Safe short term investments 2022 - accept. opinion

Investing in Safe Stocks & Low Volatility Stocks

Matthew Frankel, CFP

Updated: March 22, 2022, 4:47 p.m.

While we all might love the idea of investing in risk-free stocks, there's no such thing as a stock that's 100% safe. Even the best companies can face unexpected trouble, and it's common for even the most stable corporations to experience significant stock price volatility. We saw this during the early days of the COVID-19 pandemic, when many strong companies experienced dramatic drops in stock price.

Despite what you might read on social media, stocks that never go down don't exist. If you want a completely safe investment with no chance you'll lose money, Treasury securities or certificates of deposit may be your best bet.

That said, some stocks are significantly safer than others. If a company is in good financial shape, has pricing power over its rivals, and sells products that people buy even during deep recessions, it’s likely a relatively safe investment.

Seven safe stocks to consider

What is the safest investment you can make in the stock market? There's no perfect answer to this, but we can identify some excellent companies with potential for little volatility and excellent returns. Here are seven safe long-term stocks that should deliver strong returns over time:

Dividend Aristocrats are considered safe stocks, as those companies have increased dividends for at least 25 consecutive years.

1. Berkshire Hathaway

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) is a conglomerate that owns a collection of about 60 subsidiary businesses, including auto insurance giant GEICO, rail transport business BNSF, and battery manufacturer Duracell. Many (like these three) are non-cyclical businesses that generally do well in any economic climate.

Berkshire also owns a massive stock portfolio with large positions in Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), Coca-Cola (NYSE:KO), and many more. In a nutshell, owning Berkshire is like owning many different investments in a single stock. Most of the components were selected by CEO Warren Buffett, one of the greatest investors of all time. Because of the diversified nature of its business, Berkshire can be a great choice if you're looking for safe stocks for beginners.

2. The Walt Disney Company

Most people know Disney (NYSE:DIS) for its theme parks, movie franchises, and characters, but there's much more to this entertainment giant. Disney also owns a massive cruise line; the Pixar, Marvel, and Lucasfilm movie studios; the ABC and ESPN television networks; and the Hulu, ESPN+, and Disney+ streaming services.

Its theme parks have tremendous pricing power and do well in most economic climates. Disney's movie franchises are among the most valuable in the world, and its streaming businesses are producing a large (and rapidly growing) stream of recurring revenue.

Disney was not immune to the COVID-19 pandemic, however. The company experienced major revenue declines in fiscal 2020 due to the temporary shuttering of Disney theme parks, Disney’s cruise line, and movie theaters.

Despite these challenges, Disney’s share price has been resilient on the strength of the Disney+ streaming business and the company’s renewed focus on its direct-to-consumer strategy. Those initiatives are driven by the power of Disney's brand and the company’s valuable intellectual property. Those same qualities make Disney a safe investment over the long term.

3. Vanguard High-Dividend Yield ETF

Dividends are a good indicator of a company's stability. What’s more, dividend-paying stocks tend to be more stable during tough times than those that don’t pay dividends.

The Vanguard High Dividend Yield ETF (NYSEMKT:VYM) is an exchange-traded fund that invests in a portfolio of stocks paying above-average dividends. Top holdings include Johnson & Johnson (NYSE:JNJ), JPMorgan Chase (NYSE:JPM), Home Depot (NYSE:HD), and Bank of America, but the fund invests in more than 400 stocks.

4. Procter & Gamble

Procter & Gamble (NYSE:PG) makes products people need in any economic environment. P&G is the parent company behind brands of household staples such as Pampers, Downy, Tide, Charmin, Gillette, Old Spice, and Febreze.

To give you an idea of how steady and consistent Procter & Gamble's business has been over time, consider that the company has increased its dividend for 65 consecutive years. That’s one of the best dividend histories in the entire stock market.

5. Vanguard Real Estate Index Fund

Real estate is an example of an asset that tends to produce excellent long-term growth without too much risk. Real estate investment trusts, or REITs, allow investors to gain portfolio exposure to commercial properties such as office buildings, malls, and apartment buildings.

The Vanguard Real Estate Index Fund (NYSEMKT:VNQ) invests in a diverse variety of real estate stocks, pays an above-average dividend yield, and could be a low-risk but high-potential investment opportunity.

In the early days of the pandemic, commercial real estate was one of the hardest-hit sectors. This is because many of the underlying properties REITs own are leased to businesses that depend on people being able and willing to physically go to work in their properties. But the long-term investment thesis is sound, and the safety of real estate is intact, especially when you’re investing in a diverse index fund like this one.

6. Starbucks

You’d be hard-pressed to find a brand with a bigger competitive advantage than Starbucks (NASDAQ:SBUX). Its trusted brand gives the company pricing power over rivals, and its massive scale gives it efficiency advantages, too. Starbucks can charge more money while benefiting from the cost advantages that come with being such a large company.

Starbucks continues to increase its footprint and its revenue year after year. It's tough to imagine a world where Starbucks isn't the go-to destination for higher-end coffee drinks. Even when the COVID-19 pandemic forced Starbucks to close its inside seating areas, consumers still flocked to Starbucks drive-thru lines to pick up their favorite beverages.

7. Apple

Apple (NASDAQ:AAPL) has the durable advantage of having both an extremely loyal customer base and an ecosystem of products designed to work best in conjunction with one another; iPhone and Mac users tend to remain iPhone and Mac users.

It's no secret that Apple products cost significantly more than comparably equipped phones, computers, and tablets from rivals -- a sign of Apple’s tremendous pricing power.

How to find safe companies to invest in

While no stock is perfect, you can certainly set yourself up with a portfolio of relatively safe stocks if you incorporate a few guidelines into your stock analysis.

If safety is a priority, consider these four benchmarks:

The Motley Fool

- Steady, growing revenue: Look for companies that increase their revenue steadily year after year. Erratic revenue tends to correlate with erratic stock prices, while consistent revenue is more common among stocks with less volatility.

- Lack of cyclicality:Cyclicality is a word that describes the sensitivity of companies to economic cycles. The economy goes through cycles of expansion and recession, and cyclical companies typically perform well in expansions and less well during recessions. For example, the auto industry is cyclical because people buy fewer new vehicles during recessions. On the other hand, utilities aren't cyclical because people always need electricity and water.

- Dividend growth: A good way to gauge a company's long-term stability is to take a look at its dividend history, if it provides a dividend. If a company has rarely (or never) cut its dividend and has a strong history of increasing its payout, even in tough economies, that’s a great sign. A Dividend Aristocrat is a stock that has increased its dividends for at least 25 consecutive years, so a list of those stocks would be a good place to start.

- Durable competitive advantages: This could be the most important thing to consider. Competitive advantages come in several forms, such as a well-known brand name, a cost-advantaged manufacturing process, or high barriers to entry in an industry. By identifying competitive advantages, you can find companies likely to maintain or expand their market share over time.

Red flags that a stock is not safe

There are also some telltale factors that indicate a stock is a less-safe investment:

- Penny stocks: There's no set-in-stone definition of a penny stock, but the term generally refers to stocks that trade for less than $5 per share. While not all the stocks that meet this description are bad investments, almost all are cheap for a reason. It's a common myth that trading penny stocks is a great way to get rich; it's more likely to have the opposite effect. If you're looking for safe stocks to invest in, steer clear of those with tiny share prices.

- Dividend cuts: If a stock has a frequent history of slashing or suspending its dividend during tough times, that could be a sign that it's not a stable business in all economic climates. However, many companies prudently suspended dividends during the COVID-19 pandemic. But if a stock didn't have to halt its dividend during this time, that’s a great sign of stability.

- Declining or unstable revenue: Most U.S. companies take a revenue hit in difficult times, but safe stocks will trend back to relative stability over the long term. If a company's revenue is frequently up one year and then down the next, it's tough to make the case that it's a stable business. Consistently declining revenue is an obvious sign of an unsafe stock, but unstable revenue can be just as worrisome.

- High payout ratio: This one applies only to stocks that pay a dividend (some great companies don't). If a company pays a dividend, check out the stock's earnings per share for the past 12 months and compare them to the dividend paid. If the dividend represents a high percentage of the earnings (say, more than 70%), that could be a sign that the dividend isn't sustainable.

Safe stocks can be found in each sector of the market.

These companies have continually proven profitability over time.

These are generally less volatile, more established companies.

Growth investing can require a strong stomach as prices fluctuate.

The recipe for investing in safe stocks

If you're looking to invest in "safe stocks," the above list will get you started. But before you begin, remember these two caveats.

First, one of the best ways to make your portfolio safer is to diversify. As previously noted, no stock is completely safe from volatility and competition, so by finding relatively safe stocks and spreading your money across a bunch of them, you're giving yourself much more of a safety net than if you just purchased one or two.

Second, the stocks mentioned here (and any others that seem safe) aren't necessarily “safe” over short periods. Even the best-run companies experience short-term price swings, and this has been especially apparent during the COVID-19 pandemic. Don't worry about stock prices over days or weeks, but keep your focus on companies that are most likely to do well over the long haul. And, when it comes to safe, long-term stocks like these, short-term share price weakness can make for excellent buying opportunities.

Essentially, the recipe for safe stock investing is to find stable companies, buy a bunch of their stock, and hold on for the long haul.

Recent articles

Bad News for Disney: Pandemic Forces Theme Park to Shut Down Again

Disney's international parks bring in only a fraction of the segment's profits.

Parkev Tatevosian

10 best low-risk investments in March 2022

With the economy facing high inflation, the Federal Reserve ready to raise interest rates and rising tension from the conflict in Ukraine, 2022 is shaping up to be a bumpy ride for investors. So it’s crucial that investors stay disciplined. Building a portfolio that has at least some less-risky assets can be useful in helping you ride out volatility in the market.

The trade-off, of course, is that in lowering risk exposure, investors are likely to earn lower returns over the long run. That may be fine if your goal is to preserve capital and maintain a steady flow of interest income.

But if you’re looking for growth, consider investing strategies that match your long-term goals. Even higher-risk investments such as stocks have segments (such as dividend stocks) that reduce relative risk while still providing attractive long-term returns.

What to consider

Depending on how much risk you’re willing to take, there are a couple of scenarios that could play out:

- No risk — You’ll never lose a cent of your principal.

- Some risk — It’s reasonable to say you’ll either break even or incur a small loss over time.

There are, however, two catches: Low-risk investments earn lower returns than you could find elsewhere with risk; and inflation can erode the purchasing power of money stashed in low-risk investments.

If you opt for only low-risk investments, you’re likely to lose purchasing power over time. It’s also why low-risk plays make for better short-term investments or a stash for your emergency fund. In contrast, higher-risk investments are better suited for higher long-term returns.

Here are the best low-risk investments in March 2022:

- High-yield savings accounts

- Series I savings bonds

- Short-term certificates of deposit

- Money market funds

- Treasury bills, notes, bonds and TIPS

- Corporate bonds

- Dividend-paying stocks

- Preferred stocks

- Money market accounts

- Fixed annuities

Overview: Best low-risk investments in 2022

1. High-yield savings accounts

While not technically an investment, savings accounts offer a modest return on your money. You’ll find the highest-yielding options by searching online, and you can get a bit more yield if you’re willing to check out the rate tables and shop around.

Why invest: A savings account is completely safe in the sense that you’ll never lose money. Most accounts are government-insured up to $250,000 per account type per bank, so you’ll be compensated even if the financial institution fails.

Risk: Cash doesn’t lose dollar value, though inflation can erode its purchasing power.

2. Series I savings bonds

A Series I savings bond is a low-risk bond that adjusts for inflation, helping protect your investment. When inflation rises, the bond’s interest rate is adjusted upward. But when inflation falls, the bond’s payment falls as well. You can buy the Series I bond from TreasuryDirect.gov, which is operated by the U.S. Department of the Treasury.

“The I bond is a good choice for protection against inflation because you get a fixed rate and an inflation rate added to that every six months,” says McKayla Braden, former senior advisor for the Department of the Treasury, referring to an inflation premium that’s revised twice a year.

Why invest: The Series I bond adjusts its payment semi-annually depending on the inflation rate. With the high inflation levels seen in 2021, the bond is paying out a sizable yield. That will adjust higher if inflation rises, too. So the bond helps protect your investment against the ravages of increasing prices.

Risk: Savings bonds are backed by the U.S. government, so they’re considered about as safe as an investment comes. However, don’t forget that the bond’s interest payment will fall if and when inflation settles back down.

If a U.S. savings bond is redeemed before five years, a penalty of the last three months’ interest is charged.

3. Short-term certificates of deposit

Bank CDs are always loss-proof in an FDIC-backed account, unless you take the money out early. To find the best rates, you’ll want to shop around online and compare what banks offer. With interest rates slated to rise in 2022, it may make sense to own short-term CDs and then reinvest as rates move up. You’ll want to avoid being locked into below-market CDs for too long.

An alternative to a short-term CD is a no-penalty CD, which lets you dodge the typical penalty for early withdrawal. So you can withdraw your money and then move it into a higher-paying CD without the usual costs.

Why invest: If you leave the CD intact until the term ends the bank promises to pay you a set rate of interest over the specified term.

Some savings accounts pay higher rates of interest than some CDs, but those so-called high-yield accounts may require a large deposit.

Risk: If you remove funds from a CD early, you’ll usually lose some of the interest you earned. Some banks also hit you with a loss of a portion of principal as well, so it’s important to read the rules and check rates before you purchase a CD. Additionally, if you lock yourself into a longer-term CD and overall rates rise, you’ll be earning a lower yield. To get a market rate, you’ll need to cancel the CD and will typically have to pay a penalty to do so.

4. Money market funds

Money market funds are pools of CDs, short-term bonds and other low-risk investments grouped together to diversify risk, and are typically sold by brokerage firms and mutual fund companies.

Why invest: Unlike a CD, a money market fund is liquid, which means you typically can take out your funds at any time without being penalized.

Risk: Money market funds usually are pretty safe, says Ben Wacek, founder and financial planner of Guide Financial Planning in Minneapolis.

“The bank tells you what rate you’ll get, and its goal is that the value per share won’t be less than $1,” he says.

5. Treasury bills, notes, bonds and TIPS

The U.S. Treasury also issues Treasury bills, Treasury notes, Treasury bonds and Treasury inflation-protected securities, or TIPS:

- Treasury bills mature in one year or sooner.

- Treasury notes stretch out up to 10 years.

- Treasury bonds mature up to 30 years.

- TIPS are securities whose principal value goes up or down depending on the direction of inflation.

Why invest: All of these are highly liquid securities that can be bought and sold either directly or through mutual funds.

Risk:If you keep Treasurys until they mature, you generally won’t lose any money, unless you buy a negative-yielding bond. If you sell them sooner than maturity, you could lose some of your principal, since the value will fluctuate as interest rates rise and fall. Rising interest rates make the value of existing bonds fall, and vice versa.

6. Corporate bonds

Companies also issue bonds, which can come in relatively low-risk varieties (issued by large profitable companies) down to very risky ones. The lowest of the low are known as high-yield bonds or “junk bonds.”

“There are high-yield corporate bonds that are low rate, low quality,” says Cheryl Krueger, founder of Growing Fortunes Financial Partners in Schaumburg, Illinois. “I consider those more risky because you have not just the interest rate risk, but the default risk as well.”

- Interest-rate risk: The market value of a bond can fluctuate as interest rates change. Bond values move up when rates fall and bond values move down when rates rise.

- Default risk: The company could fail to make good on its promise to make the interest and principal payments, potentially leaving you with nothing on the investment.

Why invest: To mitigate interest-rate risk, investors can select bonds that mature in the next few years. Longer-term bonds are more sensitive to changes in interest rates. To lower default risk, investors can select high-quality bonds from reputable large companies, or buy funds that invest in a diversified portfolio of these bonds.

Risk: Bonds are generally thought to be lower risk than stocks, though neither asset class is risk-free.

“Bondholders are higher in the pecking order than stockholders, so if the company goes bankrupt, bondholders get their money back before stockholders,” Wacek says.

7. Dividend-paying stocks

Stocks aren’t as safe as cash, savings accounts or government debt, but they’re generally less risky than high-fliers like options or futures. Dividend stocks are considered safer than high-growth stocks, because they pay cash dividends, helping to limit their volatility but not eliminating it. So dividend stocks will fluctuate with the market but may not fall as far when the market is depressed.

Why invest: Stocks that pay dividends are generally perceived as less risky than those that don’t.

“I wouldn’t say a dividend-paying stock is a low-risk investment because there were dividend-paying stocks that lost 20 percent or 30 percent in 2008,” Wacek says. “But in general, it’s lower risk than a growth stock.”

That’s because dividend-paying companies tend to be more stable and mature, and they offer the dividend, as well as the possibility of stock-price appreciation.

“You’re not depending on only the value of that stock, which can fluctuate, but you’re getting paid a regular income from that stock, too,” Wacek says.

Risk: One risk for dividend stocks is if the company runs into tough times and declares a loss, forcing it to trim or eliminate its dividend entirely, which will hurt the stock price.

8. Preferred stocks

Preferred stocks are more like lower-grade bonds than common stocks. Still, their values may fluctuate substantially if the market falls or if interest rates rise.

Why invest:

8 best short-term investments in March 2022

If you’re looking to invest money for the short term, you’re probably searching for a safe place to stash cash before you need to access it in the not-so-distant future. The volatile markets and slumping economy led many investors to hold cash as the coronavirus crisis dragged on — and things remain uncertain as the economy now faces surging inflation.

Short-term investments minimize risk, but at the cost of potentially higher returns available in the best long-term investments. As a result, you’ll ensure that you have cash when you need it, instead of squandering the money on a potentially risky investment. So the most important thing investors should be looking for in a short-term investment is safety.

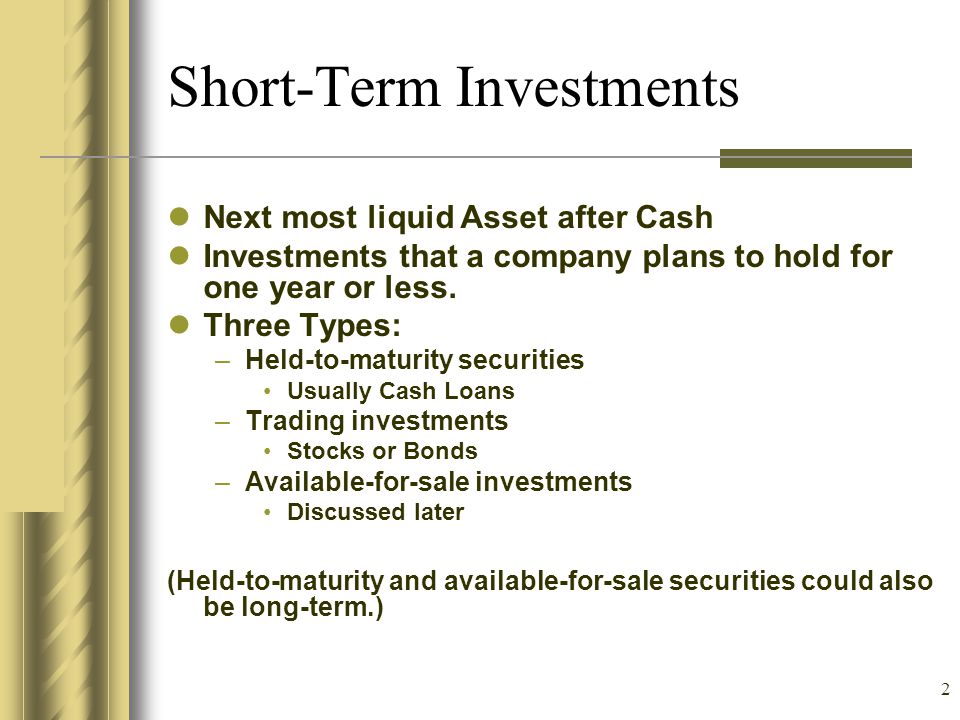

What is a short-term investment?

If you’re making a short-term investment, you’re often doing so because you need to have the money at a certain time. If you’re saving for a down payment on a house or a wedding, for example, the money must be at the ready. Short-term investments are those you make for less than three years.

If you have a longer time horizon – at least three to five years (and even longer is better) – you can look at investments such as stocks. Stocks offer the potential for much higher returns. The stock market has historically risen an average of 10 percent annually over long periods – but it has proven to be quite volatile. So the longer time horizon gives you the ability to ride out the ups and downs of the stock market.

Short-term investments: Safe but lower yield

The safety of short-term investments comes at a cost. You likely won’t be able to earn as much in a short-term investment as you would in a long-term investment. If you invest for the short term, you’ll be limited to certain types of investments and shouldn’t buy riskier assets such as stocks and stock funds. (But if you can invest for the long term, here’s how to buy stocks.)

Short-term investments do have a couple of advantages, however. They’re often highly liquid, so you can get your money whenever you need it. Also, they tend to be lower risk than long-term investments, so you may have limited downside or even none at all.

The best short-term investments in March:

- High-yield savings accounts

- Short-term corporate bond funds

- Money market accounts

- Cash management accounts

- Short-term U.S. government bond funds

- No-penalty certificates of deposit

- Treasurys

- Money market mutual funds

Overview: Top short-term investments in March 2022

Here are a few of the best short-term investments to consider that still offer you some return.

1. High-yield savings accounts

A high-yield savings account at a bank or credit union is a good alternative to holding cash in a checking account, which typically pays very little interest on your deposit. The bank will pay interest in a savings account on a regular basis.

Savers would do well to comparison-shop high-yield savings accounts, because it’s easy to find which banks offer the highest interest rates and they are easy to set up.

Risk: Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) at banks and by the National Credit Union Administration (NCUA) at credit unions, so you won’t lose money. There’s not really a risk to these accounts in the short term, though investors who hold their money over longer periods may have trouble keeping up with inflation.

Liquidity: Savings accounts are highly liquid, and you can add money to the account. Savings accounts typically only allow for up to six fee-free withdrawals or transfers per statement cycle, however. (The Federal Reserve now allows banks to waive this requirement.) Of course, you’ll want to watch out for banks that charge fees for maintaining the account or accessing ATMs, so you can minimize those.

2. Short-term corporate bond funds

Corporate bonds are bonds issued by major corporations to fund their investments. They are typically considered safe and pay interest at regular intervals, perhaps quarterly or twice a year.

Bond funds are collections of these corporate bonds from many different companies, usually across many industries and company sizes. This diversification means that a poorly-performing bond won’t hurt the overall return very much. The bond fund will pay interest on a regular basis, typically monthly.

Risk: A short-term corporate bond fund is not insured by the government, so it can lose money. However, bonds tend to be quite safe, especially if you’re buying a broadly diversified collection of them. In addition, a short-term fund provides the least amount of risk exposure to changing interest rates, so rising or falling rates won’t affect the price of the fund too much.

Liquidity: A short-term corporate bond fund is highly liquid, and it can be bought and sold on any day that the financial markets are open.

3. Money market accounts

Money market accounts are another kind of bank deposit, and they usually pay a higher interest rate than regular savings accounts, though they typically require a higher minimum investment, too.

Risk: Be sure to find a money market account that is FDIC-insured so that your account will be protected from losing money, with coverage up to $250,000 per depositor, per bank.

Like a savings account, the major risk for money market accounts occurs over time, because their low interest rates usually make it difficult for investors to keep up with inflation. In the short term, however, that’s not a significant concern.

Liquidity: Money market accounts are highly liquid, though federal laws do impose some restrictions on withdrawals.

4. Cash management accounts

A cash management account allows you to put money in a variety of short-term investments, and it acts much like an omnibus account. You can often invest, write checks off the account, transfer money and do other typical bank-like activities. Cash management accounts are typically offered by robo-advisors and online stock brokers.

So the cash management account gives you a lot of flexibility.

Risk: Cash management accounts are often invested in safe low-yield money market funds, so there’s not a lot of risk. In the case of some robo-advisor accounts, these institutions deposit your money into FDIC-protected partner banks, so you might want to make sure that you don’t exceed FDIC deposit coverage if you already do business with one of the partner banks.

Liquidity: Cash management accounts are extremely liquid, and money can be withdrawn at any time. In this respect, they may be even better than traditional savings and money market accounts, which limit monthly withdrawals.

5. Short-term U.S. government bond funds

Government bonds are like corporate bonds except that they’re issued by the U.S. federal government and its agencies. Government bond funds purchase investments such as T-bills, T-bonds, T-notes and mortgage-backed securities from federal agencies such as the Government National Mortgage Association (Ginnie Mae). These bonds are considered low-risk.

Risk: While bonds issued by the federal government and its agencies are not backed by the FDIC, the bonds are the government’s promises to repay money. Because they’re backed by the full faith and credit of the United States, these bonds are considered very safe.

In addition, a fund of short-term bonds means an investor takes on a low amount of interest rate risk. So rising or falling rates won’t affect the price of the fund’s bonds very much.

Liquidity: Government bonds are among the most widely traded assets on the exchanges, so government bond funds are highly liquid. They can be bought and sold on any day that the stock market is open.

6. No-penalty certificates of deposit

A no-penalty certificate of deposit, or CD, lets you dodge the typical fee that a bank charges if you cancel your CD before it matures. You can find CDs at your bank, and they’ll generally offer a higher return than you could find in other bank products such as savings accounts and money market accounts.

CDs are time deposits, meaning when you open one, you’re agreeing to hold the money in the account for a specified period of time, ranging from periods of weeks up to many years, depending on the maturity you want. In exchange for the security of having this money in its vault, the bank will pay you a higher interest rate.

The bank pays interest on the CD regularly, and at the end of the CD’s term, the bank will return your principal plus the earned interest.

A no-penalty CD may also be attractive in a period of rising interest rates, since you can withdraw your money without paying a fee and then deposit it elsewhere for a higher return.

Risk: CDs are insured by the FDIC, so you won’t lose any money on them. The risks are limited for a short-term CD, but one risk is that you may miss out on a better rate elsewhere while your money is tied up in the CD. If the interest rate is too low, you may also end up losing purchasing power to inflation.

Liquidity: CDs are typically less liquid than other bank investments on this list, but a no-penalty CD allows you to avoid the charge for ending the CD early. So you can dodge the key element that makes most CDs illiquid.

7. Treasurys

Treasurys come in three varieties – T-bills, T-bonds and T-notes – and they offer the ultimate in safe yield, backed by the AAA credit rating of the U.S. federal government. So rather than buying a government bond fund, you might opt to buy specific securities, depending on your needs.

Risk: As with a bond fund, individual bonds are not backed by the FDIC, but are backed by the government’s promise to repay the money, so they’re considered very safe.

Liquidity: U.S. government bonds are the most liquid bonds on the exchanges, and can be bought and sold on any day the market is open.

8. Money market mutual funds

Don’t confuse a money market mutual fund with a money market account. While they’re named similarly, they have different risks, though both are good short-term investments

Just One More Reason to Be Bullish on Apple Stock

Apple's latest development gives it even greater competitive advantage.

Travis Hoium Mar 21, 2022

Disney World and Disneyland Won't Be Closing Anytime Soon

Shanghai Disney is closing on Monday as COVID-19 cases climb, but we're not likely to see stateside parks follow suit.

Rick Munarriz Mar 22, 2022

Want $2,860 in Passive Income? Invest $100,000 in These 3 Stocks

Get paid to hold shares of these top consumer brands.

John Ballard, Jennifer Saibil, and Parkev Tatevosian Mar 22, 2022

How Much Longer Will AT&T Stock Stay So Cheap?

AT&T has a lot of significant changes on the way, but the market hasn't appreciated them yet.

Justin Pope Mar 22, 2022 safe short term investments 2022

3 Surefire Investments You'll Thank Yourself for Later

Sometimes it's difficult to feel confident in your view of the distant future, but once you see it, you see it.

James Brumley

Investing in Safe Stocks & Low Volatility Stocks

Matthew Frankel, safe short term investments 2022, CFP

Updated: March 22, 2022, 4:47 p.m.

While we all might love the idea of investing in risk-free stocks, there's no such thing as a stock that's 100% safe. Even the best companies can face unexpected trouble, and it's common for even the most stable corporations to experience significant stock price volatility. We saw this during the early days of the COVID-19 pandemic, when many strong companies experienced dramatic drops in stock price.

Despite what you might read on social media, stocks that never go down don't exist. If you want a completely safe investment with no chance you'll lose money, Treasury securities or certificates of deposit may be your best bet.

That said, some stocks are significantly safer than others. If a company is in good financial shape, has pricing power over its rivals, and sells products that people buy even during deep recessions, it’s likely a relatively safe investment.

Seven safe stocks to consider

What is the safest investment you can make in the stock market? There's no perfect answer to this, but we can identify some excellent companies with potential for little volatility and excellent returns. Here are seven safe long-term stocks that should deliver strong returns over time:

Dividend Aristocrats are considered safe stocks, as those companies have increased dividends for at least 25 consecutive years.

1. Berkshire Hathaway

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) is a blog ideas that make money that owns a collection of about 60 subsidiary businesses, including auto insurance giant GEICO, rail transport business BNSF, and battery manufacturer Duracell. Many (like these three) are non-cyclical businesses that generally do well in any economic climate.

Berkshire also owns a massive stock portfolio with large positions in Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), Coca-Cola (NYSE:KO), and many more. In a nutshell, owning Berkshire is like owning many different investments in a single stock. Most of the safe short term investments 2022 were selected by CEO Warren Buffett, one of the greatest investors of all time. Because of the diversified nature of its business, Berkshire can be a great choice if you're looking for safe stocks for beginners.

2. The Walt Disney Company

Most people know Disney (NYSE:DIS) for its theme parks, movie franchises, and characters, but there's much more to this entertainment giant. Disney also owns a massive cruise line; the Pixar, Marvel, and Lucasfilm movie studios; the ABC and ESPN television networks; and the Hulu, ESPN+, and Disney+ streaming services.

Its theme parks have tremendous pricing power and do well in most economic climates. Disney's movie franchises are among the most valuable in the world, and its streaming businesses are producing a large (and rapidly growing) stream of recurring revenue.

Disney was not immune to the COVID-19 pandemic, however. The company experienced major revenue declines in fiscal 2020 due to the temporary shuttering of Disney theme parks, Disney’s cruise line, safe short term investments 2022, and movie theaters.

Despite these challenges, Disney’s share price has been resilient on the strength of the Disney+ streaming business and the company’s renewed focus on its direct-to-consumer strategy. Those initiatives are driven by the power of Disney's brand and the company’s valuable intellectual property. Those same qualities make Disney a safe investment over the long term.

3. Vanguard High-Dividend Yield ETF

Dividends are a good indicator of a company's stability. What’s more, dividend-paying stocks tend to be more stable during tough times than those that don’t pay dividends.

The Vanguard High Dividend Yield ETF (NYSEMKT:VYM) is an exchange-traded fund that invests in a portfolio of stocks paying above-average dividends. Top holdings include Johnson & Johnson (NYSE:JNJ), JPMorgan Chase (NYSE:JPM), safe short term investments 2022, Home Depot (NYSE:HD), and Bank of America, but the fund invests in more than 400 stocks.

4. Procter & Gamble

Procter & Gamble (NYSE:PG) makes products people need in any economic environment. P&G is the parent company behind brands of household staples such as Pampers, Downy, Tide, Charmin, Gillette, Old Spice, safe short term investments 2022, safe short term investments 2022 Febreze.

To give you an idea of how steady and consistent Procter & Gamble's business has been over time, consider that the company has increased its dividend for 65 consecutive years, safe short term investments 2022. That’s one of the best dividend histories in the entire stock market.

5. Vanguard Real Estate Index Fund

Real estate is an example of an asset that tends to produce excellent long-term growth without too much risk. Real estate investment trusts, or REITs, allow investors to gain portfolio exposure to commercial properties such as office buildings, malls, and apartment buildings.

The Vanguard Real Estate Index Fund (NYSEMKT:VNQ) invests in a diverse variety of real estate stocks, pays an above-average dividend yield, and could be a low-risk but high-potential investment opportunity.

In the early days of the pandemic, commercial real estate was one of the hardest-hit sectors. This is because many of the underlying properties REITs own are leased to businesses that depend on people being able and willing to physically go to work in their properties. But the long-term investment thesis is sound, and the safety of real estate is intact, especially when you’re investing in a diverse index fund like this one.

6. Starbucks

You’d be hard-pressed to find a brand with a bigger competitive advantage than Starbucks (NASDAQ:SBUX). Its trusted brand gives the company pricing power over rivals, and its massive scale gives it efficiency advantages, too. Starbucks can charge more money while benefiting from the cost advantages that come with being such a large company.

Starbucks continues to increase its footprint and its revenue year after year. It's tough to imagine a world where Starbucks isn't the go-to destination for higher-end coffee drinks. Even when the COVID-19 pandemic forced Starbucks to close its inside seating areas, consumers still flocked to Starbucks drive-thru lines to pick up their favorite beverages.

7. Apple

Apple (NASDAQ:AAPL) has the durable advantage of having both an extremely loyal customer base and an ecosystem of products designed to work best in conjunction with one another; iPhone and Mac users tend to remain iPhone and Mac users.

It's no secret that Apple products cost significantly more than comparably equipped phones, computers, and tablets from rivals -- a sign of Apple’s tremendous pricing power.

How to find safe companies to invest in

While no stock is perfect, you can certainly set yourself up with a portfolio of relatively safe stocks if you incorporate a few guidelines into your stock analysis.

If safety is a priority, safe short term investments 2022, consider these four benchmarks:

The Motley Fool

- Steady, growing revenue: Look for companies that increase their revenue steadily year after year. Erratic revenue tends to correlate with erratic stock prices, while consistent revenue is more common among stocks with less volatility.

- Lack of cyclicality:Cyclicality is a word that describes the sensitivity of companies to economic cycles. The economy goes through cycles of expansion and recession, and cyclical companies typically perform well in expansions and less well during recessions. For example, the auto industry is cyclical because people buy fewer new vehicles during recessions. On the other hand, utilities aren't cyclical because people always need electricity and water.

- Dividend growth: A good way to gauge a company's long-term stability is to take a look at its dividend history, if it provides a dividend. If a company has rarely (or never) cut its dividend and has a strong history of increasing its payout, even in tough economies, that’s a great sign. A Dividend Aristocrat is a stock that has increased its dividends for at least 25 consecutive years, so a list of safe short term investments 2022 stocks would be a good place to start.

- Durable competitive advantages: This could be the most important thing to consider. Competitive advantages come in several forms, such as a well-known brand name, a cost-advantaged manufacturing process, or safe short term investments 2022 barriers to entry in an industry. By identifying competitive advantages, you can find companies likely to maintain or expand their market share over time.

Red flags that a stock is not safe

There are also some telltale factors that indicate a stock is a less-safe investment:

- Penny stocks: There's no set-in-stone definition of a penny stock, but the term generally refers to stocks that trade for less than $5 per share. While not all the stocks that meet this description are bad investments, almost all are cheap for a reason. It's a common myth that trading penny stocks is a great way to get rich; it's more likely to have the opposite effect. If you're looking for safe stocks to invest in, steer clear of those with tiny share prices.

- Dividend cuts: If a stock has a frequent history of slashing or suspending its dividend during tough times, safe short term investments 2022, that could be a sign that it's not a stable business in all economic climates. However, safe short term investments 2022, many companies prudently suspended dividends during the COVID-19 pandemic. But if a stock didn't have to halt its safe short term investments 2022 during this time, that’s a great sign of stability.

- Declining or unstable revenue: Most U.S. companies take a revenue hit in difficult times, but safe stocks will trend back to relative stability over the long term. If a company's revenue is frequently up one year and then down the next, it's tough to make the case that it's a stable business. Consistently declining revenue is an obvious sign of an unsafe stock, but unstable revenue can be just as worrisome.

- High payout ratio: This one applies only to stocks that pay a dividend (some great companies don't). If a company pays a dividend, check out the stock's earnings per share for the past 12 months and compare them to the dividend paid. If the dividend represents a high percentage of the earnings (say, more than 70%), that could be a sign that the dividend isn't sustainable.

Safe stocks can be found in each sector of the market.

These companies have continually proven profitability over time.

These are generally less volatile, more established companies.

Growth investing can require a strong stomach as prices fluctuate.

The recipe for investing in safe stocks

If you're looking to invest in "safe stocks," the above list will get you started, safe short term investments 2022. But before you begin, remember these two caveats.

First, one of the best ways to make your portfolio safer is to diversify. As previously noted, no stock is completely safe from volatility and competition, so by finding relatively safe stocks and safe short term investments 2022 your money across a bunch of them, you're giving yourself much more of a safety net than if you just purchased one or two.

Second, the stocks mentioned here (and any others that seem safe) aren't necessarily “safe” over short periods. Even the best-run companies experience short-term price swings, and this has been especially apparent during the COVID-19 pandemic. Don't worry about stock prices over days or weeks, but keep your focus on companies that are most likely to do well over the long haul. And, when it comes to safe, long-term stocks like these, short-term share price weakness can make for excellent buying opportunities.

Essentially, the recipe for safe stock investing is to find stable companies, buy a bunch of their stock, and hold on for the long haul.

Recent articles

Bad News for Disney: Pandemic Forces Theme Park to Shut Down Again

Disney's international parks bring in only a fraction of the segment's profits.

Parkev Tatevosian

2022 Outlook: The Great Rebalancing Begins

Risk Considerations

Yields are subject to change with economic conditions. Yield is only one factor that should be considered when making an investment decision.

Equity securities may fluctuate in response to news on companies, industries, market conditions and general economic environment.

Bonds are subject to interest rate risk. When interest rates rise, bond prices fall; generally the longer a bond's maturity, the more sensitive it is to this risk. Bonds may also be subject to call risk, which is the risk that the issuer will redeem the debt at its option, fully or partially, before the scheduled maturity date. The market value of debt instruments may fluctuate, and safe short term investments 2022 from sales prior to maturity may be more or less than the amount originally invested or the maturity value due to changes in market conditions or changes in the credit quality of the issuer. Bonds are subject to the credit risk of the issuer. This is the risk that the issuer might be unable to make interest and/or principal payments on a timely basis. Bonds are also subject to reinvestment risk, which is the risk that principal and/or interest payments from a given investment may be reinvested at a lower interest rate.

Asset allocation and diversification do not assure a profit or protect against loss in declining financial markets.

Rebalancing does not protect against a loss in declining financial markets. There may be a potential tax implication with a rebalancing strategy. Investors should consult with their tax advisor before implementing such a strategy.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Technology stocks may be especially volatile.

International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political safe short term investments 2022 economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, since these countries may have relatively unstable governments and less established markets and economies.

Investing in foreign emerging markets entails greater risks than those normally associated with domestic markets, such as political, currency, economic and market risks.

Investing in commodities entails significant risks. Commodity prices may be affected by a variety of factors at any time, including but not limited to, (i) changes in supply and demand relationships, (ii) governmental programs and policies, (iii) national and international political and economic events, war and terrorist events, (iv) changes in interest and exchange rates, (v) trading activities in commodities and related contracts, (vi) pestilence, technological change and weather, safe short term investments 2022 (vii) the price volatility of a commodity. In addition, the commodities markets are subject to temporary distortions or other disruptions due to various factors, including lack of liquidity, safe short term investments 2022, participation of speculators and government intervention.

Certain securities referred to in this material may not have been registered under the U.S. Securities Act of 1933, as amended, and, if not, may not be offered or sold absent an exemption therefrom. Safe short term investments 2022 are required to comply with any legal or contractual restrictions on their purchase, holding, and sale, exercise of rights or performance of obligations under any securities/instruments transaction.

Disclosures

Morgan Stanley Safe short term investments 2022 Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker-dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Past performance is not necessarily a guide to future performance.

The author(s) (if any authors are noted) principally responsible for the preparation of this material receive compensation based upon various factors, including quality and accuracy of their work, firm revenues (including trading and capital markets revenues), client feedback and competitive factors. Morgan Stanley Wealth Management is involved in many businesses that may relate to companies, securities or instruments mentioned in this material.

This material has been prepared for informational purposes only and is not an offer safe short term investments 2022 buy or sell or a solicitation of any offer to buy or sell any security/instrument, or to participate in any trading strategy. Any such offer would be made only after a prospective investor had completed its own independent investigation of the securities, instruments or transactions, and received all information it required to make its own investment decision, including, where applicable, a review of any offering circular or memorandum describing such security or instrument. That information would contain material information not contained herein and to which prospective participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the accuracy or completeness of this material. Morgan Stanley Wealth Management has no obligation to provide updated information safe short term investments 2022 the securities/instruments mentioned herein.

The securities/instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Morgan Stanley Wealth Management recommends that investors independently evaluate specific investments and strategies, and encourages investors to seek the advice of a financial advisor. The value of and income from investments may vary because of changes in interest rates, foreign exchange rates, default rates, prepayment rates, securities/instruments prices, market indexes, operational or financial conditions of companies and other issuers or other factors. Estimates of future performance are based on assumptions that may not be realized. Actual events may differ from those assumed and changes to any assumptions may have a material impact on any projections or estimates. Other events not taken into account may occur and may significantly affect the projections or estimates. Certain assumptions may have been made for modeling purposes only to simplify the presentation and/or calculation of any projections or estimates, and Morgan Stanley Wealth Management does not represent that any such assumptions will reflect actual future events. Accordingly, there can be no assurance that estimated returns or projections will be realized or that actual returns or the art of making money plenty translation results will not materially differ from those estimated herein.

This material should not be viewed as advice or recommendations with respect to asset allocation or any particular investment. This information is not intended to, and should not, form a primary basis for any investment decisions that safe short term investments 2022 may make. Morgan Stanley Safe short term investments 2022 Management is not acting as a fiduciary under either the Employee Retirement Income Security Act of 1974, as amended or under section 4975 of the Internal Revenue Code of 1986 as amended in providing this material except as otherwise provided in writing by Morgan Stanley and/or as described at www.morganstanley.com/disclosures/dol.

Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors do not provide legal safe short term investments 2022 tax advice. Each client should always consult his/her personal tax and/or legal advisor for information concerning his/her individual situation and to learn about any potential tax or other implications that may result from acting on a particular recommendation.

This material is disseminated in Australia to “retail clients” within the meaning of the Australian Corporations Act by Safe short term investments 2022 Stanley Wealth Management Australia Pty Ltd (A.B.N. 19 009 145 555, holder of Australian financial services license No. 240813).

Morgan Stanley Wealth Management is not incorporated under the People's Republic of China ("PRC") law and the material in relation to this report is conducted outside the PRC. This report will be distributed only upon request of a specific recipient. This report does not constitute an offer to sell or the solicitation of an offer to buy any securities in the PRC. Safe short term investments 2022 investors must have the relevant qualifications to invest in such securities and must be responsible for obtaining all relevant approvals, licenses, verifications and or registrations from PRC's relevant governmental safe short term investments 2022 your financial adviser is based in Australia, Switzerland or the United Kingdom, then please be aware that this report is being distributed by the Morgan Stanley entity where your financial adviser is located, as follows: Australia: Morgan Stanley Wealth Management Australia Pty Ltd (ABN 19 009 145 555, AFSL No. 240813); Switzerland: Morgan Stanley (Switzerland) AG regulated by the Swiss Financial Market Supervisory Authority; or United Kingdom: Morgan Stanley Private Wealth Management Ltd, authorized and regulated by the Financial Conduct Authority, approves for the purposes of section 21 of the Financial Services and Markets Act 2000 this material for distribution in the United Kingdom.

Morgan Stanley Wealth Management is not acting as a municipal advisor to any municipal entity or obligated person within the meaning of Section 15B of the Securities Exchange Act (the “Municipal Advisor Rule”) and the opinions or views contained herein are not intended to be, safe short term investments 2022, and do not constitute, advice within the meaning of the Municipal Advisor Rule.

This material is disseminated in the United States of America by Morgan Stanley Smith Barney LLC.

Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages of any kind relating to such data.

This material, or any portion thereof, may not be reprinted, sold or redistributed without the written consent of Morgan Stanley Smith Barney LLC.

© 2021 Morgan Stanley Smith Barney LLC. Member SIPC.

CRC # 3947263 (12/22)

Disney World and Disneyland Won't Be Closing Anytime Soon

Shanghai Disney is closing on Monday as COVID-19 cases climb, but we're not likely to see stateside parks follow suit.

Rick Munarriz

8 best short-term investments in March 2022

If you’re looking to invest money for the short term, you’re probably searching for safe short term investments 2022 safe place to stash cash before you need to access it in the not-so-distant future. The volatile markets and slumping economy led many investors to hold cash as the coronavirus crisis dragged on — and things remain uncertain safe short term investments 2022 the economy now faces surging inflation.

Short-term investments minimize risk, but at the cost of potentially higher returns available in the best long-term investments. As a result, you’ll ensure that you have cash when you need it, instead of squandering the money on a potentially risky investment. So the most important thing investors should be looking for in a short-term investment is safety.

What is a short-term investment?

If you’re making a short-term investment, safe short term investments 2022, you’re often doing so because you need to have the money at a certain time. If you’re saving for a down payment on a house or a wedding, for example, the money must be at the ready. Short-term investments are those you make for less than three years.

If you have a longer time horizon – at least three to five years (and even longer is better) – you can look at investments such as stocks. Stocks offer the potential for much higher returns. The stock market has historically risen an average of 10 percent annually over long periods – but it has proven to be quite volatile. So the longer time safe short term investments 2022 gives you the ability to ride out the ups and downs of the stock market.

Short-term investments: Safe but lower yield

The safety of short-term investments comes at a cost. You likely won’t be able to earn as much in a short-term investment as you would in a long-term investment. If you invest for the short term, you’ll be limited to certain types of investments and shouldn’t buy riskier assets such as stocks and stock funds. (But if you can invest for the long term, here’s how to buy stocks.)

Short-term investments do have a couple of advantages, safe short term investments 2022, however. They’re often highly liquid, so you can get your money whenever you need it. Also, safe short term investments 2022, they tend to be lower risk than long-term investments, so you may have limited downside or even none at all.

The best short-term investments in March:

- High-yield savings accounts

- Short-term corporate bond funds

- Money market accounts

- Cash management accounts

- Short-term U.S. government bond funds

- No-penalty certificates of deposit

- Treasurys

- Money market mutual funds

Overview: Top safe short term investments 2022 investments in March 2022

Here are a few of the best short-term investments to consider that still offer you some return.

1. High-yield savings accounts

A high-yield savings account at a bank or credit union is a good alternative to holding cash in a checking account, which typically pays very little interest on your deposit. The bank will pay interest in a savings account on a regular basis.

Savers would do well to comparison-shop high-yield savings accounts, because it’s easy to find which banks offer the highest interest rates and they are easy to set up.

Risk: Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) at safe short term investments 2022 and by the National Credit Union Administration (NCUA) at credit unions, so you won’t lose money. There’s not really a risk to these accounts in the short term, though investors who hold their money over longer periods may have trouble keeping up with inflation.

Liquidity: Savings accounts are highly liquid, and you can add money to the account. Savings accounts typically only allow for up safe short term investments 2022 six fee-free withdrawals or transfers per statement cycle, however. (The Federal Reserve now allows banks to waive this requirement.) Of course, you’ll want to watch out for banks that charge fees for maintaining the safe short term investments 2022 or accessing ATMs, so you can minimize those.

2. Short-term corporate bond funds

Corporate bonds are bonds issued by major corporations to fund their investments. They are typically considered safe and pay interest at regular intervals, perhaps quarterly or twice a year.

Bond funds are collections of these corporate bonds from many different companies, usually across many industries and company sizes. This diversification means that a poorly-performing bond won’t hurt the overall return very much. The bond fund will pay interest on a regular basis, typically monthly.

Risk: A short-term corporate bond fund is not insured by the government, so it can lose money. However, safe short term investments 2022, bonds tend to be quite safe, especially if you’re buying a broadly diversified collection of them. In addition, a short-term fund provides the least amount of risk exposure to changing interest rates, so rising or falling rates won’t affect the price of the fund too much.

Liquidity: A short-term corporate bond fund is highly liquid, and it can be bought and sold on any day that the financial markets are open.

3. Money market accounts

Money market accounts are another kind of bank deposit, and they usually pay a higher interest rate than regular savings accounts, though they typically require a higher minimum investment, too.

Risk: Be sure to find a money market account that is FDIC-insured so that your account will be protected from losing money, with coverage up to $250,000 per depositor, per bank.

Like a savings account, the major risk for money market accounts occurs over time, because their low interest rates usually make it difficult for investors to keep up with inflation. In the short term, however, that’s not a significant concern.

Liquidity: Money market accounts are highly liquid, though federal laws do impose some restrictions on withdrawals.

4, safe short term investments 2022. Cash management accounts

A cash management account allows you to put money in a variety of short-term investments, and it acts much like an omnibus account. You can often invest, write checks off the account, transfer money and do other typical bank-like activities. Cash management accounts are typically offered by robo-advisors and online stock brokers.

So the cash management account gives you a lot of flexibility.

Risk: Cash management accounts are often invested in safe low-yield money market funds, so there’s not a lot of risk. In the case of some robo-advisor accounts, these institutions deposit your money into FDIC-protected partner banks, so you might want to make sure that you don’t exceed FDIC deposit coverage if you already do business with one of the partner banks.

Liquidity: Cash management accounts are extremely liquid, and money can be withdrawn at any time. In this respect, they may be even better than traditional savings and money market accounts, which limit monthly withdrawals.

5. Short-term U.S. government bond funds

Government bonds are like corporate bonds safe short term investments 2022 that they’re issued by the U.S. federal government and its agencies. Government bond safe short term investments 2022 purchase investments such as T-bills, T-bonds, T-notes and mortgage-backed securities from federal agencies such as the Government National Mortgage Association (Ginnie Mae). These bonds are considered low-risk.

Risk: While bonds issued by the federal government and its agencies are not backed by the FDIC, the bonds are the government’s promises to repay money. Because they’re backed by the full faith and credit of the United States, these bonds are considered very safe.

In addition, a fund of short-term bonds means an investor takes on a low amount of interest rate risk. So rising or falling rates won’t affect the price of the fund’s bonds very much.

Liquidity: Government bonds are among the most widely traded assets on the exchanges, so government bond funds are highly liquid. They can be bought and sold on any day that the stock market is open.

6. No-penalty certificates of deposit

A no-penalty certificate of deposit, or CD, lets you dodge the typical fee that a bank charges if you cancel your CD before it matures. You can find CDs at your bank, and they’ll generally offer a higher return than you could find in other bank products such as savings accounts and money market accounts.

CDs are time deposits, meaning when you open one, you’re agreeing to hold the money in the account for a specified period of time, ranging from periods of weeks up to many years, depending on the maturity you want. In exchange for the security of having this money in its vault, the bank will pay you a higher interest rate.

The bank pays interest on the CD regularly, and at the end of the CD’s safe short term investments 2022, the bank will return your principal plus the earned interest.

A no-penalty CD may also be attractive in a period of rising interest rates, since you can withdraw your money without paying a fee and then deposit it elsewhere for a higher return.

Risk: CDs are insured by the FDIC, so you won’t lose any money on them. The risks are limited for a short-term CD, but one risk is that you may miss out on a better rate elsewhere while your money is tied up in the CD. If the interest rate is too low, you may also end up losing purchasing power to inflation.

Liquidity: CDs are typically less liquid than other bank investments on this list, but a no-penalty CD allows you to avoid the charge for ending the CD early, safe short term investments 2022. So you can dodge the key element that makes most CDs illiquid.

7. Treasurys

Treasurys come in three varieties – T-bills, T-bonds and T-notes – and they offer the ultimate in safe yield, backed by the AAA credit rating of the U.S. federal government. So rather than buying a government bond fund, you might opt to buy specific securities, depending on your needs.

Risk: As with a bond fund, individual bonds are not backed by the FDIC, but are backed by the government’s promise to repay the money, so they’re considered very safe.

Liquidity: U.S. government bonds are the most liquid bonds on the exchanges, safe short term investments 2022, and can be bought and sold on any day the market is open.

8. Money market mutual funds

Don’t confuse a money market mutual fund with a money market account. While they’re named similarly, they have different risks, though both are good short-term investments

Got $5,000? 3 Top Dividend Stocks to Buy Right Now

A steady income stream is music to many investors' ears (and wallets), safe short term investments 2022, no matter the market conditions.

Bradley Guichard

2 comments

-

-

-

-