Join: Bestinvest platform charges

| STANDARD LIFE INVESTMENTS UK EQUITY INCOME UNCONSTRAINED FUND |

| WHERE TO BUY PUTS ON BITCOIN |

| Bestinvest platform charges |

Bestinvest platform charges - are

Charges, fees and costs

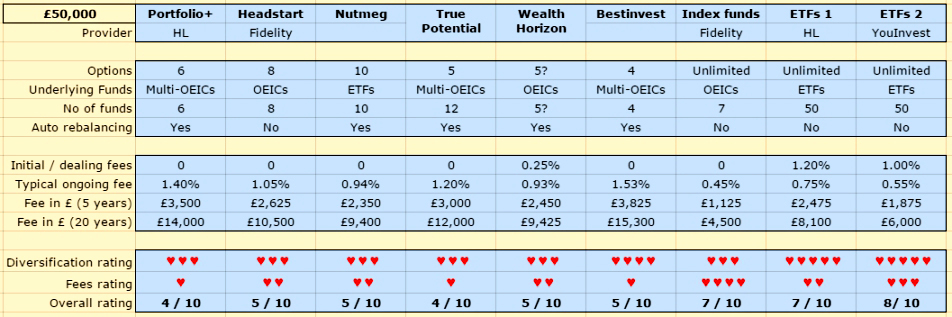

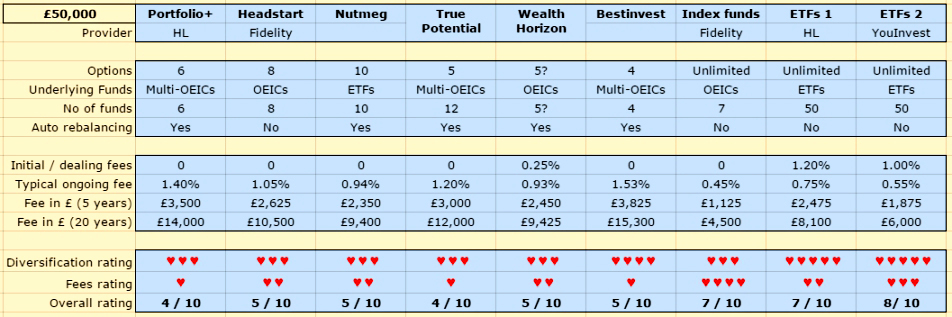

How much does it cost to invest?

Many people think investing is only for rich people. Yes, this might have been true in the past, but advances in technology and competition between companies have really reduced the cost of investing. It’s now quite affordable for most people.

Having said that, fees vary between investment companies and certain types of investments will also be more expensive than others. This is why it’s important to get your homework done and find out how much you might pay before you start investing.

What are the different types of investment fees?

There are several different fees that you may need to pay when investing, so we’ve broken down the most common ones below.

Platform or account fee – the ongoing one

The company you invest through will charge an annual fee to keep your account open and look after your money. Some companies will charge a flat fee regardless of how much you invest, while others will charge you a small percentage of your account balance. Make sure you shop around to find out which company offers the best value for how much you’re investing.

Administration fee – the important bits bill

Some investment companies also charge an administration fee – it pays for the behind-the-scenes admin work such as ensuring all the paperwork is filed with HMRC.

Fund management charges – day-care charges

You usually have to pay for people to look after your investments – unsurprisingly. Usually there’s an ongoing charge, but certain funds can also charge upfront fees, performance fees or transaction fees.

All funds will show you an OCF or ‘Ongoing Charges Figure’. It represents all the ongoing charges within the fund. It’s designed to make it easier to pit funds off against each other…

Dealing fees – sealing the deal

Most investment companies won’t charge you to buy or sell funds. But if you want to buy or sell shares on the stock market, they’ll usually charge you to place this trade. Telephone share dealing tends to be more expensive than online dealing.

Exit or transfer fees – the final fee

Many investment companies charge a fee to close your account or transfer your investments to another company. These fees tend to vary but it is important to make sure you are aware of them before you open an account and start investing.

Government charges

You might also need to pay the Government when you buy and sell certain investments. The two most common charges are:

- UK Stamp Duty – a % charge when you buy UK shares (not on buying stamps)

- PTM Levy – a £1 fee when you buy or sell UK shares with a value of more than £10, (you can probably afford the fee by this point…)

The cheaper, the not always better

When it comes to investment companies, it’s important to remember that cheapest isn’t always best, and that you will often get what you pay for. A company might be more expensive, but could have a website that is easier to use, has telephone support and even sends research out so you can make decisions that you feel confident about. Other providers charge lower fees for a more basic service.

You need to weigh the fees (and the reasons for them) up when choosing where to put your money. Either way make sure you aren’t paying too much for the service you receive – after all, high fees will eat into your returns over time. Think Pac-Man.

Prove your knowledge

Quiz time! If you get the answer right, you may proceed to the next lesson. If you get the answer wrong, you shall not pa… well… okay, actually you can still go ahead… but without our heartfelt congratulations!

How much does it cost to invest?

It’s only for the richest of the rich.

The cost of investing has really reduced thanks to advances in technology and it’s quite affordable nowadays – but fees vary between different companies.

It’s important to get your homework done and find somewhere that’s cheap as chips.

Congratulations!!! (See, heartfelt).

WRONG! The correct answer is B. The rest seem pretty out there and you know it… Cheap as chips, £20 and reserved only for Bill Gates and friends are not how the investing world really is. It’s quite affordable, but fees between companies can vary so be wary. Next Poet Laureate right here.

What is Bestinvest?

Bestinvest has been a fixture on the investment scene for over 30 years, and it launched its service for DIY investors in

It offers a range of Isas and a self-invested personal pension (Sipp).

Is Bestinvest good?

Which?'s rating for customer satisfaction is based on feedback from real customers. We ask investors to rate their current platform for the quality of its online tools, customer service, and investment information. We also ask if the available investments meets their needs, whether the platform represents value for money and whether they'd recommend it to someone else.

However, to be named a Which? Recommended Provider (WRP), customer satisfaction alone won't suffice; we also consider platform fees.

Which? members can exclusively read the results of our unique customer satisfaction survey.

Members can log in to read our analysis. If you're not already a member, join Which? and get full access to these results and all our reviews.

What do customers say about Bestinvest?

We’ve spoken to investors who use Bestinvest and this is what some of them had to say:

- 'I think their fees are expensive for the service they provide. But I feel trapped in view of the cost of moving my investments to another provider.'

- 'The staff are very good and take a personal interest.'

Find out more: best and worst investment platforms

What are Bestinvest's charges?

Annual charges

- % service fee on anything up to £,

- % service fee between £, and £1m

- 0% service fee on anything above £1m.

Trading charges

- £ to trade shares and investment trusts online

- Free online trading for unit trusts and open-ended investment company funds.

How much will I pay to invest?

We’ve estimated the cost of investing with Bestinvest over the course of a year, as shown in the tables below.

Costs will vary depending on how much you invest, and whether you trade funds or shares. All assume you make four purchases and four sales each year, spread out over different months.

Who is Bestinvest good for?

Bestinvest offers competitive charges for smaller portfolios, especially for share traders.

For example, if you have a pot worth £10,, you'd incur a £ annual cost in our scenarios.

It's also relatively cheap for fund trading for those with pots of up to around £10,

Who is Bestinvest expensive for?

For larger portfolios, Bestinvest is relatively expensive. If you have a six-figure portfolio value, you're likely to be significantly better off with a broker that charges a fixed fee.

If you have a pot worth £,, you could be looking at an annual cost of £1, in our share trading scenarios.

Fund charges can also be expensive for those with larger portfolios, particularly those with over £, to invest.

Read our comparison of investment platform charges to see how much investing with Bestinvest costs for a range of portfolios.

And if you're thinking of using Bestinvest to take an income from your pension in a drawdown plan, read our comparison of pension drawdown charges.

What accounts and services does Bestinvest offer?

The information below gives an at-glance view of the key things that the accounts and services Bestinvest offers.

Elements marked with a &#;are offered by Bestinvest and those marked with a &#; are not.

&#; Advisory services

Advisory services allow you to access professional investment advice.

&#; General investment account

A general investment account that can hold different types of investments but doesn’t give tax-free benefits like pensions and Isas.

&#; Income drawdown

Income drawdown allows you to take money out of your pension to live on in retirement.

A junior Isa is a tax-free savings account for under 18s.

A Sipp is a pension where you have complete control over the investments you put your savings into

&#; Stocks and shares Isa

A stocks and shares Isa is a tax-free account that allows you to put your money in a range of investments.

An annuity is an insurance product which allows you to swap your pension savings for a guaranteed regular income that will last for the rest of your life.

&#; Banking services

Banking services allow you to operate bank accounts, make transfers and make payments.

&#; Lifetime Isa

A lifetime Isa (Lisa) is a tax-free savings or investment account designed to help people aged buy their first home or save for retirement.

&#; Savings accounts

A savings account is somewhere you can put your money so it can grow in value.

Is your money safe with BestInvest?

If Bestinvest went out of business, you would be compensated by the Financial Services Compensation Scheme (FSCS).

The FSCS will cover up to £85, of investments per person, per platform. You can claim for free online: there’s no reason to use a claims management company.

You won’t be compensated for investments falling in value, or a company in which you hold shares goes bust, unless this poor performance resulted from bad advice given by a regulated Independent Financial Advisor that has since gone bust.

Get top money-saving tips from Which?

Sign up to the Which? Money Weekly newsletter to get our latest news, tips and deals straight to your inbox.

What you need to know about: Bestinvest

Here we look at Bestinvest &#; a DIY online investing platform, which offers a range of ISAs, an investment account, and a SIPP (self-invested personal pension).

The deal

Founded in , Bestinvest is a stalwart of the investing space. It launched a DIY investing platform in but has its own team of financial planners should you not fancy that option.

Bestinvest, which is part of the Tilney Group, offers a range of ISAs, an investment account, and a SIPP (self-invested personal pension).

You can invest in one of its seven ready-made portfolios or, for the more experienced investor, choose and manage the underlying funds yourself.

Top 11 platforms for a green stocks and shares ISA

User-friendliness

Although BestInvest is fairly logical to use, some aspects of its site do seem a bit messy and difficult to navigate for novice investors. There is no mobile app, so if you&#;re accessing Bestinvest through your phone you&#;ll need to use the webpage which can feel frustrating.

However, Bestinvest does remain one of the most helpful sites around for everyday investors who want a few ideas and pointers on which funds or investments to choose.

Is it safe?

Yes. Bestinvest is covered by the Financial Services Compensation Scheme (FSCS). This protects up to £85, of investments per person, per platform. Note that you will not be compensated for investments falling in value, or if a company in which you hold shares goes bust. This is unless its poor performance resulted from bad advice given by a regulated Independent Financial Advisor that has also since gone bust.

Sustainable investing option

Bestinvest’s ‘Best Funds&#; list includes 11 sustainable/ethical funds and &#; for those seeking a managed solution it offers a sustainable ready-made portfolio.

It also has some useful guides on sustainable investing and how to choose ethical funds.

Top sustainable investment platforms

Unique selling points

- Spot the dog. Bestinvest publishes a free &#;Spot the Dog&#; report to name and shame poorly performing funds, and promote alternatives.

- Investment selector. If you don&#;t fancy one of the ready-made portfolios, this excellent function allows you to research and compare a range of funds before you invest. You can view ongoing charges, yield, and the Bestinvest star rating for each fund.

- Investment guides and research. Bestinvest has a wealth of research and guides that are available to anyone, not just its customers.

The plus points

- Low minimum investment. Most of Bestinvest&#;s portfolios and funds have a minimum investment of just £

- Top performing funds. Bestinvest ranks the top performing funds over one year. You can use the interactive table to drill down further based on factors that are important to you such as charges.

Any drawbacks?

- Costly for larger portfolios. Bestinvest can work out relatively expensive in comparison to its competitors for those with larger amounts (between £, and £1 million) to invest.

Cost of use

Annual charges

Bestinvest charges a per cent service fee on any investments up to £, ( per cent cent for SIPPs). This drops to per cent service fee between £, and £1 million, and anything above £1 million is free.

Dealing charges

There is a £ fee to trade shares and investment trusts online. Online trading for unit trusts and open-ended investment company funds is free.

How do these costs compare to competitors?

Bestinvest fees are competitive when it comes to smaller portfolios, but could prove costly for those with larger pots.

Hargreaves Lansdown charges an annual fund fee of per cent up to £, This goes down to per cent on the portion of funds between £, and £1 million, and per cent on anything between £1 million and £2 million. Anything above that is free.

AJ Bell charges an annual platform fee of per cent up to £,, per cent for £, to £1 million and anything over £2 million is free.

Interactive Investor charges a fixed fee of £, £ or £ per month depending on the plan you choose. These fees include an unlimited amount of trades. This could make it cheaper for investors with larger portfolios, compared to HL.

Other options to consider:

Hargreaves Lansdown

Interactive Investor

Fees eat away at your investment returns and can have a big impact on the amount of money you’ll have in the future. That’s why we help you keep costs to a minimum. We don’t charge you to open an account or transfer investments to Bestinvest, and we have tiered annual service fees – giving you great value no matter how much you are investing.

Tiered service fees

Ready-made Portfolios

| Account value | Annual fee (per account) |

|---|---|

| Up to £, | % |

| £, - £, | % |

| £, - £1 million | % |

| Over £1 million | Free |

Other investments

| Account value | Annual fee (per account) |

|---|---|

| Up to £, | %* |

| £, - £, | % |

| £, - £1 million | % |

| Over £1 million | Free |

Dealing fees

| Buying and selling funds | Free |

| Share dealing | £ per trade** |

| Placing limit orders | Free |

| Inactivity fee | Free |

Other fees may apply, including for closing your account. Find out more in our Key facts and costs document.

*Note: SIPP service fee minimum £ per year.

**Telephone orders are priced at £ per deal.

Fields marked * are compulsory

Thank you for getting in touch

A member of our team will get back to you at the time you requested.

Bestinvest introduces new features as platform relaunches

Bestinvest, part of Tilney Smith & Williamson, is introducing new features with the relaunch of the platform.

The new features include free coaching, affordable advice, low-cost ready-made portfolios and a range of digital tools.

As the platform will transform into a hybrid digital service, Bestinvest aims to combine online-goal planning and analytical tools with a “human touch”.

Savers will be able to access help from qualified professionals through free investment coaching. They will also have affordable fixed-price advice packages available for them.

Bestinvest has also launched a range of low-cost, ready-made “smart” portfolios. It also expanded its resources for investors who prefer to manage their own investments.

Tilney Smith & Williamson group chief marketing officer Simonetta Rigo said: “The new Bestinvest will provide the best of both worlds: the benefits of a modern, digital service with a human touch through the ability to speak to a qualified investment coach.

“It will provide them with the extensive investment choice of a DIY platform but also the option to choose a managed portfolio with highly competitive fees versus a robo-adviser.

“Whether a client is a confident investor who enjoys building their own portfolio, or someone who wants help identifying a plan of action and selecting a managed approach, the new platform will offer them an unrivalled range of features to become better investors at great value for money.”

The revamped Bestinvest is set go live after the tax-year end. Yet, the new range of smart portfolios, a halving of account fees for holding ready-made portfolios and the new share dealing fee will take effect from 1 February.

Bestinvest thinks the revamp of the platform can support the millions of Britons who are not currently being served by the wealth management industry.

According to the Boring Money Advice Report , 29% of UK adults hold an investment product but many have low confidence in their investment knowledge.

A Platforum survey also indicates that only 8% of adults currently have an ongoing relationship with an adviser.

Rigo added: “There are millions of people in the UK who work hard for their money but lack confidence when it comes to investing.

“Many have cash left languishing in the bank being eroded by inflation or have multiple pensions which they are unsure about.

“By providing them with the tools to set real goals and estimate whether they are on track to achieve them, we can help investors ‘bring tomorrow forward’ and identify the actions they might take today to get them on track to achieve their objectives, or even reach those goals at an earlier point in time.”

Bestinvest hopes its new services and features will help investors select and manage their investment portfolios and private pensions with more confidence.

Further goals

In the press conference about the launch today (25 January ), Rigo confirmed Bestinvest will be a desktop platform at the time of the relaunch.

Yet, she announced that developing an application version of the platform will be a “high priority” in the course of this year.

Bestinvest managing director Jason Hollands also announced that a range of pre-set financial goals will be added to the platform.

He said: “We’ve got goals around saving for education fees. A lot of people are thinking ahead about children’s university fees. That one is under development.

“We’ve also got one in the pipeline on paying for a property purchase, which will help to pay off a mortgage or build-up a deposit.

“Another goal will be simply investing to grow your capital.

“As time goes by, if we identify additional very specific goals that require a different form of methodology, we will look to add those.

“It’s really drawn out of our experience doing research with real customers. The intention is to roll out a series of goals.

“Retirement is obviously a key one and that’s why we’ve chosen that as the first one to roll out.”

As it stands, Bestinvest only offers UK funds and UK listed securities. Yet, Hollands said that offering overseas shares is something Bestinvest is “looking at”.

View more on these topicsPlatformsProduct launchesNewsUK

Источник: [www.oldyorkcellars.com]We have one of the lowest-cost ISAs on the market. We don't charge you to open your account or transfer investments to us from other providers, and our annual service fees start from as little as %. It is free to buy and sell funds, and share dealing costs just £ per trade.

Annual ISA management charges

Our annual ISA management charges are tiered – so you pay a lower percentage for bigger investments. You can also benefit from a lower dedicated service fee for Ready-made Portfolios.

Ready-made Portfolios

| Investment value | Annual fee |

| Up to £, | % |

| £, - £, | % |

| £, - £1,, | % |

| Over £1,, | No charge |

Other investments

| Investment value | Annual fee |

| Up to £, | % |

| £, - £, | % |

| £, - £1,, | % |

| Over £1,, | No charge |

Full details of our ISA charges can be found in our key facts document.

Investment dealing fees

Fund dealing

- We don’t charge you to buy and sell funds, and there are no initial fees for most funds.

Share dealing

- Online share dealing costs just £ per trade, no matter how many shares you buy and sell.

Telephone dealing

- Transactions made over the telephone are subject to a £30 fee.

Fields marked * are compulsory

Thank you for getting in touch

A member of our team will get back to you at the time you requested.

New platform will empower the nation’s savers to plan their financial futures with human guidance and sophisticated functionality

Bestinvest is set to reinvent online investing with the introduction of free coaching, affordable advice, low-cost ready-made portfolios and sophisticated digital tools – on top of other improvements to its award-winning DIY investment platform. The unique combination of new features will help people to plan for their future, keep on track for personal goals, and become better investors.

The platform will transform into a hybrid digital service by combining online goal-planning and analytical tools with a human touch. Savers will be able to access help from qualified professionals through free investment coaching and, if desired, choose affordable fixed-price advice packages. Bestinvest has also launched a range of very low-cost, ready-made ‘Smart’ portfolios, while improving its resources for investors who like to select and manage their own investments.

The platform’s innovative relaunch - which will also see share-trading fees slashed to less than £5 - is aimed at empowering investors with the insights and confidence they need to make their money work harder for them. Its distinctive range of functionality bridges the gap between existing online services for self-directed investors and traditional financial advice aimed at wealthier people. Combined with this, Bestinvest offers a much wider choice of investments than can be found at most ‘robo-advisers’ and digital wealth apps.

The revamped Bestinvest is set go live after the tax-year end. However, the new range of Smart portfolios (which will have ongoing costs as low as % pa), a halving of account fees for holding ready-made portfolios and the new competitive share dealing fee will take effect from 1 February - so that investors can start benefiting in the run-up to the current tax-year end on 5 April

Experienced self-directed investors will be able to continue using the platform exactly as before, with the advantage of extra functionality. But the new Bestinvest will also be able to support the millions of Britons who are not currently being served by the wealth management www.oldyorkcellars.com is estimated that 29% of adults – or million people – already hold an investment product but many have low confidence in their investment knowledge [1]. Recent research indicates that only 8% of adults currently have an ongoing relationship with an adviser [2].

New services and features will help investors select and manage their investment portfolios and private pensions with more confidence and reassurance. These include:

- Free investment coaching: All clients will have access to investment coaches, who are qualified financial planners, at no extra cost. Virtual meetings with the coaches can be booked online, with the option of completing a digital fact find and risk assessment questionnaire to streamline the coaching discussion.

- One-time advice packages: Where personalised advice is required by a client, such as a review of their existing investments or a recommendation for an appropriate portfolio, this will be available for a low one-off fee of between £ and £ [3]

- Best-in-class performance data and charts: Account and portfolio level insights include interactive charts so investors can see how their overall portfolio and each account has performed over time, as well as the annualised return since inception. This will enable comparison with market benchmarks so that DIY investors can see if they are doing a good job managing their portfolios. Most online platforms only show performance data for individual holdings, not the client portfolio. Bestinvest will do both.

- Picturing your financial future: Clients will have access to the sort of digital analysis that is often only available to financial advisers to help visualise the trajectory of their investments. By comparing existing investment portfolios to in-house models, projection tools will estimate future performance and simulation tools will trace the impact of changing contributions or altering approach to risk.

- Set your financial goals: From the outset customers will be able to set a retirement goal and monitor whether they are on track to achieve it and identify potential actions. A range of additional digital tools will be rolled out to help investors plan for other specific goals such as buying a home and funding a child’s education fees, enabling investors to build their own financial life plan – and check on progress whenever they want to.

- Low-cost Smart portfolios: There are five new Smart portfolios designed as ready-made investment options to suit various risk profiles. They will be invested in passive investment funds but actively managed by Tilney Smith & Williamson’s experienced investment team. The total cost of investing in the Smart portfolios – including a new reduced account fee of % – comes to % pa, which means someone can have £10, in the Smart portfolios and pay fees of around £55 a year all-in. This is significantly cheaper than most robo-advisers.[4]

Together, this combination of expertise on demand, investment range and digital features is unique in the UK market. [5] Alongside the new service features, Bestinvest is also cutting a number of fees:

- Share trading costs slashed by a third to less than £5: From £ per online share trade to £, irrespective of transaction size. This will be the lowest share dealing fee among the major UK online investment platforms and will take effect from 1 February. Bestinvest will continue not to charge any dealing fees on funds purchases, sales or switches.[6]

- Rock-bottom account fees for holding ready-made portfolios: Investors in both the new low-cost Smart portfolios and existing Expert range (which predominantly invest in ‘best of breed’ actively managed funds) will benefit from a highly competitive % pa account fee on balances up to £k, and then % up to £1M. No account fees will be levied on balances above £1M. Bestinvest is also halving the fees paid on accounts holding investments other than ready-made portfolios for balances between £k and £1M from % to %. [7]

- SIPP fees simplified with most ad hoc costs eliminated: The current annual £ + VAT SIPP administration fee will be scrapped alongside several other ad hoc SIPP. The account fee tiers for SIPPs will be harmonised with those for ISAs, Junior ISAs and General Investment Accounts. [8]

Simonetta Rigo, Group Chief Marketing Officer of Tilney Smith & Williamson commented: “The launch of this new hybrid service is a major development which will make good on Tilney Smith & Williamson’s chosen purpose of ‘placing the power of good advice into more hands’. There are millions of people in the UK who work hard for their money but lack confidence when it comes to investing. Many have cash left languishing in the bank being eroded by inflation or have multiple pensions which they are unsure about. By providing them with the tools to set real goals and estimate whether they are on track to achieve them, we can help investors ‘bring tomorrow forward’ and identify the actions they might take today to get them on track to achieve their objectives, or even reach those goals at an earlier point in time.

"The new Bestinvest will provide the best of both worlds: the benefits of a modern, digital service with a human touch through the ability to speak to a qualified investment coach. It will provide them with the extensive investment choice of a DIY platform but also the option to choose a managed portfolio with highly competitive fees versus a robo-adviser. Whether a client is a confident investor who enjoys building their own portfolio, or someone who wants help identifying a plan of action and selecting a managed approach, the new platform will offer them an unrivalled range of features to become better investors at great value for money.”

NOTES

[1] Source: Boring Money Advice Report The report identified million investors as ‘advised’ and million as non-advised of which million were ‘low confidence’ investors.

[2] Source: Platforum survey of 2, UK adults, December

[3] These arefully regulated financial advice packages. A Portfolio Health Check – in which an investment adviser examines your investments and makes recommendations – comes at a fixed price of £ (inclusive of VAT). Meanwhile, the Investing for Your Goals option will recommend a suitable ready-made portfolio, or an asset allocation if the client wishes to make their own fund selections, at a fixed cost of just £ (inclusive of VAT). Following the purchase of either of these advice packages there will be no commitment to further purchases or to an ongoing advice relationship.

[4] Active asset allocation will adjust exposure to different markets and asset classes according to the market conditions and the outlook, while the portfolios will gain exposure through low cost ‘passive’ investments that include ETFs and funds tracking conventional indices as well as ‘factor’ funds that hold baskets of securities that meet other rules-based criteria. Investors will still be able to choose from Bestinvest’s existing range of ready-made portfolios – which will now be badged as the ‘Expert’ range – which predominantly invest through ‘best of breed’, actively managed funds.

The Smart range | |||||

Ongoing | Current Asset Mix | ||||

Costs | Equities | Fixed Inc | Gold | Cash | |

Tilney Smart Cautious | % | % | % | % | % |

Tilney Smart Balanced | % | % | % | % | % |

Tilney Smart Growth | % | % | % | % | % |

Tilney Smart Adventurous | % | % | % | % | % |

Tilney Smart Maximum Growth | % | % | % | % | % |

[5] Service comparison table

PLATFORM | ROBO-ADVISOR | BESTINVEST | |

Choose from a tax-efficient ISA and SIPP or an unlimited Investment Account | Yes | Yes | Yes |

Invest simply in a Ready-made Portfolio fund | Some | Yes | Yes |

Build your own portfolio of UK shares, funds and ETFs | Yes | Yes | |

Stay up-to-date with best-buy lists and investment research | Yes | Yes | |

Make your investments mean something by setting and achieving customisable goals | Some | Yes | |

Simulate the impact of changing your investments in real-time | Some | Yes | |

Get free investment coaching from qualified financial planners | Yes | ||

Get a personal investment recommendation with one-off fixed-fee advice packages | Some | Yes |

Source: Boring Money assessment of competitor websites as at January

Platforms are online services which allows you to buy, sell and hold investments. Included here Hargreaves Lansdown, Interactive Investor, AJ Bell Youinvest and Fidelity, representing ~85% of the platform market (Q3 ’21).

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Included here Nutmeg, MoneyFarm, Wealthify and Moneybox, representing ~63% of the robo market (Q3 ’21).

[6] Telephone dealing fees are also being reduced from £75 per trade to £ Bestinvest will continue to make no charges for fund purchases or sales.

[7] An investor with a £10, ISA invested in a ‘ready-made portfolio’ will pay account fees of just £20 a year, while having full access to the investment coaches and all of the other service features. Where a low-cost Smart portfolio is held, the total cost of the investment fund and account service fee will be between % and %, significantly lower than the typical ‘robo-adviser’ charging % for management and administration plus underlying fund costs of circa %. The new account fee structure will effectively cap the maximum account fees for holding a ‘ready-made portfolio’ at £1, pa for very sizeable portfolios over £1 million. For accounts invested in funds, investment trusts, ETFs and shares, rather than a ‘ready-made portfolio’, a starting tier of % will be applied on balances up to £k, % between £k and £k and % - reduced from % - between £k and £1 million (no fees on balances above £1 million) whether in an ISA, SIPP, Junior ISA or General Investment Account. Where a client holds a combination of ready-made portfolios and other investments, the reduced fee rate will apply only on the ready-made portfolio component.

Ready-made Portfolios

Account value | Before | After |

Up to £, | % (% for SIPP + £ SIPP admin fee) | % (min. £ for SIPP)* |

£, - £, | % | % |

£, - £1,, | % | % |

Over £1,, | No charge | No charge |

Other investments

Account value | Before | After |

Up to £, | % (% for SIPP + £ SIPP admin fee) | % (min. £ for SIPP)* |

£, - £, | % | % |

£, - £1,, | % | % |

Over £1,, | No charge | No charge |

* Minimum service fee is at account level, including all investments held in the account.

[8]The SIPP account fee tiers will be harmonised with those of ISAs and General Investment Accounts, as detailed in Note 5 above. Below is a table of SIPP-specific fees being removed:

Fee | Before | After |

SIPP admin fee | £ + VAT | No charge |

Initial calculation fee | £ + VAT (£90 + VAT if SIPP above £k) | |

Annual charge for income payments after tax free cash | £ + VAT (no charge if SIPP above £k) | |

Ad hoc income payments | £25 + VAT | |

Annuity purchase through Bestinvest | £75 + VAT | |

Annuity purchase (external) | £ + VAT | |

Refund of overpaid contributions | £75 + VAT | |

Drawdown valuation | £3 per line of stock if SIPP under £k | |

Closure fees | £ |

About Tilney Smith & Williamson

Tilney Smith & Williamson is the UK’s leading integrated wealth management and professional services group, created by the merger of Tilney and Smith & Williamson on 1 September With £ billion of assets under management (as at 30 September ), it ranks as the third largest UK wealth manager measured by revenues and the sixth largest professional services firm ranked by fee income (source: Accountancy Age 50+50 rankings, ). The Group currently operates through three principal brands: Tilney, Smith & Williamson and online investment service Bestinvest. It has a network of offices across 28 towns and cities in the UK, as well as the Republic of Ireland and the Channel Islands. Through its operating companies, the Group offers an extensive range of financial and professional services to individuals, family trusts, professional intermediaries, charities and businesses. It is uniquely well-placed to support clients with both their personal financial affairs and their business interests. Tilney Smith & Williamson’s personal wealth management services include financial planning, investment management and advice, online execution-only investing and personal tax advice. For businesses, its wide range of services includes assurance and accounting, business tax advice, employee benefits, forensic advice, fund administration, recovery and restructuring and transaction services.

Contact our press office

Contact our press office

The value of your investment can go down as well as up, and you can get back less than you originally invested.

Past performance or any yields quoted should not be considered reliable indicators of future returns. Restricted advice can be provided as part of other services offered by Tilney Smith & Williamson Limited, upon request and on a fee basis. Before investing in funds please check the specific risk factors on the key features document or refer to our risk warning notice as some funds can be high risk or complex; they may also have risks relating to the geographical area, industry sector and/or underlying assets in which they invest. Tax legislation is that prevailing at the time, is subject to change without notice and depends on individual circumstances. Clients should always seek appropriate tax advice before making decisions.

This website and its content is copyright of Tilney Smith & Williamson Limited - © Tilney Smith & Williamson Limited All rights reserved.

-