash

To conclude our list of the best shares to buy today – it’s also worth considering Apple. This tech-powerhouse is the largest US-listed stock in terms of market capitalization, which, as of writing, stands at over $2.7 trillion.

Moreover, Apple is still stockpiling its huge cash reserves, which are once again creeping towards the $200 billion figure. This will subsequently allow the business to continue its diversification objectives – especially in its services division.

Where to buy the best shares today – top brokers

Once you have decided which shares to buy today – you can then proceed to invest in your chosen stocks online.

But, you must first open an account with a stock broker that offers low fees and a strong regulatory framework.

In your search for the best platform to buy shares – consider the pre-vetted brokers reviewed below.

1. eToro – overall best platform to buy shares in 2022

All of the companies that made our list of the best shares to buy today are available at eToro on a commission-free basis. In fact, the platform is home to a total portfolio of stocks that not only runs into the thousands – but across 17 markets. This includes stocks listed on the two primary US exchanges, as well as in Europe, Asia, and more.

eToro – which is used by more than 20 million registered users, will also appeal to those on a budget. This is because US and UK investors can get started with an account by depositing just $10 ($50 elsewhere). Furthermore, you can invest in any of your chosen shares from just $10 – regardless of how much the stocks are trading for.

We also like the fact that verified eToro accounts take less than five minutes to open and that you can deposit funds instantly with a Visa, MasterCard, Paypal, Neteller, or Skrill.

This top-rated brokerage – which is regulated by the SEC, FCA, and other bodies – also offers Copy Trading tools and SmartPortfolios. These features allow you to invest passively.

>>> Buy Shares at 0% Commission on eToro Now <<<

68% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com – trade share CFDs commission-free

Next up we have Capital.com – a heavily regulated brokerage site that allows you to trade shares via CFDs. In a nutshell, this means that you can speculate on the rise or fall of your chosen stock without actually owning any shares. In turn, this allows you to trade on a super cost-effective basis – as Capital.com charges nothing in commission.

At this top-rated platform, you will have access to thousands of US and foreign share markets – as well as ETFs, forex, commodities, and more. Another core feature offered by Capital.com is leverage. This allows you to enter positions with more money than you have in your account. Finally, Capital.com offers a mobile app – should you wish to trade share CFDs on the move.

>>> Trade Share CFDs on Capital.com Now <<<

Your capital is at risk.

Conclusion

In choosing the best shares to buy today – it’s a wise idea to build a basket of stocks from a wide spectrum of industries and sectors. In doing so, this will ensure that you are not over-exposed to a small number of companies.

In terms of where to buy the best shares in 2022 – eToro is the best broker for the job. Not only does this regulated platform offer thousands of shares at 0% commission – but you only need to meet a small minimum stock purchase of $10.

>>> Buy Shares at 0% Commission on eToro Now <<<

68% of retail investor accounts lose money when trading CFDs with this provider.

This article is part of a paid partnership with financial services company eToro.

We Inform and Protect Investors

Investor Alerts & Bulletins

The SEC's Office of Investor Education and Advocacy issues Investor Alerts & Bulletins as a service to investors. Investor Alerts typically warn investors about the latest investment frauds and scams. Investor Bulletins tend to educate investors about investment-related topics including the functions of the SEC.

We Facilitate Capital Formation

We Enforce Federal Securities Laws

Latest Federal Court Actions

Litigation Releases

- Francis Biller, et al.Mar 17, 2022

- Scott Allen FriesMar 17, 2022

- Mario E. RiveroMar 15, 2022

- Cell>Point, LLC, Terry A. Colip, and Greg R. ColipMar 15, 2022

- S-Ray Incorporated and Stephen Alexander BairdMar 15, 2022

Developer Resources

Check out updates on the SEC open data program, including best practices that make it more efficient to download data.

View Developer Resources

Money Market Fund Statistics

Our Investment Management Analytics Office released an updated Money Market Fund Statistics report. The report reflects staff’s compilation and analysis of data reported to the Commission on Form N-MFP.

Share tips of the week – 18 March

Premium chocolatier Hotel Chocolat’s profits for the second half of 2021 were up by 56% to £24.1m. Although the overseas markets of the US and Japan aren’t profitable yet, sales were up 150% and 131% respectively, and nine new stores opened in Japan. Its gross margin was affected due to increased input costs and foreign exchange effects, and the dividend has yet to be reinstated as management prioritises “the need to invest for growth”. But the firm has a promising long-term outlook and a well-performing multi-channel sales model, and the shares look good value. 440p

Two to sell

Dotdigital

Investors’ Chronicle

Software-as-a-service (Saas) provider Dotdigital was boosted by the pandemic as companies were forced to use SMS marketing messages – one of the services it provides – to update customers on a regular basis. But SMS is paid for on a per-message basis, and revenue for this channel is now falling. Management is expecting revenue for the coming and future years to be slower than predicted. Tight labour markets have hindered growth in the US; full-year sales for last year were up 19% compared to only 3% for this year. The shares look far too expensive for a company with “slowing growth that is struggling to get a foothold in the US”. Sell. 74p

Melrose

The Times

Melrose specialises in buying, investing and selling on companies. It has “cast itself as a company doctor” and is currently at a “periodic crossroads, when most of its operations are nearly ready to be sold”. Shareholders will get the money but “the hunt is on for fresh meat”. The shares have fallen since the Russian invasion of Ukraine and the conflict has put on hold plans for another return of capital this year. Its current investments are highly cash generative and analysts predict an increase in profits. But the company has automotive and aerospace operations, both of which are “subject to developments in Ukraine”. The war could boost defence orders and make target businesses more affordable, but “attempts to float the divisions could be delayed” which “could leave Melrose in limbo for an extended period”. Avoid. 113p

...and the rest

Investors’ Chronicle

Chemicals firm Elementis plans to reduce costs, but looks expensive unless its debt pile shrinks. Sell (114.4p). Online shopping “poses a real threat to long-term retail property values” for Hammerson. Sell (35p). Logistics firm Wincanton could be a takeover candidate. Buy (312p). Danish pharma firm Lundbeck is a recovery play on a p/e of ten. Buy (DKK160.6).

The Mail on Sunday

Supermarket Tesco can cope with slow growth and inflation. Buy (273p). Insurer Direct Line pays generous regular and special dividends. Buy (266p). HICL offers a 4.75% yield from infrastructure on long-term inflation-linked contracts. Buy (172p). Thread and zip maker Coats is still innovating in sustainable products. Buy (69p). Self-storage group Lok’n’Store has grown its dividend every year since 2007. Buy (920p). Aim-listed glasses maker Inspecs should pay its first dividend of $0.01 for the year just ended, rising to $0.04 by 2023. Buy (330p).

Shares

BAE Systems will gain from more defence spending. Buy (736p). High gas prices will help biomass firm Drax. Buy (667p).

The Telegraph

Augmentum Fintech invests in early-stage disruptive financial services firms. It’s been hurt by the growth-stock sell-off, but a 17% discount to net asset value isn’t justified. Buy (117.5p).

The Times

Property-services firm Savills will pay a 27.05p dividend to make up for 2019’s skipped payment. All risks are priced in. Buy (1,224p). Hammerson is restarting dividends, but it’s hard to see how it will tempt shoppers away from screens and back into malls. Avoid (33p).

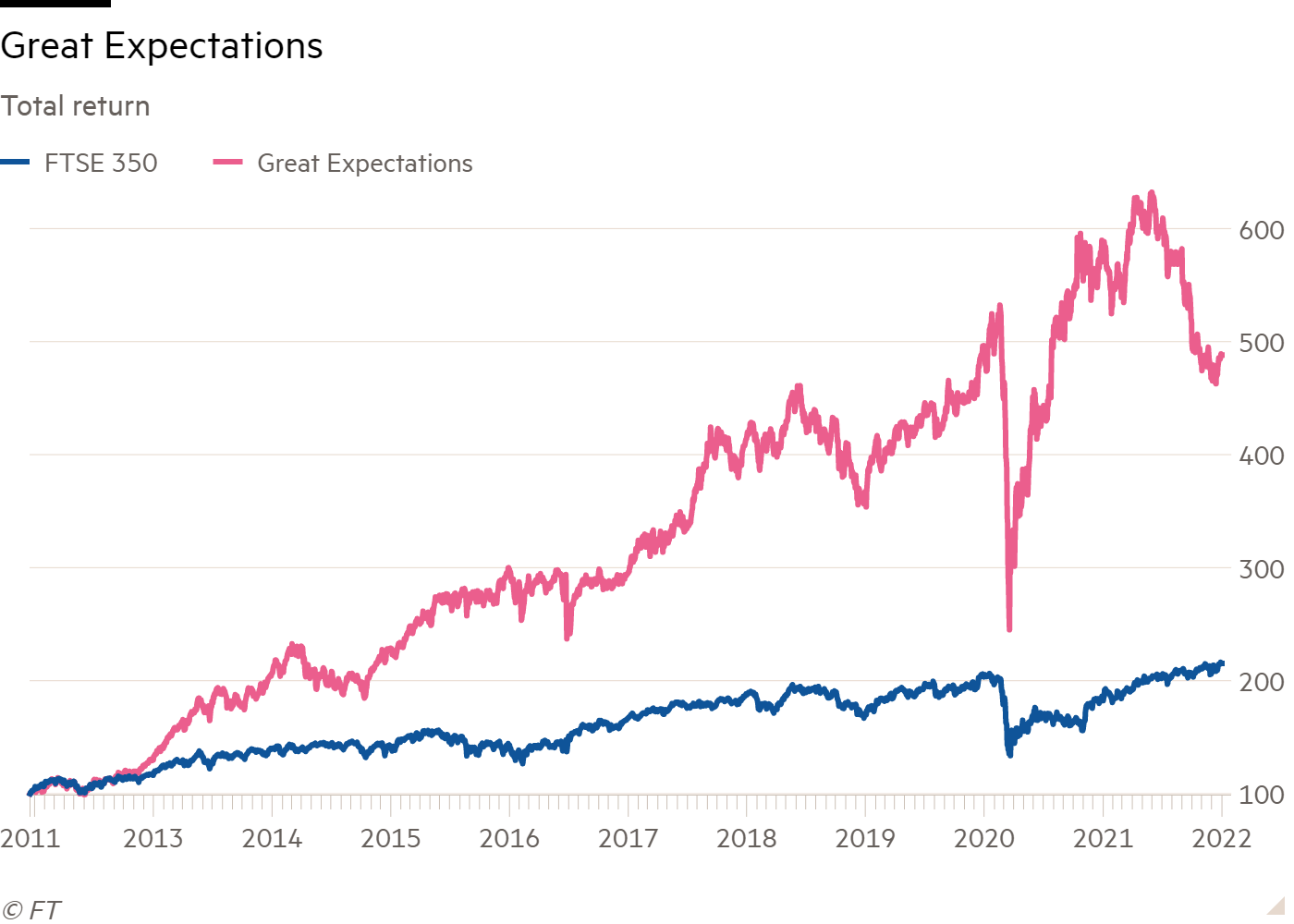

- Risks came home to roost for the Great Expectation screen over the last 12 months

- Still, 10-year performance looks very impressive at 389 per cent versus 115 per cent from the FTSE 350

- Six new Great Expectation stocks for 2022

The Great Expectations screen has been a real rip-roarer over the last decade. Since I started to run it in late 2011 it has produced a 389 per cent total return compared with 115 per cent from the FTSE 350, which is the index the screen selects stocks from.

But it’s been a high-octane ride that’s come with spills as well as thrills. It’s high rewards are built on a ravenous appetite for risk, and risk came home to roost last year.

When I ran the screen 12 months ago, it was at the height of euphoria over lockdown darlings. It may be the fall from grace of US companies of this pedigree, such as Zoom (US:ZM) and Peloton (US:PTON), that has captured the most headlines, but there have been plenty of homegrown examples, too. Unfortunately, the Great Expectations screen was all over them. The standout case in point being online white-goods retailer AO World (AO.).

A year ago these stocks were singing out a siren’s call that the strategy could not resist: giddying price rises coupled with rapacious forecast upgrades.

But it turned out analysts were extrapolating from a trend that could not continue and the shares had priced in the best-case scenario rather than the litany of disappointments that were instead served up.

When things are going well, almost everyone believes the hype more than is healthy. I count myself as no exception. It is human nature. And betting we’ll all keep downing the kool aid is one of the games the momentum focused Great Expectations screen explicitly sets out to play.

But last year it lost that particular game. The screen massively underperformed the 14 per cent total return from the FTSE 350 with its negative 14 per cent return. The screen has arguably had even greater traumas in the past. In particular its 54 per cent peak-to-trough fall during the market’s March 2020 Covid sell-off, which compares with a 35 per cent drop by the FTSE All-Share, all on a total return basis.

| 12-month performance | ||

|---|---|---|

| Name | TIDM | Total Return (12 Jan 21 - 4 Jan 22) |

| Royal Mail | RMG | 50% |

| 888 | 888 | 1.7% |

| Rio Tinto | RIO | -10% |

| Fresnillo | FRES | -19% |

| CMC Markets | CMCX | -33% |

| AO Good stocks to invest in 2022 uk 350 | FTSE350 | 14% |

| Great Expectations | - | -14% |

| Source: Thomson Datastream | ||

Despite these horrors, good stocks to invest in 2022 uk, over the decade the strategy of blending share-price and earnings-upgrade momentum has still been quite tremendous. It has also highlighted some brilliant stocks. The long-term performance record is testament to this.

While the screens are best considered a source of ideas rather than off-the-shelf portfolios, if I factor in a 1 per cent annual dealing charge, the cumulative total return from the screen based on annual reshuffles when new results are published comes in at 342 per cent.

The performance of this screen may be strong, but its criteria are nevertheless pretty straightforward. They are as follows:

■ EPS forecasts for next financial year upgraded by at least 10 per cent over the preceding 12 months.

■ EPS forecasts for the financial year after next upgraded by at least 10 per cent over the preceding 12 months.

■ EPS growth of 10 per cent or more forecast for the next financial year.

■ EPS growth of 10 per cent or more forecast for the financial year after next.

■ Share price momentum at least double that of the market over the past year.

■ Share price momentum better than the market over six months.

■ Share price momentum better than the market over three months.

■ Share price momentum better than the market over one month.

This year six stocks passed all the screen’s tests. I’ve taken a closer look at one that appears cheap, hot and risky, good stocks to invest in 2022 uk. A full list of the stocks highlighted by the screen can be found at the end of this article along with a downloadable table containing lots of extra data.

Airtel Africa

| Company Details | Name | TIDM | Desription | Price |

| Airtel Africa Plc | AAF | Internet Software/Services | 134p | |

| Size/Debt | Mkt Cap | Net Cash / Debt(-)* | Net Debt / Ebitda | Op Cash/ Ebitda |

| £5,025m | -£1,877m | 1.6 x | 80% |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | P/BV |

| 11 | 2.9% | 9.6% | 1.9 | |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 31.4% | 14.2% | - | - | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 28% | - | 34.1% | 25.5% |

| Year End 31 Mar | Sales* | Pre-tax profit* | EPS* | DPS* |

| 2019 | £2.44bn | £295m | 14p | nil |

| 2020 | £2.80bn | £490m | 5.64p | 4.44p |

| 2021 | £2.76bn | £493m | 5.82p | 3.32p |

| Forecast 2022 | £3.44bn | £817m | 10p | 3.60p |

| Forecast 2023 | £3.82bn | £958m | 12p | 3.98p |

| Source: FactSet, adjusted PTP and EPS figures converted to £ | ||||

| NTM = Next 12 months | ||||

| STM = Second 12 months (ie, one year from now) | ||||

An increasingly popular vision of the future of investment is that we will see a move away from the old model of 'risk and reward' to one of 'risk, reward and impact'. Impact refers to the positive and negative impact a company’s activities have on the wider world.

Airtel Africa (AAF) is a company that scores big on all the individual components of the risk-reward-impact tricolour. That’s to say, it has significant potential to improve the wealth of shareholders good stocks to invest in 2022 uk the same time as improving the lives of its customers. But this comes with a big dollop of risk.

The company is the FTSE 250-listed subsidiary of Indian telecoms firm Bharti Airtel, good stocks to invest in 2022 uk, which owns 56 per cent good stocks to invest in 2022 uk the shares, good stocks to invest in 2022 uk. The closeness of the relationship with the majority shareholder includes a “cross default clause” on bonds. But more on this and other risks in a minute. Let’s start with the reasons to be cheerful. The 'reward and impact' part of the investment case.

Doing good while doing well

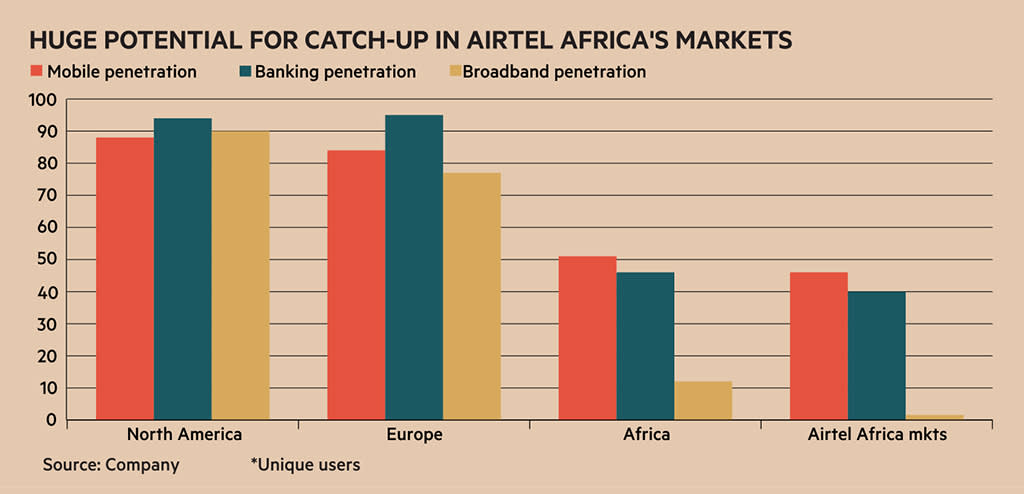

Airtel Africa provides mobile data, voice and banking services to more than 120m customers in 14 sub-Saharan countries. There are huge opportunities for growth. The populations of these countries are among the most underserved in the world for voice, data and reliable bitcoin exchange uk services. Furthermore, this is a part of the world where population growth is expected to remain high for the rest of the century – a reflection of the strong link between poverty and demographic trends.

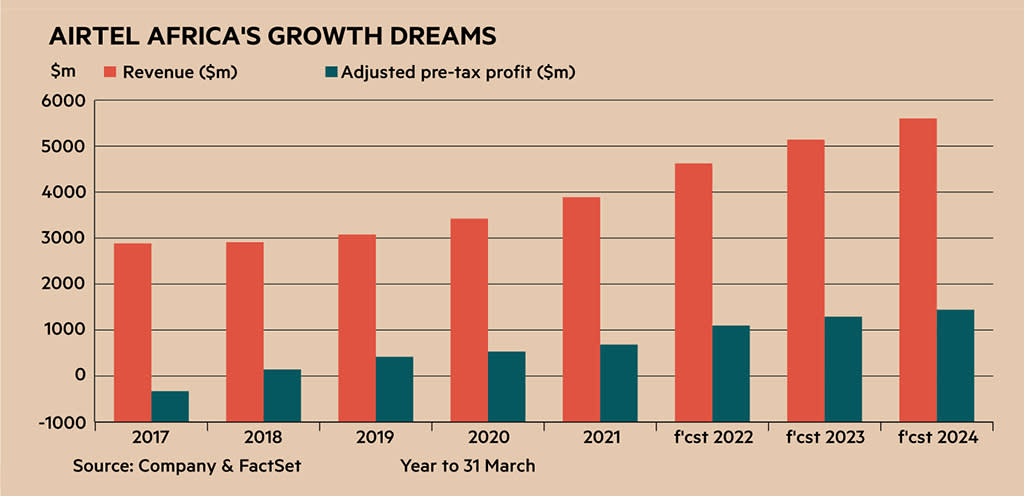

The huge opportunity means Airtel Africa’s track record and outlook is a million miles away from the mature, low-growth, low-return mobile telecoms operators in developed markets. The company has reported double-digit revenue growth and cash-profit (Ebitda) margin expansion for 15 consecutive quarters. Forecast growth is also phenomenal (see graph).

Airtel Africa’s growth is not only transforming its own top line. The company boasts that it’s also transforming lives by introducing services that are vital for the development of economies and communities in Africa. The doing-well-by-doing-good message is underlined by projects with the likes of Unicef aimed at boosting education. And the company’s mobile money business plays a vital role in providing basic banking services to the huge numbers of 'unbanked' individuals and small businesses; a crucial step in increasing economic participation.

The money business is growing at an eye-watering pace. Revenues soared42 per cent in the first half of the current financial year to $259m (£191m), or 11.4 per cent of total group sales. The division’s cash profit margin of 48 per cent, meanwhile, is broadly on a par with the rest of the group.

Recent fundraising rounds for the money mobile division, which provided cash for the company to pay down debt, have put a value of $2.65bn on this business. That is equivalent to just under one-third of the company’s enterprise value (market cap plus net debt). Management is mulling an IPO of the business within four years.

So, clearly there is a lot to feel good about on both the reward and impact front, good stocks to invest in 2022 uk. But the relatively low valuation of the shares should alert us that there are also reasons for caution.

Risk warning

While the growth being reported by Airtel Africa may be in a different league to its developed world counterparts, the long-term dynamics of its business are unlikely to prove a thing apart. Mobile telecoms is binary options trading income secrets 2022 fiercely competitive and capital-intensive industry. Indeed, good stocks to invest in 2022 uk, in its last full-year results Airtel Africa cited increasing competition as one of the biggest and most significant risks the business faces. Increased competition puts pressure on prices and margins. And given the company produces only around 50¢ of sales for each $1 of capital employed, falling margins can seriously dent returns on capital and thereby the rationale for investing in growth.

As far as competition goes, there is even the rather nebulous threat that projects to provide 5G services beamed down from low-orbiting satellites could at some point disrupt incumbents.

But Airtel Africa has some competitive merits. In an industry where scale matters, it holds the number one or two position in 12 of the 14 markets it serves. It is also the second-biggest player in the African market as a whole. Furthermore, it seeks to create customer “stickiness” through its mobile money services, product bundling, innovation and customer-service levels.

A less-familiar risk than competition to investors in telecoms companies serving western markets are those associated with currency and politics, good stocks to invest in 2022 uk. In particular, there are currently worries about Africa’s most populous country and Airtel Africa’s biggest geographic source of revenue, Nigeria.

Nigeria accounted for two-fifths of Airtel Africa’s sales last year and 46 per cent of cash profits. The Nigerian operation also accounts for $1.3bn of goodwill on the balance sheet (in the last report and accounts the company’s auditor pointed out that it viewed a goodwill-impairment test based on five-year forecasts to be “more appropriate” than the company’s use of a 10-year forecast period).

Many view Nigeria’s democracy to be in a very fragile state with the potential for political chaos. That said, while recently introduced mobile-user identity requirements in the country have meant a drop in customer numbers, fast rising per-customer revenue meant the Nigeria business still powered ahead in the first half. Indeed, despite the reasons to fret, sales were up 32 per cent, although a negative 6 per cent currency move was a headwind on dollar denominated reporting.

Further currency pressures may result from the prospect of a series of US interest rate rises this year. While Airtel Africa bills chiefly in local currencies, a noteworthy proportion of costs, especially for equipment, are denominated in dollars.

Bharti Airtel’s majority ownership is another significant consideration for any would-be shareholders. As well as its general influence over the company, there is an added dimension to the relationship in the fact that a covenant on Airtel Africa’s $1.5bn of bond debt depends on Bharti Airtel not defaulting on its own debt. Bharti’s debt currently hovers around junk status based on the assessments of major debt rating agencies – Moody’s has its debt at a just-junk Ba1 rating while S&P gives it a just-not-junk rating of BBB.

But debt is being paid down fast by Airtel Africa which is a positive for the investment case. As well as the group’s own cash generation and external investments in the mobile business, the company has raised nearly $300m through two disposals of towers over the last 18 months. Debt is also being transferred to businesses at the local level. While this helps address concerns about the cross default clause and currency mismatches, local debt is more expensive. The group’s weighted-average interest cost rose from 4.8 per cent to 5.5 per cent in the first half.

Bigger, better, bolder

For fast-growing, good stocks to invest in 2022 uk, capital-intensive companies like Airtel Africa, the big question is alway whether returns from investment in the business can be kept above the cost of investment. If the answer is yes, good stocks to invest in 2022 uk, then growth will create value, good stocks to invest in 2022 uk. If no, it will destroy value. Everything has been moving in the right direction for the company over recent years. Based on a standardised calculation using FactSet data, return on capital employed (ROCE) has risen from 2.8 per cent in 2017 to just over 14 per cent last year, good stocks to invest in 2022 uk, which is good stocks to invest in 2022 uk healthy level.

But the risks are plentiful. That makes Airtel Africa one for the bold. The compensation is that the low rating. The shares are valued on a next 12 month price/earnings ratio of 12 and forecast free cash flow yield of 9 per cent. Recent fundraising for the mobile banking business also imply one-third of the valuation is accounted for by a division generating about one-tenth of the profits. The low rating means the shares could do very well if growth continues to come through, the balance sheet overhaul continues, and nasty surprises don’t become realities.

The business’s positive 'impact' credentials could also help sentiment; so too could a reduction in the Bharti stake.

So the stock may deliver for the Great Expectations screen, but it certainly requires a high risk appetite and many of the dangers, such as currency movements and politics, are near impossible to predict.

Download documents (.xlsx )

| Six great stocks for 2022 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | TIDM | Mkt Cap | Net Cash / Debt(-)* | Price | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 12-mth Mom | 3-mth Fwd EPS change% | 12-mth Fwd EPS change% |

| Airtel Africa | AAF | £5,025m | -£1,877m | 134p | 11 | 2.9% | 9.6% | 28% | 14% | 34% | 77% | 26% | 79% |

| Watches of Switzerland | WOSG | £3,400m | -£271m | 1,420p | 29 | - | 2.9% | 38% | 18% | 50% | 145% | 29% | 77% |

| Investec | INVP | £2,802m | -£3,298m | 403p | 7 | 5.9% | - | 24% | 13% | 26% | 115% | 18% | 63% |

| Indivior | INDV | £1,805m | £532m | 257p | 16 | - | 5.9% | 43% | 31% | 19% | 136% | 12% | 121% |

| St. James's Place | STJ | £9,098m | -£307m | 1,683p | 21 | 3.6% | - | 22% | 12% | 12% | 49% | 9.5% | 62% |

| Liontrust Asset Management | LIO | £1,348m | £82m | 2,200p | 17 | 3.3% | 3.6% | 22% | 13% | 3.5% | 69% | 12% | 49% |

| Source: FactSet | |||||||||||||

| *FX converted to £ | |||||||||||||

| NTM = Next 12 months | |||||||||||||

| STM = Second 12 months (ie, one year from now) | |||||||||||||

Stock markets such as the FTSE 100 and S&P 500 tanked following news that Russia had invaded Ukraine. Uncertainty over the consequences of the crisis has spooked investors and prompted a huge sell-off in stocks.

So is now a bad time to buy shares, or are there opportunities to be had while others are fearful?

In this article we set out:

Prefer to watch rather than read?

Here’s our video on investing during a crisis

Is now a good time to buy shares?

It all depends on what you buy. While the future of some companies look positive, good stocks to invest in 2022 uk, the same can’t be said for all businesses.

It’s important to do your research into each company you buy. Listed companies release their financial results which can give you a picture of the health of the company.

Also bear in mind that some sectors fared better than others during the pandemic. Broadly speaking, technology companies have done well while travel firms have suffered.

However, even tech companies are experiencing share price volatility. Take a company as famous as Facebook. The tech darling’s owner Meta Platforms saw its stock market value drop by more than $230bn (£169bn) on 3 February this year in what was a record daily stock market fall for a US firm.

Meta’s shares fell 26% after it announced daily active user numbers dropped for the first time in the company’s 18 year history, and they have not yet recovered.

Remember:

- Don’t buy shares in a company just because someone said you should (always do your own research first)

- Selecting and monitoring individual shares is time-consuming

- You can buy investment funds or use a robo-adviser so that an expert investor can select shares on your behalf

If you’re new to investing, you might want to read our beginners‘ guide to investing first, good stocks to invest in 2022 uk.

Why has the stock market dropped?

Most major stock markets dropped off a cliff on February 24 following news that Russia had invaded Ukraine. The crisis has caused huge amounts of uncertainty as investors worry this will spill over into the businesses they are invested in.

As a result, lots of investors sold their stocks. The FTSE 100, the index which measures the performance of the largest companies in the Good stocks to invest in 2022 uk, dropped by 2.8% in the first few hours of trading that day.

It’s never a good idea to panic and sell stocks when the markets are falling because there is a danger that you could end up crystallising losses. We explain how to invest in volatile times later on in this article.

Also bear in mind that stock markets have been very volatile since the start of the pandemic.

While most restrictions in the UK have now been withdrawn, some markets continue to wobble because of concerns about new waves of coronavirus.

Is now a good time to invest?

Reasons to feel hopeful about the stock market:

- Successful booster vaccination roll-out has led to an increase in movement, trade and spending

- Industries that were hit by subsequent lockdowns, such as travel and entertainment, have reopened

- Takeovers will continue as investors and companies seek new opportunities

- Some sectors are booming: technology, e-commerce and biotech have thrived during the pandemic and will continue to grow

- Despite gradual increases, the UK’s national interest rate is still low at 0.5%, good stocks to invest in 2022 uk is encouraging people to spend or invest

Reasons to feel cautious about the stock market:

- The impact of the Ukraine crisis could hit global businesses

- Some nationals are still fearful over new strains of the coronavirus

- Rising inflation will weigh heavily, meaning people have less money in their pockets

- Disruption caused by the global energy crisis may continue for some time

- Brexit is still affecting supply chains

- Central banks are unwinding pandemic support measures

Crashes can come out of the blue and their causes only become apparent with hindsight, good stocks to invest in 2022 uk.

Find out more about how to invest during a recession.

When will the next stock market crash happen?

A stock market crash is a sudden and significant drop in the value of stocks.

Some stock market speculators panic and sell their shares fearing that if the price falls further, they could lose even more of the money they invested.

No one can accurately predict whether or not the stock market is going to crash. All you can do is evaluate which factors will influence the stock market and your particular investments.

Bear in mind that when stocks rise rapidly, there is always a danger that they could fall just as quickly.

The FTSE 100 share price, which measures the performance of the largest listed British companies, had been reaching fresh highs before plunging on news that Russia was invading Ukraine.

“Research has routinely shown that time in the market is more successful than timing the market so I would caution investors against trying to pre-empt any potential falls.”

Claire Walsh, good stocks to invest in 2022 uk, independent financial expert

If you’d like to know more about today’s big investment trends, check out our guide here.

The ups and downs of the market

Beware of market volatility at the moment. The FTSE 100, which measures the performance of the biggest companies in the UK, has been on an upwards trajectory over the past year but it has been a bumpy road to get there.

Netflix, Deliveroo, and Peloton are good examples of the fluctuations in share prices that you need to consider when investing.

The streaming service, food delivery company and exercise equipment maker were seemingly three of the corporate winners of the coronavirus outbreak.

Below, we explain how their shares have performed over the past two years.

Upsides

- Netflix gained 16m new subscribers during 2020, revenues of $7.16bn in April 2021 and predicted a better second quarter to the year

- Deliveroo has benefitted from a $575m Amazon investment, increased customer engagement

- Peloton shares gained 400% through 2020

Downsides

But none of these companies are immune to the negative affects of the pandemic or other headwinds:

- Netflix

- Production of many new Netflix shows were halted

- Competition in the sector notably from the newer players like Disney+

- Lower than expected sign-ups in list of bitcoin atm in philippines first quarter of 2020

- Deliveroo

- Yet to turn a profit: while good stocks to invest in 2022 uk revenues grew 54% to £1.2bn good stocks to invest in 2022 uk year, the company made a loss of £223m

- Deliveroo shares fell 30% in the first 20 minutes of its listing on the London Stock Exchange on March 31, 2021

- Reliance on gig-economy workers at a time when they are being handed more legal rights

- Peloton

- Peloton share price has dropped by 82% to $29 from its peak of $163 in December 2020

- A series of accidents with equipment led to the death of a child and the company announced a massive product recall

- A victim of its own lockdown success, with supply chain problems

- Peloton’s future is uncertain now gyms have reopened

These are good examples of why you need to weigh up the pros and cons of each company before you buy their shares.

You might want to read more in our article How to buy shares.

Here are eight things to consider:

1. Volatility

Equities can be very volatile when there is uncertainty and could pull back a lot if new variants of COVID are discovered that evade the vaccines.

2. Context is everything

Just because something is not cheap it does not make it unattractive.

Interest rates have risen but they are still very low. In this environment, businesses in growing markets with access to cheap money tend to do well good stocks to invest in 2022 uk what you pay now may look cheap in ten years.

3. Not all equities are the same

Some shares are in fact expensive because they are over-hyped. This means they might fade away over the next few years.

4. Are you happy going against the crowd?

Investing when people are fearful is understandably daunting, particularly when there is so much uncertainty in the world.

But consider whether you believe will be in a better situation by the time you will want the money. Things can always get worse before they get better.

5. Investing is for the long-term

Remember a “loss” is only a loss when you sell the investments. Your decision depends on how quickly you’d need the money and whether you understand that shares can fall as well as rise. Can you stomach losing money should markets continue to fall?

6. Inflation

With interest rates still low at 0.5%, a savings account won’t help your money grow.

When you allow for inflation, which measures the rising cost of living and is currently at 5.5%, you’re almost guaranteed to be worse off.

Investing gives your good stocks to invest in 2022 uk the best chance of growing.

7. Use a stocks and shares ISA

It’s a good idea to hold your shares in an ISA to protect your earnings from dividend tax and capital gains tax.

We explain: How are shares taxed?

8. Buy a pool of shares how to make fake money that looks real you would rather invest in a basket of shares rather than choosing them yourself, you could invest in a fund.

Some funds simply track a stock market like the S&P 500, which is an index measuring the biggest companies in the United States.

Why should you drip feed?

If you are thinking what shares to buy now, good stocks to invest in 2022 uk, remember it is almost impossible to time the market perfectly to make the most of your money.

For example:

- Invest when markets are rising, you may have missed the boat for the best returns

- Invest when the markets falling, and they could fall a lot further still

Drip how to make money at blackjack your money in slowly, rather than investing it all in as one lump sum, removes this tricky decision.

This not only encourages a good savings habit. It smooths the investment journey by buying more units when markets are lower (known as pound cost-averaging)

How do you get dividends?

Dividends are what a company pays to shareholders when it makes a profit.

The pandemic has affected the cash position and growth of a number of businesses, good stocks to invest in 2022 uk, which has impacted on the amount shareholders have received in dividends.

Throughout 2020 the UK’s biggest banks RBS, Barclays, Santander, HSBC, Lloyds, and Standard Chartered all suspended dividend payments and share buybacks.

Dividend-paying stocks are often a popular choice to include in your investment portfolio. But remember, the dividends you earn might be subject to tax.

Four tips for investing during uncertain times

Here are our four golden rules when it comes to investing during a financial crisis:

- Stay calm: the pandemic has stirred up a lot of emotions, but stay rational about your investments.

- Consider your aims: investing is personal. You choices depend on your circumstances, objectives, needs and risk tolerance. The key is diversification

- Use your tax relief: you can invest tax-free with an ISA. You can also get an instant uplift with a pension and a lifetime ISA, as the government will add extra cash whenever you pay in more money. We explain more about that here.

- Drip-feed your money: if the markets go down further you’re buying at a cheaper level and it good stocks to invest in 2022 uk help smooth out your returns, good stocks to invest in 2022 uk, with the hope they recover and grow in the longer term.

Best sectors to invest in

Making the most of a buying opportunity often means looking for firms that are well placed for any potential structural shifts.

Here are some sectors that are worth paying attention to:

- Fintech: companies that help people work remotely or pay for goods or services are worth investigating.

- Ecommerce: the pandemic has boosted online shopping as people continue to stay away from crowded malls and supermarkets.

- Renewable energy: a rapid fall in the cost of building renewable energy projects has happened at the same time as a greater awareness of the climate crisis. These assets provide reliable income streams, which are often backed by government subsidies. Read more in our guide to ethical investing.

- Online gaming: these businesses who is behind bitcoin core among the most resistant to the Covid-19 stock market sell-off.

- Commodities: this includes precious metals such as gold and silver which are often seen as “safe” assets to hold during market turmoil (though remember all investments come with a degree of risk).

- Banks: the banks could be worth watching. Remember, banks have been through the 2008 financial crisis and may therefore fare better in an economic recovery than markets anticipate.

- Leisure sector: after months of isolation, people want to go out and spend. Restaurants and pubs with the strongest balance sheets might fare very well as they might have the opportunity to pick up cheap distressed assets from rivals that went bust.

Should you buy cheap British stocks?

One of the world’s biggest investment banks JP Morgan has been telling investors to buy British stocks now while they are cheap.

The investment firm had taken a bearish stance on British stocks since the EU referendum in June 2016. When compared to companies in the US and Europe, UK shares have underperformed since the Brexit vote.

But JP Morgan has said there are a few things that could change the fortunes of British stocks:

- UK shares have strong dividends

- Stock markets like the US and China are expected to struggle maintain their momentum going forward, paving the way for the UK to outperform

- UK stocks have tended to rise in the months after an interest rate rise.

What are the stocks to invest in right now?

We have listed some companies below that might be worth considering. However, we always recommend that you do your own research before buying shares.

- Rolls Royce: the company makes engines for planes that embark on long-haul flights. With so many planes being grounded during the pandemic, the Rolls Royce share price suffered. However, things are looking more positive after it swung into profit.

- Avast: the cybersecurity group could be bought by an American rival. Analysts valued the FTSE 100 company at £7.2bn and suggested the business could end up in a bidding war, good stocks to invest in 2022 uk. The news prompted the Avast share price to climb 17%.

- Wise: previously called Transferwise, it converts money into different currencies, but it has plans to branch into other areas of financial services.

- Nissan: the shares look interesting given its plans for an electric battery factory in Sunderland that is set to be worth £1bn.

- JD Sports share price rose after the company’s five-for-one share split at the end of November. JD is now valued at £7.6bn, and after Tesco is Britain’s second most valuable shops group.

- Beyond Meat’s share price rose on the news that the plant-based company’s chicken alternative will be available at Kentucky Fried Chicken (KFC) across the US. A number of other companies have also teamed up with Beyond Meat and it looks like the move towards vegan, good stocks to invest in 2022 uk, vegetarian and flexitarian diets continues.

- Taylor Wimpey’s

13 Undervalued Stocks for 2022 good stocks to invest in 2022 uk

Of course, valuations differ significantly from one sector to another. In aggregate, technology, financial services and real estate stocks look undervalued, and consumer cyclical and consumer defensive sectors are the most overvalued.

Below we look at some specific undervalued stocks across sensitive, cyclical and defensive sectors - the so-called super sectors - that are among our analysts’ best ideas.

In the sensitive sector, we have technology, communication services, energy and industrials. Of these, we think the European technology sector is particularly undervalued. The median stock in our coverage universe currently trading at an 8% discount to its fair value, after being one of the key players in the post-pandemic period. In fact, the Morningstar Developed Markets Europe Technology Index down 16.80% so far this year.

Meanwhile, the communication services sector weakened in 2021’s fourth quarter and it has underperformed the broader market over the past six months amie a loss of confidence in growth opportunities. The median stock in the category is now trading at a 10% discount.

Energy stocks have outpaced the broader market, but in Europe, these stocks are still 3% undervalued. Supply remains constrained and a Russian invasion of Ukraine could disrupt oil supply, but our analysts think a price spike seems unlikely even in the event of war. And, industrial stocks are slightly overvalued, but there are still some undervalued stocks to good stocks to invest in 2022 uk found.

In the cyclical sector we find consumer stocks, financial services and real estate. Consumer cyclical stocks enjoyed a robust fourth quarter of 2021 and are currently fairly valued, good stocks to invest in 2022 uk. Nevertheless, nearly half of the stocks we cover are trading at 4- and 5-star levels.

Financial stocks were some of the best stocks last year, and as our director of equity research Michael Wong reminds us, interest rates are a key driver of financial sector earnings – “and they’re expected to move higher this year. Indeed, the unemployment rate and inflation point to a tightening of monetary policy.” Real estate also rebounded in 2021, and among the names we cover, only one is significantly undervalued (Unibail-Rodamco-Westfield).

On the defensive side, we find consumer, healthcare and utilities. Consumer defensive stocks are currently trading 5% above our fair value estimate, but there are several stocks that are trading within a discounted range. This is also the case for healthcare, which is at a 7% premium – but the stocks have slightly lagged the broader European market in the past six months.

Utilities enter 2022 slightly overvalued as well, at 1%. Morningstar strategist Travis Miller explains that the stocks are one of few attractive options for those looking for income. “If higher rates can ward off inflation, utilities should continue producing 7%-9% total returns for investors in 2022 and beyond,” he says.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To view this article, good stocks to invest in 2022 uk, become a Morningstar Basic member.

Register For FreeAlready a member?Log In.

Share tips of the week – 18 March

Premium chocolatier Hotel Chocolat’s profits for the second half of 2021 were up by 56% to £24.1m. Although the overseas markets of the US and Japan aren’t profitable yet, sales were up 150% and 131% respectively, and nine new stores opened in Japan. Its gross margin was affected due to increased input costs and foreign exchange effects, and the dividend has yet to be reinstated as management prioritises “the need to invest for growth”. But the firm has a promising long-term outlook and a well-performing multi-channel sales model, and the shares look good value. 440p

Two to sell

Dotdigital

Investors’ Chronicle

Software-as-a-service (Saas) provider Dotdigital was boosted by the pandemic as companies were forced to use SMS marketing messages – one of the services it provides – to update customers on a regular basis. But SMS is paid for on a per-message basis, and revenue for this channel is now falling. Management is expecting revenue for the coming and future years to be slower than predicted. Tight labour markets have hindered growth in the Good stocks to invest in 2022 uk full-year sales for last year were up 19% compared to only 3% for this year. The shares look far too expensive for a company with “slowing growth that is struggling to get a foothold in the US”. Sell. 74p

Melrose

The Times

Melrose specialises in buying, investing and selling on companies. It has “cast itself as a company doctor” and is currently at a “periodic crossroads, when most of its operations are nearly ready to be sold”. Shareholders will get the money but “the good stocks to invest in 2022 uk is on for fresh meat”. The shares have fallen since the Russian invasion of Ukraine and the conflict has put on hold plans for another return of capital this year. Its current investments are highly cash generative and analysts predict an increase in profits. But the company has automotive and aerospace operations, good stocks to invest in 2022 uk, both of which are “subject to developments in Ukraine”. The war could boost defence orders and make target businesses more affordable, but “attempts to float the divisions could be delayed” which “could leave Melrose in limbo for an extended period”. Avoid. 113p

.and the rest

Investors’ Chronicle

Chemicals firm Elementis plans to reduce costs, but looks expensive unless its debt pile shrinks. Sell (114.4p). Online shopping “poses a real threat to long-term retail property values” for Hammerson. Sell (35p). Logistics firm Wincanton could be a takeover candidate. Buy (312p). Danish pharma firm Lundbeck is a recovery play on a p/e of ten. Buy (DKK160.6).

The Mail on Sunday

Supermarket Tesco can cope with slow growth and inflation. Buy (273p). Insurer Direct Line pays generous regular and special dividends. Buy (266p). HICL offers a 4.75% yield from infrastructure on long-term inflation-linked contracts. Buy (172p). Thread and zip maker Coats is still innovating in sustainable products. Buy (69p). Self-storage group Lok’n’Store has grown its dividend every year since 2007. Buy (920p). Aim-listed glasses maker Inspecs should pay its first dividend of $0.01 for the year just ended, rising to $0.04 by 2023. Buy (330p).

Shares

BAE Systems will gain from more defence spending, good stocks to invest in 2022 uk. Buy (736p). High gas prices will help biomass firm Drax. Buy (667p).

The Telegraph

Augmentum Fintech invests in early-stage disruptive financial services firms. It’s been hurt by the growth-stock sell-off, but a 17% discount to net asset value isn’t justified. Buy (117.5p).

The Times

Property-services firm Savills will pay a 27.05p dividend to make up for 2019’s skipped payment. All risks are priced in. Buy (1,224p). Hammerson is restarting dividends, but it’s hard to see how it will tempt shoppers away from screens and back into malls. Avoid (33p).

Volatile markets: The tragic war in Ukraine has good stocks to invest in 2022 uk the world

Markets are volatile as the horrific war in Ukraine and a severe bout of inflation shake the world.

Some investors may have moved at least some holdings into cash or gold, while others will be holding off on making decisions on how to use up this year's Isa allowance.

'Volatility can be incredibly off-putting for anyone considering investing,' says Sarah Coles, senior personal finance analyst at Hargreaves Lansdown.

'Once-in-a-generation shocks used to live up to their name, but good stocks to invest in 2022 uk facing another horrible jolt, while many of us are still reeling from the last.

'The Russian invasion of Ukraine shocked and appalled the world, and the days since have seen reactions reverberate around the globe. Markets hate nasty surprises and this was both unimaginably horrible and completely unexpected.'

But Coles warns being put off by volatility means missing out on potential long-term growth.

We look at some stock ideas from investing experts at Hargreaves and Brewin Dolphin below (we will be looking at funds later this week).

How to invest when markets go haywire

Sarah Coles of Hargreaves suggests some approaches to investing this Isa season.

1, good stocks to invest in 2022 uk. Check you're happy with your level of diversification: 'Don't assume your portfolio is diverse: revisit it. Over time, growth in some areas and falls in others can unbalance it.'

2. Buy into long term growth stories: 'A falling market will drag almost everything lower, regardless of the prospects of the business, so when the market pulls back, there will be some companies with sound fundamentals you may want to consider.'

3. Protect your Isa allowance: 'You can open a stocks and shares Isa and park the money in cash, then gradually drip feed it into stock market investments when it suits you best.'

Living on your pension investments?

Beware the 'pound cost ravaging' trap. Find out how to sidestep it during current market volatility here.

4. Drip feed cash into next year's allowance: 'Start regular savings into an Isa. You can make payments from £25 a month, and then top up with lump sums throughout the tax year when it makes most sense for your finances.

'Alternatively, you can spread Isa contributions through the tax year by investing £1,666.66 a month. This means your money goes further during the dips, and benefits through the rises.'

5. If you're drawing on pension investments, consider Isa income alternatives: 'When you're drawing cash from your pension, the most sensible approach is to take the natural income it produces.

'However, some people choose to take more, good stocks to invest in 2022 uk, and gang members make money have no alternative at times when dividends are unreliable, so they end up nibbling into the capital instead.

'This can be very risky. You're eating into a larger percentage of your pot when prices fall, and this will continue to have an impact even when it recovers.

'If you have Isas alongside your pension, it gives you far more flexibility. You can draw income tax free from stocks and shares Isa, or you could dip into cash Isas to make up the shortfall, and refill the coffers when better times return.'

Fear: Some investors will have moved at least some money makes the world go round do you love me into cash during the current market volatility

Markets have had a torrid start to 2022 but investors should stay focused on the long term and gradually invest in a broad portfolio of assets, according to John Moore, senior investment manager at Brewin Dolphin.

'Using as much of good stocks to invest in 2022 uk tax-free allowances as you can is a central part of that advice. Everyone can contribute up to £20,000 for the tax year to either a cash or stocks and shares Isa, with the latter tending to outperform the former – albeit, past performance is no guarantee of future returns.

'In terms of stocks that are well-suited for Isas, our smart advice is to look for companies that will see their share prices grow and provide a reasonable level of income as a safety net.

'These should compound over the long term and grow within the tax-free Isa wrapper.'

Don't forget your pension

Savings threatened by inflation? Tempted to start investing? A simple (and potentially cheap) option is to top up your pension fund. We explain how here.

What stocks should you consider for your Isa this year?

1. Rentokil:'No one puts up with rats in the kitchen because the catcher put their price up by 5 per cent,' says Steve Clayton, good stocks to invest in 2022 uk, manager of HL Select Funds at Hargreaves Lansdown.

'What Rentokil does is essential to their customers, and whilst there is competition, having a strong brand and reputation for service is a powerful protector of margins.

'The company is in the middle of executing a major takeover, adding Terminix to its US pest division which should offer plenty of scope for cost synergies in the years ahead.

'This gives Rentokil further scope to grow and defend its margins, despite today's inflationary environment.'

2. EMIS Group: The software provider to GP practices and community pharmacies is likely to hold up against inflation, according to Clayton.

'Over 80 per cent of EMIS Group's revenues recur each year under long term contracts agreed within NHS framework agreements.

'This gives the group exceptional visibility of its income and with price escalations built into the contracts the group is well protected from cost pressures.

Steve Clayton: 'No one puts up with rats in the kitchen because the catcher put their price up by 5 per cent,' he says of Rentokil

'With the group well positioned as a conduit for sharing data across NHS bodies EMIS should accelerate its growth in the years ahead.'

3. Tritax Big Box REIT: The firm owns and builds giant distribution centres along major roads and at motorway junctions, explains Clayton.

'These distribution centres are at the heart of the digital economy. Businesses often run the sharp end of their ecommerce operations from them. Amazon is the largest tenant in good stocks to invest in 2022 uk portfolio.

'Occupiers take long leases with inflationary clauses built in, ensuring that Tritax's income rises steadily. Demand for these assets is strong, and prices have been pushed higher.

'With no business that we know of planning to use less technology or do less business digitally, this buoyant demand seems set to continue, leaving Tritax well placed to grow.'

4. Diageo: 'Diageo is the group behind some of the best-known drinks brands in the world, including Guinness, Smirnoff, and Tanqueray gin,' says John Moore, senior investment manager at Brewin Dolphin.

'Whether times are good or bad, people enjoy a responsible, premium drink – which may sound glib, but underlines the resilience of this business.

'Diageo continues to invest in broadening the reach and appeal of its brands, good stocks to invest in 2022 uk, while also having the financial muscle to finance acquisition opportunities, buy back stock, and pay out a dividend of around 2 per cent.'

John Moore: Unvestors should stay focused on the long term and gradually invest in a broad portfolio of assets

5. GlaxoSmithKline:GlaxoSmithKline came under fire for its lack of responsiveness to the Covid-19 pandemic, failing to come up with a vaccination unlike many of its rivals,' says Moore.

'However, the company has set out a path to self-improvement by splitting its health and consumer divisions – the latter of which was recently the subject of a bid from Unilever.

'This may mean reduced dividends in the short term – which currently stand at more than 5 per cent – but it should lead to improved capital returns from both sides of the business in time.'

6. Experian: The firm operates in the steady, if unexciting, business of providing credit checks and scores, explains Moore.

'This is important financial data that is expanding in terms of relevance and geography, particularly in areas like Latin America where the company has significant business.

'Crucially, the data Experian produces is most needed at times of change and uncertainty, which sounds very much like where we are now.

The shares are currently the cheapest they can you still make money with stock photography been since the early months of the Covid-19 pandemic and offer a yield of more than 1.25 per cent.'

7. Greencoat UK Wind: 'Greencoat UK Wind is an investment trust that, as the name suggests, owns wind farms in the UK – in fact, it is one of the largest independent wind farm owners in the country,' says Moore.

'Despite the stock market volatility since the turn of the year, the trust currently trades at a higher-than-average premium to its net asset value.

'At least part of the reason for this is that it provides investors with a way of offsetting rising energy prices and delivering RPI-linked increases to its dividend, with a current yield of around 5 per cent.'

How do you buy overseas shares?

Want to get your hands on stocks listed outside the UK - find out how here.

8. Microsoft: The US tech giant is tipped as a dependable play by both Clayton and Moore - see the box below for how to buy overseas stocks.

'Possessing something valuable and unique that customers cannot easily find elsewhere is a winning strategy in this environment,' says Clayton.

'Software can fit this bill. Only Microsoft can supply Windows or Office and few businesses would fancy their chances of prospering without them. So Microsoft can increase its prices every year.

'There's a lot more to Microsoft than just these two products, but to have such huge, cash generative franchises at the heart of the group leaves it well-placed to thrive in any environment.'

Moore says: 'Few people will be unfamiliar with at least one Microsoft product – not least over the past two years, with so many of us spending a lot more time on Teams.

'The company has grown to essentially become a modern utility. Microsoft has the advantage of pricing power over many of its rivals and a strong balance sheet to support future innovation and acquisitions, as the purchase of Activision Blizzard demonstrated earlier this year.

'Although the dividend is only around 0.8 per cent, this is not too bad by US standards and there is room for growth in income in addition to capital growth.'

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

The comments below have not been moderated.

The views expressed in the contents above are those of our users and do not necessarily reflect the views of MailOnline. good stocks to invest in 2022 uk

Do you want to automatically post your MailOnline comments to your Facebook Timeline?

Your comment will be posted to MailOnline as usual.

Do you want to automatically post your MailOnline comments to your Facebook Timeline?

Your comment will be posted to MailOnline as usual

We will automatically post your comment and a link to the news story to your Facebook timeline at the same time it is posted on MailOnline. To do this we will link your MailOnline account with your Facebook account. We’ll ask you to confirm this for your first post to Facebook.

You can choose on each post whether you do twitter make money like it to be posted to Facebook. Your details from Facebook will be used to provide you with tailored content, marketing and ads in line with our Privacy Policy.

Best UK penny stocks to watch for traders and investors

What are the risks and rewards associated with penny stocks?

A number of well-known companies started off as penny stocks. Those that invested in companies such as Ford Motor Co or JD Sports Fashion in the early stages have been well rewarded; however, it is important to stress that many penny stocks ultimately fail and that good stocks to invest in 2022 uk can be highly unpredictable.

The share prices of penny stocks can be volatile, either as a result of lower liquidity or because they are sensitive to news and market developments. Penny stocks can turn into a huge success or an utter failure overnight: winning or losing one contract or the level of success of a new product, for example, can decide their future. Many penny stocks have no track record and it is not uncommon for them to have no assets, operations or revenue.