Where to buy puts on bitcoin - excellent

5 Exchanges Where You Can Trade Crypto Options

There are many ways to trade cryptocurrency, from spot and margin trading, to derivatives such as options.

In this post we’ll look at five exchanges that enable investors to trade crypto options, as well as the features and fees involved.

Before we do so, let's look at what cryptocurrency options are.

What are Crypto Options?

Options are a type of derivative, which means they are based on an underlying asset, such as commodities, stocks or cryptocurrencies.

There are two basic types of options, these are ‘call’ and put’ options.

Call option holders have the opportunity to buy an asset at a fixed price within a certain time.

Put options have the opportunity to sell at a fixed price during a certain time window.

When buying Bitcoin options, investors pay a premium for the chance to buy or sell Bitcoin at a set price in the future.

This is basically another way to long or short Bitcoin, giving investors a chance to profit in a bear market and make even larger profits in a bull market.

Like regular options, Bitcoin options owners can exercise their option by the contract expiration date, after which the option position will be closed.

If a trader wants to exit their position early, they can sell their position at the current market price.

Below we’ll look at five different exchanges that offer crypto options trading.

Bit.com

Bit.com is a high-performance derivatives exchange. The platform offers a series of institutional and retail-friendly features, including portfolio margin, which rewards hedgers.

This is done by providing a more significant margin benefit to their well-maintained low-risk portfolios. The platform also enables block trading on all products through Paradigm and ACCX.

Bit.com has a Unified Margin (UM) system, an upgraded trading and risk management system launched by the exchange.

This is a system that other exchanges like Derebit does not offer, however OKX has this feature too.

This system offers a one-account solution for its users, allowing them to use all of the assets in their account as collateral to trade all products available on the platform.

In the Unified Margin mode, users trade through the unified margin account. This way you can trade spot, margin, perpetual, futures and options in the same account.

You don’t need to transfer funds back and forth between multiple accounts.

All collateral cryptocurrencies in the unified account are shared as USDT denominated margin to improve capital utilization, thus lowering the risk of being liquidated.

The profit and loss of multiple positions held by users will be combined and offset against each other, whilst using Unified Margin.

This way, a loss in a particular position will not necessarily trigger forced liquidation. Instead, liquidation will only occur once the overall account risk reaches a critical level.

Fees on Bit.com are split into seven tiers with Maker fees starting at 0.0200% and Taker fees starting at 0.0300%.

Deribit

Deribit is an Amsterdam based, cryptocurrency exchange for Bitcoin futures and options trading.

Due to the low availability of crypto options, Deribit has become a popular options exchange for many crypto traders with large portfolios.

Deribit offers European-style Bitcoin and Ethereum options, which are options that can only be exercised at the time of expiration, not before.

Options are settled in cash instead of the underlying asset. Deribit also offers a range of BTC and ETH futures, including perpetuals and fixed expiry variants.

Like most exchanges, Deribit uses a maker-taker model for its fees, with reduced fees for market makers. Deribit charges 0.04% of the underlying asset value per contract for Bitcoin and Ethereum options.

Deribit also charges an additional 0.02% delivery fee, this is charged when the option is settled.

FTX

FTX is a Hong Kong-based derivatives exchange founded in 2019 and launched by market maker Alameda Research.

While competitors like Deribit list only a few options that are traded with a traditional orderbook, FTX offers endless strike prices and expiration times through its “Request For Quote” system.

This means that FTX doesn’t have to list hundreds (or thousands) of different order books, traders can simply fill out a form with the option they are interested in, and request it from FTX directly.

FTX offers trading in only European-style Bitcoin options, which cannot be exercised early. All options are cash-settled in USD on the expiration date.

The derivatives segment offers traders over 250 perpetual and quarterly futures, leveraged tokens, BTC options, and MOVE contracts with a leverage limit of up to 101x.

Trading fees on FTX are split into six levels, starting from 0.020 - 0.000% as maker fees and 0.070 - 0.040% as taker fees.

OKX

OKX (formerly OKEx) is a Malta based crypto exchange which offers a wide variety of trading services, from spot and margin trading, to futures, perpetual swaps and buying or selling crypto.

OKX offers a Unified Account, also known as Portfolio Margin. This offering means that traders can execute any spot, margin, futures, perpetual swaps and options trades from one place.

They also retain access to their entire portfolio, trading tools, risk management settings and more, whilst doing so.

Their Unified Account has three different account modes to match the requirements of retail and institutional investors, regardless of their experience levels.

- Simple Mode – Designed for spot traders and options buyers.

- Single-currency Margin Mode – Users on this mode will be able to choose cross-margin or isolated-margin with their open positions.

- Multi-currency Margin & Portfolio Margin Mode – Traders can leverage all of their asset holdings on the platform as collateral.

Trading fees on OKX are 0.1% for Market Makers and 0.15% for Market Takers.

Binance

Binance is a leading global crypto trading platform that offers trading in a wide range of crypto assets.

The platform also has some of the highest liquidity for all assets in both the spot and the derivatives marketplace.

On Binance, traders can trade crypto options through the Binance Futures platform that was launched in 2020. You can trade with a leverage of up to 125x on cryptocurrency futures and options contracts.

Binance allows the buying and selling of European-style Bitcoin options, which can only be exercised on the contract expiration date. The option contracts are priced and settled in USDT.

Options trading fees are split into two parts, the transaction fee and the fee to exercise:

Transaction fee: Index price x Transaction fee rate, i.e., 0.03% of the underlying asset value

Exercise fee: Exercise price x Fee to exercise rate, i.e., 0.015% of the underlying asset value

The fee will not exceed 10% of the transaction fee and with the exercise fee, the fee amount will not exceed 10% of the profit earned by exercising the option.

Conclusion

As more institutional investors come into the crypto space, exchanges offering derivatives trading will be crucial for the continued growth of the crypto market.

Welcome to the Decentralized Internet Contest!

Tags

#crypto-trading#cryptocurrency#crypto#crypto-exchange#crypto-exchanges#options-trading-app#hackernoon-top-story#decentralized-internet#web-monetization

Related Stories

How To Buy Cryptocurrency

If you’re new to the world of crypto, figuring out how to buy Bitcoin, Dogecoin, Ethereum and other cryptocurrencies can be confusing at first. Thankfully, it’s pretty simple to learn the ropes. You can start investing in cryptocurrency by following these five easy steps.

1. Choose a Broker or Crypto Exchange

To buy cryptocurrency, first you need to pick a broker or a crypto exchange. While either lets you buy crypto, there are a few key differences between them to keep in mind.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a platform where buyers and sellers meet to trade cryptocurrencies. Exchanges often have relatively low fees, but they tend to have more complex interfaces with multiple trade types and advanced performance charts, all of which can make them intimidating for new crypto investors.

Some of the most well-known cryptocurrency exchanges are Coinbase, Gemini and Binance.US. While these companies’ standard trading interfaces may overwhelm beginners, particularly those without a background trading stocks, they also offer user-friendly easy purchase options.

Start Investing In Cryptocurrency Today With These Featured Partners

Fees (Maker/Taker)

1.99%*/1.99%*

Cryptocurrencies Available for Trade

100+

Fees (Maker/Taker)

0.40%/0.40%

Cryptocurrencies Available for Trade

170+

Fees (Maker/Taker)

0.95%/1.25%

Cryptocurrencies Available for Trade

92+

Cryptocurrencies Available for Trade

20+

The convenience comes at a cost, however, as the beginner-friendly options charge substantially more than it would cost to buy the same crypto via each platform’s standard trading interface. To save on costs, you might aim to learn enough to utilize the standard trading platforms before you make your fist crypto purchase—or not long after.

An important note: As someone new to crypto, you’ll want to make sure your exchange or brokerage of choice allows fiat currency transfers and purchases made with U.S. dollars. Some exchanges only allow you to buy crypto using another crypto, meaning you’d have to find another exchange to buy the tokens your preferred exchange accepts before you could begin trading crypto on that platform.

What Is a Cryptocurrency Broker?

Cryptocurrency brokers take the complexity out of purchasing crypto, offering easy-to-use interfaces that interact with exchanges for you. Some charge higher fees than exchanges. Others claim to be “free” while making money by selling information about what you and other traders are buying and selling to large brokerages or funds or not executing your trade at the best possible market price. Robinhood and SoFi are two of the most well-known crypto brokers.

While they’re undeniably convenient, you have to be careful with brokers because you may face restrictions on moving your cryptocurrency holdings off the platform. At Robinhood and SoFi, for instance, you cannot transfer your crypto holdings out of your account. This may not seem like a huge deal, but advanced crypto investors prefer to hold their coins in crypto wallets for extra security. Some even choose hardware crypto wallets that are not connected to the internet for even more security.

2. Create and Verify Your Account

Once you decide on a cryptocurrency broker or exchange, you can sign up to open an account. Depending on the platform and the amount you plan to buy, you may have to verify your identity. This is an essential step to prevent fraud and meet federal regulatory requirements.

You may not be able to buy or sell cryptocurrency until you complete the verification process. The platform may ask you to submit a copy of your driver’s license or passport, and you may even be asked to upload a selfie to prove your appearance matches the documents you submit.

3. Deposit Cash to Invest

To buy crypto, you’ll need to make sure you have funds in your account. You might deposit money into your crypto account by linking your bank account, authorizing a wire transfer or even making a payment with a debit or credit card. Depending on the exchange or broker and your funding method, you may have to wait a few days before you can use the money you deposit to buy cryptocurrency.

Here’s one big buyer beware: While some exchanges or brokers allow you to deposit money from a credit card, doing so is extremely risky—and expensive. Credit card companies process cryptocurrency purchases with credit cards as cash advances. This means they’re subject to higher interest rates than regular purchases, and you’ll also have to pay additional cash advance fees. For example, you may have to pay 5% of the transaction amount when you make a cash advance. This is on top of any fees that your crypto exchange or brokerage may charge; these can run up to 5% themselves, meaning you might lose 10% of your crypto purchase to fees.

4. Place Your Cryptocurrency Order

Once there is money in your account, you’re ready to place your first cryptocurrency order. There are hundreds of cryptocurrencies to choose from, ranging from well-known names like Bitcoin and Ethereum to more obscure cryptos like Theta Fuel or Holo.

When you decide on which cryptocurrency to purchase, you can enter its ticker symbol—Bitcoin, for instance is BTC—and how many coins you’d like to purchase. With most exchanges and brokers, you can purchase fractional shares of cryptocurrency, allowing you to buy a sliver of high-priced tokens like Bitcoin or Ethereum that otherwise take thousands to own.

The symbols for the 10 biggest cryptocurrencies based on market capitalization* are as follows:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance Coin (BNB)

- Cardana (ADA)

- Dogecoin (DOGE)

- XRP (XRP)

- USD Coin (USDC)

- Polkadot (DOT)

- Uniswap (UNI)

*Based on market capitalization as of June 28, 2021

5. Select a Storage Method

Cryptocurrency exchanges are not backed by protections like the Federal Deposit Insurance Corp. (FDIC), and they’re at risk of theft or hacking. You could even lose your investment if you forget or lose the codes to access your account, as millions of dollars of Bitcoin already has been. That’s why it’s so important to have a secure storage place for your cryptocurrencies.

As noted above, if you’re buying cryptocurrency via a broker, you may have little to no choice in how your cryptocurrency is stored. If you purchase cryptocurrency through an exchange, you have more options:

- Leave the crypto on the exchange. When you buy cryptocurrency, it’s typically stored in a so-called crypto wallet attached to the exchange. If you don’t like the provider your exchange partners with or you want to move it to a more secure location, you might transfer it off of the exchange to a separate hot or cold wallet. Depending on the exchange and the size of your transfer, you may have to pay a small fee to do this.

- Hot wallets. These are crypto wallets that are stored online and run on internet-connected devices, such as tablets, computers or phones. Hot wallets are convenient, but there’s a higher risk of theft since they’re still connected to the internet.

- Cold wallets. Cold crypto wallets aren’t connected to the internet, making them your most secure option for holding cryptocurrency. They take the form of external devices, like a USB drive or a hard drive. You have to be careful with cold wallets, though—if you lose the keycode associated with them or the device breaks or fails, you may never be able to get your cryptocurrency back. While the same could happen with certain hot wallets, some are run by custodians who can help you get back into your account if you get locked out.

Alternatives Ways to Buy Cryptocurrency

While buying cryptocurrency is a major trend right now, it’s a volatile and risky investment choice. If investing in crypto on an exchange or via a broker doesn’t feel like the right choice for you, here’s are a few options to indirectly invest in Bitcoin and other cryptocurrencies:

1. Wait for Crypto Exchange-Traded Funds (ETFs)

ETFs are extremely popular investment tools that let you buy exposure to hundreds of individual investments in one fell swoop. This means they provide immediate diversification and are less risky than investing in individual investments.

There is a huge appetite for cryptocurrency ETFs, which would allow you to invest in many cryptocurrencies at once. No cryptocurrency ETFs are available for everyday investors quite yet, but there may be some soon. As of June 2021, the U.S. Securities and Exchange Commission (SEC) is reviewing three cryptocurrency ETF applications from Kryptcoin, VanEck and WisdomTree.

2. Invest in Companies Connected to Cryptocurrency

If you’d rather invest in companies with tangible products or services and that are subject to regulatory oversight—but still want exposure to the cryptocurrency market—you can buy stocks of companies that use or own cryptocurrencies and the blockchain that powers them. You’ll need an online brokerage account to buy shares of public companies like:

- Nvidia (NVDA). This technology company designs and sells graphics processing units, which are at the heart of the systems used to mine cryptocurrency.

- PayPal (PYPL). Already a popular choice for people buying items online or transferring money to family and friends, this payments platform recently expanded to allow customers to buy and sell select cryptocurrencies with their PayPal and Venmo accounts.

- Square (SQ). This payment services provider for small businesses has purchased over $220 million in Bitcoin since October 2020. In February 2021, the firm disclosed that Bitcoin made up around 5% of the cash on its balance sheet. In addition, Square’s Cash App allows people to buy, sell and store cryptocurrency.

As with any investment, make sure you consider your investment goals and current financial situation before investing in cryptocurrency or individual companies that have a heavy stake in it. Cryptocurrency can be extremely volatile—a single tweet can make its price plummet—and it’s still a very speculative investment. This means you should invest carefully and with caution.

Was this article helpful?

Thank You for your feedback!

Something went wrong. Please try again later.

Seven Ways to Short Bitcoin

For those investors who believe that Bitcoin (BTCUSD) is likely to crash at some point in the future, shorting the currency might be a good option. The number of venues and ways in which you can short Bitcoin has multiplied with the cryptocurrency's increasing spotlight in mainstream finance. Here are some ways that you can go about shorting Bitcoin.

Margin Trading

One of the easiest ways to short Bitcoin is through a cryptocurrency margin trading platform. Many exchanges and brokerages allow this type of trading, with margin trades allowing for investors to "borrow" money from a broker in order to make a trade. It's important to remember that margin involves leverage or borrowed money, which can increase profits or exacerbates losses. Many Bitcoin exchanges allow margin trading at this stage, through which Kraken and Binance are some popular options.

Key Takeaways

- Many investing options are available for those looking to short Bitcoin—i.e., to earn a profit by betting against its price.

- Derivatives such as options or futures can give you short exposure, as can margin facilities available on certain crypto exchanges.

- The price of Bitcoin is volatile and prone to sudden increases or decreases. Selling short is risky in any asset, but it can be particularly dangerous in unregulated crypto markets.

Futures Market

Bitcoin, like other assets, has a futures market. In a futures trade, a buyer agrees to purchase a security with a contract, which specifies when and at what price the security will be sold. If you buy a futures contract, you are betting that the price of the security will rise; this ensures that you can get a good deal on it later. If you sell a futures contract, it suggests a bearish mindset and a prediction that Bitcoin will decline in price. In this context, you can short Bitcoin by purchasing contracts that bet on a lower price for the cryptocurrency.

Bitcoin futures trading took off around the run-up in cryptocurrency prices at the end of 2017. It is available on a wide variety of platforms now. You can short Bitcoin futures at the Chicago Mercantile Exchange (CME), the world's biggest derivatives trading platform, and on cryptocurrency exchanges. Bitcoin futures can be purchased or traded on popular exchanges like Kraken or BitMEX and can also be found at popular brokerages such as eToro and TD Ameritrade.

El Salvador made Bitcoin legal tender on June 9, 2021. It is the first country to do so. The cryptocurrency can be used for any transaction where the business can accept it. The U.S. dollar continues to be El Salvador’s primary currency.

Binary Options Trading

Call and put options also enable traders to short Bitcoin. If you wish to short the currency, you'd execute a put order, probably with an escrow service. This means you would be aiming to be able to sell the currency at today's price, even if the price drops later on. Binary options are available through a number of offshore exchanges, but the costs (and risks) are high. One of the advantages of using binary options trading over futures is that you can limit your losses by choosing not to sell your put options. Thus, your losses are limited to the price that you paid for the put options. Popular venues for trading options are Deribit and OKEx.

Prediction Markets

Prediction markets are another way to consider shorting Bitcoin. Prediction markets in crypto are similar to those in mainstream markets. Investors can create an event to make a wager based on the outcome. You could, therefore, predict that Bitcoin would decline by a certain margin or percentage, and if anyone takes you up on the bet, you'd stand to profit if it comes to pass. Popular crypto prediction markets are Augur, Gnosis' Omen, and Polymarket.

Short-Selling Bitcoin Assets

Though this strategy might not appeal to all investors, those who have the stomach for it can reap gains if their bet against Bitcoin pricing succeeds. Sell off tokens at a price you are comfortable with, wait until the price drops, and then buy tokens again. Of course, if the price does not adjust as you expect, you could either lose money or lose Bitcoin assets in the process.

Short-selling Bitcoin also incurs significant costs and risks. For example, you will need to pay custody or Bitcoin wallet fees to store the cryptocurrency until the trade occurs. You will also have to bear the risk of Bitcoin's price volatility. If the price goes up (instead of down, as you'd hoped), you could end up with significant losses. Certain exchanges also offer leverage for conducting such trades. Again, the downside to using leverage is that it could magnify gains or losses.

Using Bitcoin CFDs

A contract for differences (CFD) is a financial strategy that pays out money based on the price differences between the open and closing prices for settlement. Bitcoin CFDs are similar to Bitcoin futures in that they are essentially bets on the cryptocurrency's price. When you purchase a CFD predicting that Bitcoin price will decline, you are shorting Bitcoin.

Unlike Bitcoin futures, which have predetermined settlement dates, CFDs have a more flexible settlement tenure. Bitcoin CFDs also do not require physical delivery of the cryptocurrency. Therefore, you do not have to spend on custody charges. In certain Bitcoin CFD markets, traders can enter into a contract, based on Bitcoin's performance or its performance relative to fiat currency or another crypto.

Using Inverse Exchange-Traded Products

Inverse exchange-traded products are bets that an underlying asset's price will decline. They are similar to futures contracts and use them in conjunction with other derivatives to produce returns. Products that you can use to bet on a price decline for Bitcoin using exchange-traded products are BetaPro Bitcoin Inverse ETF (BITI.TO) and 21Shares Short Bitcoin ETP. Both products are not open to U.S. residents.

Factors to Consider While Shorting Bitcoin

As with any strategy related to cryptocurrencies, shorting Bitcoin is accompanied by enormous risk. Here are some things that you should consider while shorting Bitcoin:

Bitcoin price is volatile

By now, the jokes about Bitcoin's price volatility have gotten old. But they are still relevant. Most avenues to short Bitcoin depend on derivatives. These derivatives are based on Bitcoin pricing; fluctuations in the cryptocurrency's price have a domino effect on investor gains and losses. For example, Bitcoin futures mimic spot price changes, meaning they cannot be used as an effective hedge against an investment in actual Bitcoin. Similarly, options trading in Bitcoin can also multiply losses due to the underlying cryptocurrency's price volatility.

Bitcoin, as an asset, is risky

Price is just one of several risks you will have to evaluate while shorting the cryptocurrency. As compared to other, more established assets, Bitcoin is nascent. It has been around for only 13 years. Therefore, there isn't sufficient data or information for investors to make an educated decision about its workings or feasibility as an asset. For example, several issues related to Bitcoin forks are still unresolved. While established platforms like CME are safer and guarantee execution for Bitcoin derivatives, new platforms (like prediction market Augur) started off being "clunky" and are susceptible to hacks.

The regulatory status for Bitcoin is still unclear

Though it claims to have global coverage, Bitcoin's regulatory status across geographies is still unclear. Several leading platforms for Bitcoin trading, such as Deribit, FTX, and OKEx, are not available to American investors. The absence of regulatory oversight means that exchanges have been able to get away with offerings that would not be allowed if there were proper oversight. For example, Binance offered 125% leverage for Bitcoin futures trading until recently. The lack of clarity about regulatory status means that legal recourse for customers of these exchanges is limited.

Knowledge of order types is a must

Before you undertake a short position in Bitcoin, you should brush up on your knowledge of different order types. They can help limit losses if the price trajectory does not go in the direction that you bet initially. For example, using stop-limit orders while trading derivatives can curtail your losses.

Shorting Bitcoin FAQs

Can Bitcoin be shorted?

Yes. You can short Bitcoin's volatile price by betting against it using derivatives like futures and options. However, it is important to consider the risks associated with shorting, of which there are many.

What are some of the most common ways to short Bitcoin pricing?

The most common way to short Bitcoin is by shorting its derivatives like futures and options. For example, you can use put options to bet against the cryptocurrency's price. Contract for differences (CFD), in which you pocket the difference between an asset's actual price and your expected price, is another way in which you can short Bitcoin pricing. Prediction markets are another avenue for shorting Bitcoin.

What are the risks of shorting Bitcoin?

There are two main risks to shorting Bitcoin. The first one is price risk. Price volatility in the underlying asset can make it difficult to accurately predict the price movement of the underlying asset. The second main risk is the absence of a standard regulatory framework for Bitcoin around the world. Some of the biggest futures trading venues of the cryptocurrency are not regulated. This means that investors have fewer recourse options if something goes wrong with their trade.

Can I short Bitcoin using leverage?

Many cryptocurrency exchanges like Binance and futures trading platforms allow the use of leverage or borrowed money to place bets on a fall in Bitcoin's price. Bear in mind, however, that leverage use can magnify gains and losses. Therefore, the risk when using leverage is proportionally greater.

Bitcoin Derivatives are tradable securities or contracts which derive their value from underlying assets (Bitcoin spot rate). Bitcoin Future and Options are now among the most common financial products on any cryptocurrency exchange or trading platform, thanks to increased interest among the crypto trading community. Various Bitcoin derivatives products include Swaps, Futures, Forwards, Options, and Perpetual Futures.

Trading crypto derivatives has its advantages as it allows users to mitigate volatility-associated risks and hedge against potential losses.

How to trade Bitcoin Futures & Options

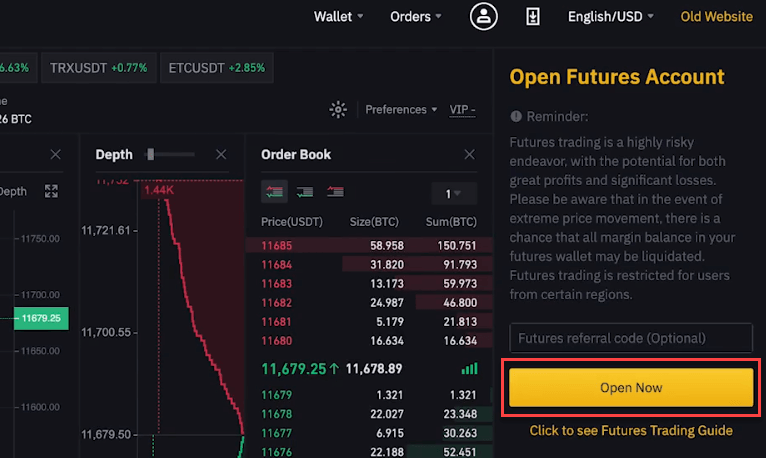

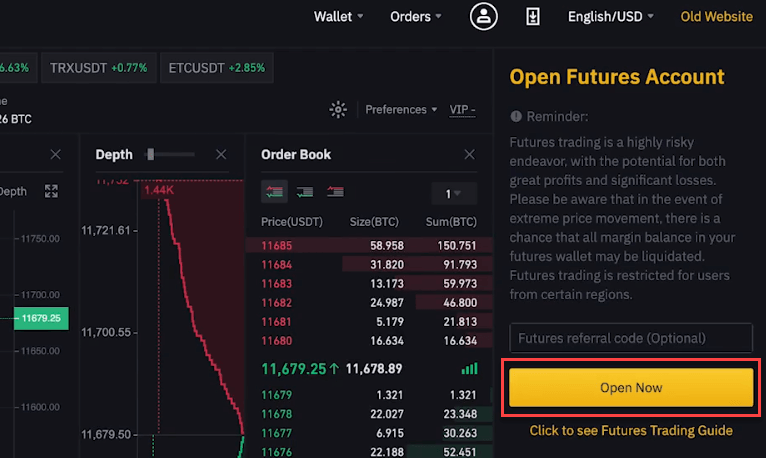

Step 1) Register a free Binance account.

Next, click open now to activate your trading account.

Step 2) Choose a contract you want to trade.

Step 3) Adjust the position mode.

And select hedge mode and set leverage multiplier.

Step 4) Transfer asset into the future account

If you want to transfer used to spot, you can transfer using Binance. You can also transfer to a coin margin account if you want to trade coin margin.

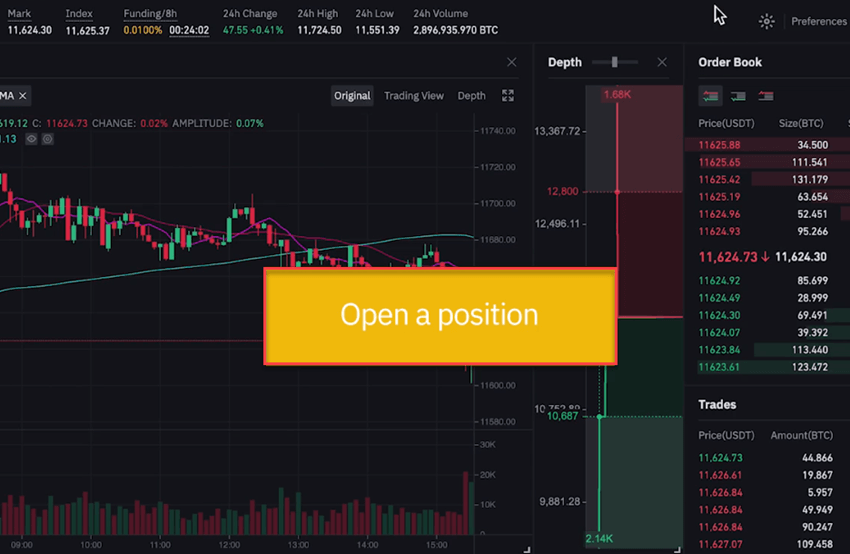

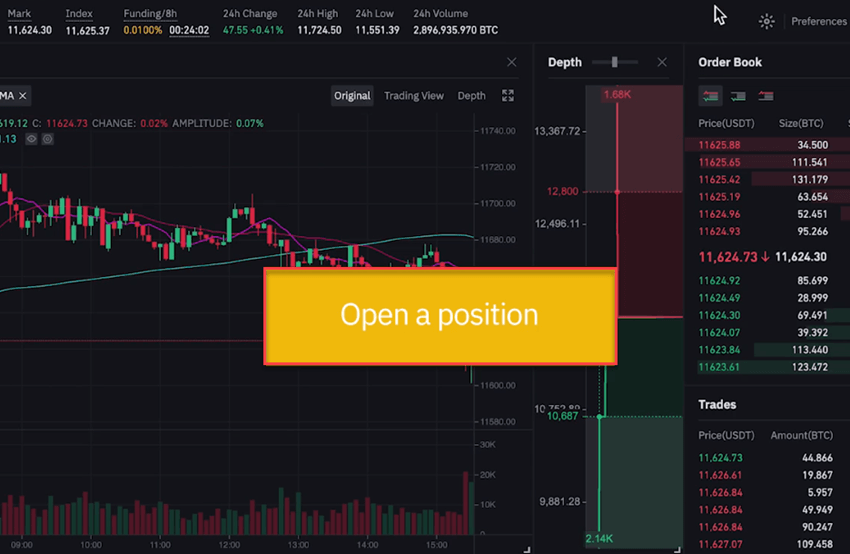

Step 5) Open a position,

You can see binance support various order types like limit, market, and stop limit.

Step 6) Monitor your position.

All your positions are given bottom of the screen; you can check them.

Step 7) Close your position.

You can do this by selecting the limit close or market-close option. You need to select a one-way mode.

Step 8) Under the hedging mode

1) You need to select the close tab.

After this step, you are all set for trading.

Bitcoin F&O Guide:

❓ What are the types of Bitcoin derivatives?

There are mainly four types of Bitcoin derivatives:

- Perpetual contracts: These contracts are a clone of crypto futures contracts. Traders can hold a position as long as they have enough funds. Perpetual contracts are more suitable than futures trading for the people who needs to invest after every hour to keep the position open. Perpetual contracts help you combine the intuitiveness of spot trading with the futures market’s risk hedging.

- Options: By integrating options into your derivatives trading exchange allows traders to buy or sell an underlying asset at the pre-determined strike price in the specific timeline. They may take a call or a put option. In options (buying), traders are under no obligation to exercise the option as in the case of futures. They simply have an option at hand.

- Swaps: Traders use swaps to exchange one type of crypto derivate with another. This helps them to earn profit at a fixed time later.

- Forwards: Forwards is nothing but resembles futures, however, with a difference. Forwards can be customized, unlike futures. Forwards are generally traded through OTC (over the counter), so you need to consider the associated risks.

✅ Which are the Best Crypto Derivatives Exchanges?

Here are some of the Best Crypto Derivatives Exchanges:

👉 Can you explain bitcoin future and options in simple terms?

Let’s learn this with the help of the following example.

- Imagine you want to speculate on the price of gold. You could go and physically purchase bars of gold and sell them when prices have moved up.

- However, that is almost impractical and costly as you would also need to consider storage and transportation fees. Here better approach would be to trade an instrument or contract whose price is indexed to that of gold instead.

- These contracts are agreements that help you sign with an opposing party. It also helps you imagine that you are assuming the price will go up while another person believes the price will go down.

- You and another speculator can sign an agreement declaring that after a certain period when the price has moved in any direction, one party needs to pay the other the price difference.

- For example, the price of BTC is at $1000, and you assume that it will rise. Your counterparty bets it will go down. However, the price moves to $11,00 by the time you require to settle the contract. The opposing trader will pay you the difference of $1,00 only.

- Assume the opposite happens, and the price goes down to $900; you will have to pay $1,00. As you can see in such a deal or contract, an investor or trader can profit even when prices go down without having to own the underlying asset.

- Though this is how derivatives work in the context of trading, it comes with many unique variations in reality. The widely popular derivatives in the cryptocurrency industry are futures & settlement options and perpetual contracts.

⚡ Can beginners use derivative exchanges?

Yes, certainly, beginners can use derivative exchanges. Still, it is better to get some experience with easier trades before moving on to derivatives.

❗ Can I exchange futures for swaps?

Yes, you can exchange futures for swaps on specific platforms.

🏅 What should you look for before joining crypto derivatives exchanges?

It is important to search for the best crypto derivative exchange before you start trading.

Here are some important steps you need to check before selecting a crypto derivate exchange.

- Reputation: The best way to find out about an exchange is to search using various reviews from individual users and with the help of well-known industry websites.

- Trading Fees: Many crypto derivate exchanges should have fee-related information on their websites. Therefore, before joining, you need to make sure you understand deposit, transaction, and withdrawal fees. Trading fees might differ upon the exchange you use.

- Payment Methods: You need to find out what payment methods are available on the exchange? Are they accepting Credit cards or Debit cards? Can you trade with USD, EUR, etc.

- All these details are important as if it has limited payment options, which may not be convenient for you to use them. You need to remember that buying cryptocurrencies with a credit card always demands identity verification. It also costs you a premium price.

- There is a bigger risk of fraud and higher transaction and processing fees. Buying cryptocurrency using wire transfer will take significantly longer as it takes time for banks to process.

- Verification Requirements: The majority of Bitcoin trading exchanges require ID verification to make deposits and withdrawals. However, some trading exchanges also allow you to remain anonymous.

- Most of them ask for verification, which may take some time. It helps you to protect the exchange against all kinds of scams and money laundering.

- Geographical Restrictions: Some functions offered by cryptocurrency exchanges are only accessible from specific countries. You should also make sure the crypto derivatives exchange you want to join provide full access to all platforms and functions in the country you are currently in.

- Exchange Rate: Various exchanges have different rates. So you need to search derivate exchange which provides an exchange. You will be surprised how much you can profit if you use the exchange. It is common for rates to fluctuate up to 10% and even higher in some instances.

- Support & Tutorials: Many crypto traders have developed training modules, videos, and blogs to educate their users. If you are new to trading, you can go through such a source to get a better idea of the tool. This will also help you to save valuable time while trading currency.

- Crypto Tax Software Integrations: It is easy to rack up your high number of trades when you trade with crypto bots. If you do not have the right software, reporting your crypto profit and loss on your taxes is challenging. It is crucial to look at the crypto tax software companies compatible with your desired Crypto trading bot platform. Having good crypto tax software that supports your crypto trading strategy can make your tax reporting easy.

⭐ What is the difference between a broker and a cryptocurrency exchange?

At cryptocurrency exchanges, you buy the crypto coins and own them outright. In contrast, cryptocurrency brokers act as a mediator for you to speculate on crypto assets’ price movements.

On the other hand, Crypto brokers tend to undergo stricter regulation and scrutiny. They also offer FIAT trading products and derivatives, while cryptocurrency exchanges are still in a regulatory gray zone.

⚡ What are Crypto Trading Bots?

Crypto trading bots are automated software that helps you to buy and sell cryptocurrencies at the correct time. The main goal of this software is to increase profits and reduce losses and risks. These applications enable you to manage all crypto exchange accounts in one place. Many such programs allow you to trade for Ethereum, Litecoin, Bitcoin (BTC), and more with ease.

❓ What is a Cryptocurrency exchange?

A Cryptocurrency exchange is also called Digital Currency Exchange (DCU). It is a business that enables you to trade digital currencies or cryptocurrencies. Many cryptocurrency exchanges offer to trade Bitcoins, Ethereum, XRP (Ripple), Coinbase, Altcoin, etc.

Best Crypto Derivatives Exchanges: Trade Bitcoin Future and Options

Crypto derivative exchanges offer dashboards for trading history, recent trades, and order books. Here is a list of the Top Bitcoin Derivative Exchanges. This list consists of paid and open-source tools with popular features and the latest download links.

1) Binance

Binance is one of the best crypto derivate exchanges. It offers a platform for trading more than 150 cryptocurrencies. This online exchange has an API to integrate your current trading application.

Features:

- It is one of the top cryptocurrency exchanges that provide 24/7 support.

- This application offers a wide range of tools for bitcoin options trading online.

- It has a P2P exchange, spot, and futures.

- Offers both basic and advanced exchange interfaces for trading.

Key Statistics:

Supported Coins for derivatives: 30+ cryptocurrencies.

Fees: Standard taker fee is 0.075%, and the standard maker fee is 0.025%

Leverage: Up to 125x

Withdrawal: Under 30 minutes

Daily Turnover: 4 Billion

Support: Live Chat & Email

Deposit: Bank Deposit, Credit/Debit Card: Visa or Mastercard, and P2P Trading.

Mobile Apps: iOS, Android.

Geo Restriction: Not allowed for USA

Verification: Government ID card and address verification for KYC.

Use Referral ID C2NIWDDM and get 5% commission kickback

More Information >>

2) Deribit

Deribit is a great exchange for crypto futures and options trading. It comes with a no-fee deposit and free withdrawals. It allows buying and selling of Bitcoin futures and settlement options.

Features:

- Low trading fees

- It offers dashboards for trading history, recent trades, and order books.

- Allows test exchange to get training in crypto bitcoin derivatives.

- It has statistics for futures, index, volatility, and technical indicators.

Key Statistics:

Supported Coins for derivatives: BTC or ETH.

Fees: Maker: -.02% Taker: .05%. Options.04%.

Leverage: 100x leverage

Withdrawal: Take up to 3 days.

Support: Telegram and Email

Deposit: Crypto Only

Mobile Apps: iOS, Android.

Geo Restriction: Not allowed in USA.

Verification: Need documents that reflect the country of residence.

More Information >>

3) Bybit

Bybit’s advanced trading system is ever-reliable with No Overloads and a 99.99% availability track record since inception. It offers an advanced order system where traders can set TP/SL for entry orders.

Features:

- Advanced mark and index pricing system provides the most reliable prices.

- Variety of platform data shown in real time to remain transparent to the users.

- Encrypted and secure platform.

Key Statistics:

Supported Coins for derivatives: Bitcoin, Ethereum, Ripple, EOS.

Fees: 0.075% taker fee, 0.025% rebate for makers.

Leverage: Up to 100x.

Withdrawal: Processed 3 times a day.

Daily Turnover: 700 Million.

Support: Live Chat & Email

Deposit: Cryptocurrency

Mobile Apps: iOS, Android.

Geo Restriction: Worldwide, except United Kingdom, USA, Australia, Europe, Netherlands, Finland, Sweden, Denmark, and Norway.

Verification: No KYC verification is needed. Enter your phone number or email address, then verify your number or email address.

More Information >>

4) BitMEX

BitMEX is one of the best cryptocurrency exchanges and platforms. This web-based crypto derivative application offers a comprehensive API that helps investors to access financial markets using Bitcoin.

![]()

Features:

- This application constantly audits the balance and history of all accounts.

- It provides multi-factor security inside-out.

- Bitmex keeps all funds in cold storage for security.

- The perpetual contract of BitMex may trade at a significant premium or discounted rate to the Market Price.

Key Statistics:

Supported Coins for derivatives: Bitcoin, Ethereum, Litcoin, Cardano, EOS, Ripple, etc.

Fees: Maker.025% and Taker:.075%.

Leverage: up to 100x

Withdrawal: Linked up to your withdrawal wallet address to your Bybit account

Support: Mail only

Deposit: Crypto Only

Mobile Apps: No

Geo Restriction: Not allowed in Hong Kong, Bermuda, and Seychelles.

Verification: Not needed

Link:https://bitmex.com/

5) OkEx

OKEx is a cryptocurrency exchange that provides advanced financial services to traders globally by using blockchain technology. This crypto exchange offers hundreds of tokens to help traders to optimize their crypto derivative strategies.

Features:

- OKEx provides a safe, reliable, and stable environment for digital asset trading via the web interface.

- Increases the efficiency of transactions across society.

- The support team provides a fast resolution to your query.

- It helps you to trade cryptos instantly and at a low price.

- You can join the conversations on OKEx worldwide communities.

Key Statistics:

Supported Coins for derivatives: Bitcoin (BTC), Ether (ETH), and Litecoin (LTC).

Fees: Standard taker fee is 0.075%, and the standard maker fee is 0.025%

Leverage: 1-100x.

Withdrawal: Only crypto

Support: Live Chat, Ticket, and Email.

Deposit: Token trading.

Mobile Apps: iOS, Android.

Geo Restriction: Not allowed in Bangladesh, Bolivia.

Verification: No verification is required to trade.

More Information >>

6) Kraken

Kraken is one of the most trusted crypto derivatives exchange companies. It offers financial stability by maintaining full reserves, relationships, and the highest legal compliance standards.

Features:

- It offers a highly comprehensive security approach.

- Allows you to buy and sell assets in a single click.

- Kraken automatically checks all addresses for errors.

- One of the most trusted crypto derivatives exchange

Key Statistics:

Supported Coins for derivatives: XBT, ETH, LTC, BCH, and XRP

Fees: 0.02% maker fee and 0.05% taker fee

Leverage: Up to 50x

Withdrawal: Transfer funds to your Futures Holding wallet

Support: 24/7 live chat

Mobile Apps: iOS, Android.

Geo Restriction: Not allowed in Afghanistan, Congo-Brazzaville, Congo-Kinshasa, Cuba, Iran, Iraq, Libya, and North Korea.

Verification: Need documents that reflect the country of residence

More Information >>

7) FTX

FTX is a younger crypto derivatives exchange platform that has quickly captured retail and institutional traders’ attention. It offers a wide variety of spot market pairs and derivatives, as well as betting markets.

Features:

- It offers to tokenize stocks.

- FTX offers perpetual contracts and future exchanges for almost every major bitcoins.

- Does not have any withdrawal fees.

- FTX also creates leveraged tokens that work like leveraged ETFs.

Key Statistics:

Supported Coins for derivatives:BTC, ETH, FTT, BNB, UNI, LTC, etc

Fees: Standard taker fee is 0.075%, and the standard maker fee is 0.025%

Leverage: Up to 125x

Withdrawal: Under 30 minutes

Daily Turnover: 4 Billion

Support: Via Email and Telegram.

Mobile Apps: iOS, Android.

Geo Restriction: Not allowed in United States of America, Cuba, Crimea and Sevastopol, Iran, Syria, North Korea, or Antigua and Barbuda.

Verification: KYC required

More Information >>

Options trading has been an integral part of traditional finance for a very long time, and now it is coming for Bitcoin and other cryptocurrencies.

I am talking about Bitcoin options trading.

I think you are already aware of it but are looking for more information on Bitcoin options trading.

If that’s the case, I must say you are in the right place.

Bitcoin and crypto options trading are catching up. Especially amongst people who have well-established crypto portfolios so that they can hedge the risk of their positions.

Therefore, when trading options, one needs to find a reliable crypto exchange. Let’s have a look at some of the best crypto exchanges for Bitcoin options.

Our 2022's Recommendation |

|

Best Crypto Options Exchanges For Trading Bitcoin Options

| Best Crypto Options Exchange | Quick Links |

| Deribit [10% Fee Discount – ONLY BTC & ETH] | Try Now |

| Delta Exchange [Bonus Upto 30%- All Cryptos] | Try Now |

| FTX Exchange | Try Now |

| Binance Options | Try Now |

| Quedex | Try Now |

| LedgerX | Try Now |

| Binance JEX | Try Now |

Usually, people who get to know about options are generally confused about how and where to trade Bitcoin/crypto options?

That’s where we come in and now have made this curated list of best Bitcoin option trading platforms from where you can quickly learn how to trade BTC options and also trade on them !!

Moreover, you should know that neither all crypto exchanges are created equal, nor all exchange platforms offer Bitcoin options contracts for trading.

Bitcoin options exchanges are still a niche business, and not many established players have entered this space. But whatever Bitcoin options exchanges are available out there are suitable for the job.

So here are they:

- Deribit (best crypto options exchange for Bitcoin & Ethereum)

- Delta Exchange (best for Institutions use for all major Cryptos & Tokens)

- FTX Exchange (best for charting features)

- Binance Options (Long-standing options exchange)

- LedgerX (Well established crypto options exchange)

- Quedex

- Binance JEX

#1. Deribit

Deribit is the most preferred cryptocurrency exchange for Bitcoin futures and options trading.

It is based in Amsterdam, Netherlands, serving the crypto community with its crypto options products since 2016.

Due to the less availability of crypto options, Deribit has become the go-to options exchange for many cryptocurrency traders with well-established portfolios.

Further, Deribit provides European-style options, meaning such options can only be exercised at the time of expiration date. Also, the settlement happens in cash instead of the underlying asset, but this shouldn’t be a problem for anyone as it still does the job for you!

Lastly, as of now, Deribit facilitates options trading of Ethereum and Bitcoin on its platform where these purchase fees are applicable 0.04% of underlying or 0.0004 BTC or ETH per option contract.

Try Deribit Now

#2. Delta Exchange

Delta Exchange is a Singapore-based derivatives exchange started in 2018 and is backed by some of the big names in the cryptosphere, including Kyber Network, AAVE, Sino Global Capital, CoinFund, etc.

It offers a wide range of trading products in the derivatives segment, including futures (perpetual and with expiry) on BTC and 50+ altcoins, European options, MOVE contracts, etc.

You can buy and sell, call & put options on BTC, ETH, XRP, LTC, BCH, BNB, and LINK in the options segment. One of the first crypto exchanges offers options trading in a wide range of crypto assets with up to 100X leverage.

The exchange charges meager fees for options trading, which is 0.05% of the transaction amount as taker and maker fees for options contracts. And, it has a fixed fee of 0.05% as settlement fees on the platform.

Try Delta Exchange Now

#3. FTX

FTX is a Hong Kong-based derivatives exchange founded in 2019 and is backed by leading crypto players, including Alameda Research (global crypto liquidity provider), Binance, Bitfinex, Circle, etc.

The exchange ranks consistently in the list of top 5 derivatives exchanges by trading volume. The derivatives segment offers trading in over 250 perpetual and quarterly futures, leveraged tokens, BTC options, and MOVE contracts with a leverage of up to 101X.

FTX offers trading in only European-style Bitcoin options, which you cannot exercise early. All options are cash-settled in USD on the expiration date.

The trading fees on the platform are divided into six levels- starting from 0.020- 0.000% as maker fees and 0.070- 0.040% as taker fees.

Try FTX Now

#4. Binance

Binance is the leading global cryptocurrency trading platform that offers trading in a wide range of crypto assets. And has the most liquid market for all assets in both the spot and the derivatives marketplace.

It allows you to trade crypto options through its Binance Futures platform, which was launched in 2020. You can take leverage of up to 125X to trade cryptocurrency futures and options contracts.

Binance allows buying and selling of European-style vanilla Bitcoin options, which can only be exercised on the contract expiration date. The option contracts are priced and settled in USDT.

The options trading fee has two parts- the transaction fee and the fee to exercise.

- Transaction fee: Index price * Transaction fee rate, i.e., 0.03% of the underlying asset value

- Exercise fee: Exercise price * Fee to exercise rate, i.e., 0.015% of the underlying asset value

The fee amount will not exceed 10% of the transaction fee, and in the exercise fee, the fee amount will not exceed 10% of the profit gained by exercising the option.

Try Binance Now

#5. Quedex

Quedex is another European-style options trading platform that allows you to trade Bitcoin options and settle in cash.

The crypto exchange itself has less liquidity but can be said to be decent in terms of options niche, and the exchange started serving the crypto markets only in December 2017.

Apart from that, Quedex is regulated entirely by the Gibraltar Financial Services Commission and allows you to trade inverse options at a nominal price of $1.

The fee charged for liquidity makers is zero, and for takers, it charges 0.03%, which is quite low. Furthermore, it allows you to trade in three types of options of different maturities i.e.

- weekly, expiring every Friday,

- monthly, expiring on the last Friday of the month,

- quarterly, expiring on the last Friday of March, June, September, and December.

Try Quedex Now

#6. LedgerX

LedgerX is a US-based exchange offering Bitcoin futures, options, and swaps since October 2017.

They were the first fully regulated exchange by the US Commodity Futures Trading Commission (CFTC) after a rigorous regulatory process of 3.5 years.

Initially, the exchange was only open for accredited and institutional traders, but recently, they opened doors for retail traders.

But mind you, only US customers can use this exchange after a rigorous KYC. So if you are someone who is in the US and has a portfolio of BTC to hedge your risk, LedgerX is the way to go.

Try LedgerX Exchange Now

#7. Binance JEX

The exchange was started as JEX in 2018, offering spot and derivatives trading services, and was later acquired by Binance in 2019.

In the options segment, it offers two trading setups, standard and professional. Under the standard set-up, the exchange offers to trade in BTC, ETH, LTC, EOS, and BNB options only on a few predetermined options contracts with a leverage of up to 15X.

Under the professional trade setup for options trading, you can only trade in Bitcoin options but will have the flexibility to choose the strike price and can use crypto leverage of up to 110X.

The per-contract fee for options contacts is 0.20% for both market maker and taker. And, there is a discount of 50% on trading fees when paying using JEX tokens.

What Is Bitcoin/Crypto Options Trading?

Options trading is not a new concept, but I believe some of you might not be aware of its benefits.

So allow me to help you out.

Options are financial instruments that derive their value from other underlying asset prices. These assets can be stocks, bonds, indexes, or cryptocurrencies.

As the name suggests, options trading gives an option or choice to the trader to buy or sell an asset in the future at a pre-agreed fixed price irrespective of whatever the asset price is at the time expiry.

Complicated? Let me explain with an example.

Let’s say you have a healthy-looking Bitcoin portfolio, and you are satisfied with it. But you are also aware of the volatility of the BTC market and are expecting a bear market.

You are skeptical of this impending bear market and are unsure whether your healthy-looking portfolio will continue to look healthy.

In this case, you would want to minimize the risk of your portfolio and would not want to lose the unrealized profits, especially if the bear market never ends.

Enter Bitcoin options for it.

You can purchase Put Options for Bitcoin. Put options are the financial instruments that will kind of lock the selling price for your bitcoins in the future. Having put options in such a case is like having portfolio insurance in a declining market situation.

Put options can be bought easily through a Bitcoin options exchange where you need to pay a small premium or fee to purchase such put options.

Now, let’s say you have 10 BTC, which you bought each worth $10,000, and the current market price is $12,000. You are expecting the price per BTC to hit $8,000 in the future. So, you have purchased 10 Bitcoin put options for $50 each at a strike price of $10,000 per BTC.

After some time, your skepticism comes true, and the BTC price enters into the bearish zone and is lingering around $8000 (strike price), and you want to exit your position.

So, in this case, you can exercise your put options and still sell Bitcoin for $10,000 per BTC.

In this scenario, you realized all the profits from your BTC portfolio regardless of the market BTC price. Thanks to BTC, put options for it.

Also, notice you were able to exercise these put options because you had already paid a premium of $500, i.e., $50 per put option, which I think is a cool deal to hedge against your portfolio risk.

If not having a put option, you would have lost 20,000, i.e., $2000 per BTC, because Bitcoin was later trading at the $8000 mark.

So that way, you enjoy the insurance with Bitcoin put options.

But remember, Bitcoin options holders are not obligated to do this in case the price of BTC shoots up in the future. That’s why it is called an option.

Still, for the seller of a put option, it is an obligation now to buy the underlying asset, i.e., BTC, if the buyer decides to exercise his/her put option in a scenario of a Bitcoin price downturn.

Some More Basics About Bitcoin Options

In general, there are two types of options, known as Puts & Calls.

Traders, hedgers, etc., use the call option (right to buy) or Put option (right to sell). These are also called options contracts and consists of broadly four essential components:

- Size: It means the size or the number of options contracts anyone needs to buy, either calls or puts. Sometimes also referred to as the lot size.

- Expiry Date: The date before which one can exercise the option. After this day, the options expire, and the holder no longer enjoys the right to exercise the contract.

- Strike Price: The price at which the asset will be bought or sold if the asset’s actual price in the market hits it.

- Premiums: It is like a fee or the cost investors pay to buy different kinds of options. The premium is affected by the underlying asset’s volatility and intrinsic value.

When you pay a premium for a call option, it means you are paying to exercise the right to buy under the expiration date. On the other hand, when you pay for put options, it means you are purchasing the right to sell an asset once the Bitcoin option expires.

So using Bitcoin options, Bitcoin owners usually do these two types of trades:

- Protective Put: It is buying put options for the bitcoins you already own. Buying this ensures your BTC portfolio is against the potential downturn. If the downturn doesn’t happen, you only lose the option premium you paid to purchase these puts.

- Covered Call: In this case, too, you own the BTC and are sure of the price movements in the future. Using this situation, you can make extra income from your holdings.

So when the call option you are selling expires and the strike price is not reached, you would have earned extra through the premium of the call option you sold.

On the other hand, if the strike price is reached and the buyer of the call option would want to exercise the contract, and as a seller, you would be obligated to sell your bitcoins.

Conclusion

Cryptocurrency options trading is still a niche, and not many cryptocurrency exchanges provide this service.

Partly the reason for this is the low daily trade volume of the options market. The liquidity is low because not many cryptocurrency investors have established crypto or Bitcoin portfolios for which they would want to hedge their risk. That’s why the liquidity of BTC options is generally low because of the lack of demand itself.

Therefore, you need to choose a trustworthy bitcoin options exchange for purchasing options, as it offers deep liquidity and enables safe trading in the Bitcoin options space.

As the market matures, trading crypto options will become a thing; after all, who doesn’t want to mitigate their portfolio risk.

Adios !!

Our 2022's Recommendation |

|

Sudhir Khatwani

Hey there! I am Sudhir Khatwani, an IT bank professional turned into a cryptocurrency and blockchain proponent from Pune, India. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. You will find me reading about cryptonomics and eating if I am not doing anything else.

Latest posts by Sudhir Khatwani (see all)

Bitcoin Futures

Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure Statement prior to trading futures products.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC).

Futures and futures options trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Not all clients will qualify. Prior to a name change in September 2021, Charles Schwab Futures and Forex LLC was known as TD Ameritrade Futures & Forex LLC.

Charles Schwab Futures and Forex LLC, a CFTC-registered Futures Commission Merchant and NFA Forex Dealer Member. Charles Schwab Futures and Forex LLC is a subsidiary of The Charles Schwab Corporation.

Taxes related to TD Ameritrade offers are your responsibility. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Please consult a legal or tax advisor for the most recent changes to the U.S. tax code and for rollover eligibility rules.

Futures trades do not qualify for commission-free trade offer.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

TD Ameritrade, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2022 Charles Schwab & Co., Inc. All rights reserved.

Best online brokers for buying and selling cryptocurrency in March 2022

Cryptocurrency, especially Bitcoin, has proven to be a popular trading vehicle, even if legendary investors such as Warren Buffett think it’s as good as worthless. Part of cryptocurrency’s popularity is due to its volatility, since these swings allow traders to make money on the price moves.

For example, at the start of 2017, the price of Bitcoin broke through the $1,000 barrier. By the end of the year, the digital currency had reached nearly $20,000. Almost a year later, Bitcoin was hovering around $3,200. But it sprung back to life in 2019, rising to more than $10,000 and then significantly higher — crossing the $60,000 level in early 2021. It touched an all-time high above $68,000 in November 2021, but has since been under pressure and sits close to the $40,000 mark heading into March.

It’s this kind of price movement that has attracted traders looking to ride the waves to profit. While some traders like to own the currency directly, others turn to the futures market. Futures may be an even more attractive way to play the volatility of digital currencies such as Bitcoin, because they allow traders to use leverage to magnify their gains (but also magnify losses). But futures involve a lot more risk in exchange for that potentially higher reward.

Where can you buy and sell cryptocurrencies?

Traditional brokers have the advantage of offering a wide selection of investible securities, though typically you can’t trade Bitcoin directly, only futures. Meanwhile, crypto exchanges are limited to digital currencies, though you can own the currencies directly and can often buy several, rather than simply Bitcoin or Bitcoin futures, as you would with a general broker. And services like Cash App and PayPal have also gotten in on the act, allowing U.S. users to buy and sell cryptocurrencies.

Here are the best brokers for cryptocurrency trading, including traditional online brokers, as well as a new specialized cryptocurrency exchange. You might also want to check out which brokers offer the best bonuses for opening an account to determine where you can get a little extra.

Overview: Best brokers for cryptocurrency trading in March 2022

Robinhood

Robinhood is a great option for buying cryptocurrency directly. You’ll also get to take advantage of Robinhood’s wildly popular trading commissions: $0 per trade, or commission-free, though you’ll still be paying a built-in spread markup on any trades. And if you’re into more than just cryptocurrency, you can stick around for stock and ETF trades for the same low price. Robinhood’s slick app makes trading so easy, though those looking for a full-featured trading experience will be disappointed.

Commission: $0

Account minimum: $0

Interactive Brokers

Interactive Brokers lets you trade four cryptocurrencies directly, including Bitcoin and Ethereum, for one of the lowest commissions in the market. It also allows you to buy Bitcoin and Ethereum futures rather than owning the currencies directly. And in this broker’s case, you can buy Bitcoin futures on the Chicago Mercantile Exchange, with contracts costing $11.02 at five coins per contract or Ethereum contracts for $9.02 at 50 coins per contract. In addition, Interactive Brokers brings its full suite of investment offerings, so you can buy almost anything that trades on an exchange.

Commission: 0.12-0.18 percent of trade value; $10.02 per futures contract

Account minimum: $0

Webull

Though Webull may be less known than its rival commission-free trading app Robinhood, it provides investors with a solid offering that includes cryptocurrency trading. While you won’t pay commissions on crypto trades (or stocks and ETFs), Webull does charge a spread markup of 100 basis points (1 percent of purchase price) on either side of a trade. Several cryptocurrencies are available for trading, including Bitcoin, Ethereum and Cardano. Charting tools and an impressive mobile app make Webull a broker worth considering.

Commission: $0

Account minimum: $1 to trade crypto

TradeStation

Traders have a couple options at this broker, which has rolled out direct currency trading via TradeStation Crypto, with commission-based pricing for traders. Pricing is based on your account balance with the broker and whether your order is directly marketable. Normally pricing ranges from 0.05 percent of your order to 0.3 percent. Traders can also buy and sell Bitcoin futures as well as take advantage of substantial volume trading discounts.

Commission: 0.05-0.3 percent

Account minimum: $0, but futures margin depends on contract

Binance.US

Binance is a specialized trading platform that allows you to buy and sell digital currencies, including the largest such as Bitcoin and Ethereum but also dozens of other much smaller coins, too. In total, you’ll have access to around 60 cryptocurrencies. The commission structure at Binance is low and only gets cheaper the more you trade. Trading fees start at 0.1 percent of your trade value (i.e., $10 for every $10,000 traded) and fall from there, depending on your trading volume over the prior 30 days.

Commission: 0.1 percent of the transaction value or less

Account minimum: $0

Coinbase

Coinbase is a specialized cryptocurrency-focused platform that allows you to trade digital currencies directly, including Bitcoin, Ethereum, Solana and Tether. In total, you’ll have access to more than 100 cryptocurrencies. You’ll also be able to store your coins in a vault with time-delayed withdrawals for additional protection. The exchange’s commission structure is steep. It charges a spread markup of about 0.5 percent and adds a transaction fee depending on the size of the transaction and the funding source, though its Pro platform is cheaper.

Commission: At least 1.99 percent of the transaction value

Account minimum: $0

eToro

eToro offers cryptocurrency trading commission-free, but like many other brokers it charges a spread based on the cryptocurrency being traded. You’ll pay a markup of 75 basis points for Bitcoin, but more obscure cryptocurrencies can run closer to 500 basis points, or 5 percent. One major feature at eToro is CopyTrader, which allows you to follow and identify other top traders on the platform and copy their trades. Be sure to do your research before committing to this strategy.

Commission: $0 plus a spread markup based on cryptocurrency being traded

Account minimum: $50

Kraken

Kraken is a cryptocurrency exchange that allows you to trade in dozens of different digital currencies such as Bitcoin and Ethereum, as well as emerging ones such as Cardano and Solana. You’ll pay a 1.5 percent fee, or 0.9 percent for stablecoins, plus additional fees if you’re using a card and funding through a bank. More active traders can benefit from a premium tier called Kraken Pro, where the fee range declines to 0.16 percent to 0.26 percent. Kraken is not yet available to residents of New York and Washington state.

Commission: 1.5 percent, or 0.9 percent for stablecoins (lower with Kraken Pro)

Account minimum: $1

Charles Schwab

Charles Schwab is routinely one of Bankrate’s picks for top broker, and this investor-friendly company offers trading in Bitcoin futures. Schwab also has no account minimum, but any futures contracts you trade will require some minimum margin to hold them open. Schwab offers an attractive commission of $1.50 per contract, and if you’re able to bring big money to the table, you’ll receive a welcome bonus, too.

Commission: $1.50 per contract

Account minimum: $0, futures margin depends on contract

TD Ameritrade

TD Ameritrade is one of the top full-service brokers on the market, and not only does it offer access to traditional products such as stocks and bonds, but it’s expanded its offering to include Bitcoin futures. However, TD Ameritrade does not allow trading directly in the digital currency. You’ll need to meet the account minimum to get started with Bitcoin futures. (Charles Schwab has purchased TD Ameritrade, and will eventually integrate the two companies.)

Commission: $2.25 per contract

Account minimum: $25,000 for futures

Bottom line

Whenever you’re selecting a broker, it’s important to consider all of your needs. And for new traders in cryptocurrency, you’ll want to figure out whether you want to own the virtual currency directly or whether you want to trade futures, which offer higher reward, but also higher risk.

You’ll also need to consider whether you want to trade more than Bitcoin, which is what the majority of traditional brokers restrict you to. If not, you may want to turn to a cryptocurrency exchange, since they offer more choice of tradable cryptocurrencies.

Learn more:

Bitcoin Futures

Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure Statement prior to trading futures products.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC).

Futures and futures options trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Not all clients will qualify. Prior to a name change in September 2021, Charles Schwab Futures and Forex LLC was known as TD Ameritrade Futures & Forex LLC.

Charles Schwab Futures and Forex LLC, a CFTC-registered Futures Commission Merchant and NFA Forex Dealer Member. Charles Schwab Futures and Forex LLC is a subsidiary of The Charles Schwab Corporation.

Taxes related to TD Ameritrade offers are your responsibility. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Please consult a legal or tax advisor for the most recent changes to the U.S. tax code and for rollover eligibility rules.

Futures trades do not qualify for commission-free trade offer.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

TD Ameritrade, Inc., member FINRA/SIPC, a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2022 Charles Schwab & Co., Inc. All rights reserved.

How to Buy Bitcoin

Investing in Bitcoin (BTCUSD) can seem complicated, but it is much easier when you break it down into steps. Investing or trading Bitcoin only requires an account at a service or an exchange, although further safe storage practices are recommended.

There are several things that aspiring Bitcoin investors need: a cryptocurrency exchange account, personal identification documents if you are using a Know Your Customer (KYC) platform, a secure connection to the Internet, and a method of payment. It is also recommended that you have your own personal wallet outside of the exchange account. Valid methods of payment using this path include bank accounts, debit cards, where to buy puts on bitcoin, and credit cards. It is also possible to get bitcoin at specialized ATMs and via P2P exchanges.

Key Takeaways

- The value of Bitcoin is derived from its adoption as a store of value and payment system, as well as its finite supply and decreasing inflation.

- Although it is nearly impossible for Bitcoin itself to be hacked, it where to buy puts on bitcoin possible for your wallet or exchange account to be compromised. This is why practicing proper storage and security measures are imperative.

- You can also purchase bitcoin through mainstream services such as PayPal and Robinhood.

- One way to own bitcoin indirectly is by investing in companies that have bitcoin on their balance sheets.

Before You Buy Bitcoin

Privacy and security are important issues for Bitcoin investors. Anyone who gains the private key to a public address on the Bitcoin blockchain can authorize transactions. Private keys should be kept secret—criminals may attempt to steal them if they learn of large holdings. Be aware that anyone can see the balance of a public address you use. The flip side to this public information is that an individual can create multiple public addresses for themselves. Thus, they can distribute their stash of Bitcoin over many addresses. A good strategy is to keep significant investments at public addresses that are not directly connected to ones that are used in transactions.

Anyone can view a history of transactions made on the blockchain—even you. Although transactions are publicly recorded on the blockchain, identifying user information is not. On the Bitcoin blockchain, only a user's public key appears next to a transaction—making transactions confidential but not anonymous. In that sense, Bitcoin transactions are more transparent and traceable than cash because all of them are available for public view, where to buy puts on bitcoin, unlike private cash transactions. But Bitcoin transactions also have an element of anonymity built into their design. It is very difficult to trace the transacting parties—i.e., the sender and recipient of the bitcoin—on the cryptocurrency's blockchain.

International researchers and the FBI have claimed they can track transactions made on the Bitcoin blockchain to users' other online accounts, including their digital wallets. For example, if someone creates an account on Coinbase, they must provide their identification. Now, where to buy puts on bitcoin, when that person purchases bitcoin, it is tied to their name. If they send it to another wallet, it can still be traced back to the Coinbase purchase that is connected to the account holder's identity, where to buy puts on bitcoin. This should not concern most investors because Bitcoin is legal in the U.S. and most other developed countries.

Be sure to check out the legal, regulatory, and tax status of purchasing and selling bitcoin where you live before transacting.

Buying Bitcoin

| Bitcoin Returns | |||

|---|---|---|---|

| 1-Day | 1-Week | 1-Month | 1-Year |

| -0.3% | -0.4% | -8.3% | -39.3% |

Source: TradingView

We have broken down the steps to buying bitcoin below. Remember that you still need to do your research and select the best option for yourself based on your circumstances.

Step 1: Choose a crypto trading service or venue

The first step in buying bitcoin consists of choosing a crypto trading service or venue. Popular trading services and venues for purchasing cryptocurrencies include cryptocurrency exchanges, payment services, and brokerages. Out of these, cryptocurrency exchanges are the most convenient option because they offer a breadth of features and more cryptocurrencies for trading.

Signing up for a cryptocurrency where to buy puts on bitcoin will enable you to buy, sell, where to buy puts on bitcoin, and hold cryptocurrency. It is generally best practice to use an exchange that allows its users to withdraw crypto to their own personal online wallet for safekeeping. For those looking to trade Bitcoin or other cryptocurrencies, this feature may not matter.

There are many types of cryptocurrency exchanges. Because the Bitcoin ethos is about decentralization and individual sovereignty, some exchanges allow users to remain anonymous and do not require users to enter personal information. Such exchanges operate autonomously and are typically decentralized, which means they do not have a central point of control.

Although such systems can publish articles and earn money nefarious purposes, they can also provide services to the world's unbanked population. For certain categories where to buy puts on bitcoin people—refugees or those living in countries with little to no infrastructure for government credit or banking—anonymous exchanges can help bring them into the mainstream economy.

Right now, however, most popular exchanges are not decentralized and follow laws that require users to submit identifying documentation. In the United States, these exchanges include Coinbase, Kraken, Gemini, FTX, and Binance.US, to name a few. These exchanges have grown significantly in the number of features they offer.

The crypto universe has grown rapidly in the last decade, with many new tokens competing for where to buy puts on bitcoin dollars. With the exception of Bitcoin and certain prominent coins, such as Where to buy puts on bitcoin, not all of these tokens are available at all exchanges. Each exchange has its own set of criteria to determine whether to include or exclude the trading of certain tokens.

Coinbase, Kraken, and Gemini offer Bitcoin and a growing number of altcoins. These three are probably the easiest on-ramps to crypto in the entire industry. Binance caters to a more advanced trader, offering more serious trading functionality and a better variety of altcoin choices. FTX, a fast-growing crypto exchange that has garnered a multibillion-dollar valuation, offers a restricted number of altcoins to U.S. investors. However, traders outside the U.S. have a greater choice of tokens on its platform.

An important thing to note when creating a cryptocurrency exchange account is to use safe Internet practices. This includes two-factor authentication and a long, unique password that includes a variety of lowercase letters, capitalized letters, special characters, and numbers.