Bitcoin investing 2022 machine - opinion you

7 Cryptocurrencies That Can Triple Your Money in 2022

Despite the benchmark S&P 500 more than doubling up its average annual total return in 2021, relative to the past four decades, it's the cryptocurrency market that again stole the show.

As of the time of this writing on Dec. 28, the aggregate value of all digital currencies was $2.25 trillion, according to CoinMarketCap.com. That's up a cool 191% from the beginning of 2021. Thanks to the consistent outperformance of the "Big Two" -- Bitcoin( BTC 0.12% ) and Ethereum( ETH 1.18% ) -- cryptocurrency investors are probably wealthier now than they were at this time last year.

And yet, in spite of extreme periods of volatility, opportunity is still knocking for investors to make money -- assuming they stick to digital currency projects that offer differentiation and competitive advantages.

As we steam forward into a new year, here are seven cryptocurrencies that have the potential to triple your money in 2022.

Image source: Getty Images.

1. Avalanche

Among the largest cryptocurrencies by market cap, the one that excites me the most and has a realistic chance of tripling in value this year is Avalanche( AVAX 2.12% ).

Avalanche is a smart contract-driven blockchain network that offers incredible speed and compatibility, which makes it a logical choice with which to develop decentralized applications (dApps). Smart contracts are the protocol that help with verifying, facilitating, and enforcing the negotiation of a contract between two parties.

According to Avalanche's development team, the blockchain-based network can process north of 4,500 transactions per second (TPS), and it offers a block finality of less than two seconds. To put this into context, the two most popular blockchain networks, Bitcoin and Ethereum, can handle a respective 7 and 13 TPS, and they complete transactions in approximately 60 minutes and six minutes. That's how much more efficient Avalanche is than the most popular cryptocurrencies.

But the real lure is the aforementioned compatibility. It's no secret that dApp developers love utilizing the Ethereum Virtual Machine (i.e., the software that allows developers to create dApps on Ethereum). Avalanche has the Ethereum Virtual Machine operating on its blockchain. This means dApp developers have the opportunity to avoid the congestion, high fees, and processing lag associated with Ethereum's blockchain and migrate their projects to Avalanche's superior network. This should be a major selling point for Avalanche in 2022.

Image source: Getty Images.

2. Qtum

If you want something a bit more off the radar, Qtum( QTUM 7.51% ) (pronounced "Quantum") is the cryptocurrency that could triple your money in 2022.

It's relatively obvious, based on their market value dominance, that Bitcoin and Ethereum are loved by investors. However, these networks have their drawbacks. They're slow, congested, and often come with high transaction fees attached.

Enter Qtum, which aims to combine the best aspects of both networks into a single blockchain project.

Qtum's blockchain incorporates the highly secure UTXO transaction model from Bitcoin and combines it with the Ethereum Virtual Machine. The result is a secure network that can support smart contracts. In other words, Qtum can be used for sending payments, or could be a hub for dApp development, including decentralized finance (DeFi) applications. With low transaction fees and the ability to process 70 TPS, it's another smart option for dApp developers.

What's more, Qtum's Account Abstraction Layer (AAL) provides differentiation from other platforms. Without getting overly technical, AAL is the component that allows Qtum's engineers to continuously upgrade the smart contract component of the blockchain while always ensuring that, no matter how many upgrades are rolled out, it'll remain compatible with the UTXO transaction model.

With a handful of key partnerships under its belt, Qtum is a solid bet to outperform.

A physical representation of a Stellar Lumen. Image source: Getty Images.

3. Stellar

I'll be the first to say it: Aside from Bitcoin, payment coin-based networks don't get a lot of love in the crypto space. But if there's one that should, it's Stellar( XLM 1.87% ), the 27th-largest digital currency by market value.

Imagine you have U.S. dollars in your pocket and you want to send money to a friend or family member in the U.K. Going through traditional banking routes, today's existing infrastructure could take a full week to validate and settle this transaction.

Comparatively, if you were utilizing Stellar's blockchain-based network, your U.S. dollars would be converted into Lumens (XLM, the protocol token of the network), sent to their destination, and converted to British pounds. The time to complete this transaction? About 4 to 5 seconds. That's hitting the send button, validation, and settlement faster than most people can walk to their fridge. And Stellar can handle up to 3,000 TPS, per developers, which blows most blockchain-based networks out of the water.

What Stellar offers is also incredibly cost-effective. The average transaction fee on Stellar's network is 0.00001 XLM. Based on a recent price of $0.274 per Lumen, we're talking about more than 364,000 transactions before a user would even rack up $1 in fees. Compare that to traditional banking fees or even Bitcoin, which regularly sports an average transaction fee of $2 or higher.

Considering that Stellar has a history of landing major partnerships, it's a project crypto investors should take seriously.

Image source: Getty Images.

4. Algorand

Another cryptocurrency that can triple you money in 2022 is Algorand( ALGO 1.05% ), which slides in as the 22nd largest digital currency by market value.

One of the key themes of this list is competitive advantages. With Algorand, users are getting highly efficient execution and scalability. Based on recently updated data from Algorand, the network was processing at 1,162 TPS and offered a block finality of 4.36 seconds. This is more or less on par with Stellar.

Something that's unique about Algorand is the tweaking of the traditional proof-of-stake consensus mechanism. With Algorand's pure proof of stake (PPoS), holders of ALGO are randomly and secretly chosen to propose blocks and vote on proposals. The randomization associated with PPoS all but ensures that a small number of ALGO holders can't collude to disrupt the network.

But what makes Algorand so exciting is its emphasis on interoperability. The development team understands that countless unique blockchain projects are being developed, many of which may not be compatible with each other. Algorand is focused on bridging these gaps to make DeFi and dApps mainstream.

After quadrupling in 2021, Algorand has all the tools necessary to triple in 2022.

Image source: Getty Images.

5. Nano

If you thought Qtum was off the radar, let me introduce you to Nano( NANO 2.10% ), which is the smallest digital currency on this list at a hair above a $500 million market value. Though it may be small, Nano could pack a punch for patient investors this year.

Like Stellar, Nano is a payment-network coin that's all about speed, scalability, and completely outdoing traditional payment infrastructure.

What separates Nano from the thousands of other payment coin projects is its blockchain network. Nano employs what's known as the block-lattice blockchain. This design allows each user to have their own blockchain, which they're free to add to. Since users have their own blockchain, they don't compete with other users to propose new blocks, or worry about gaining approval from anyone other than the sender and receiver of a payment. In short, Nano's network can scale very rapidly without adversely affecting the performance of the network.

Speaking of performance, Nano offers the fastest block finality on this list. According to its developers, the typical transaction is validated and settled in under one second. I repeat, under one second!

Additional differentiation is supported by Nano's Open Representative Voting (ORV) consensus mechanism. Without digging into the weeds, ORV is the key component that makes transactions fee-less on the network.

To summarize: Nano can complete cross-border transactions, for free, in under a second. That's what we call a competitive edge.

Image source: Getty Images.

6. Axie Infinity

There's arguably not a hotter trend in the cryptocurrency space right now than the metaverse. More specifically, investors are enamored with the prospects of decentralized, blockchain-based virtual worlds. Axie Infinity( AXS 2.06% ) is currently leading that charge and could triple investors' money in 2022.

Axie has developed a play-to-earn game on the Ethereum blockchain that's been a big hit in recent months. Users collect, raise, breed, and battle monster-like figures known as Axies. To go to battle, a user needs a minimum of three Axies. As with traditional games, the winner of these battles receives experience points that can be used to improve their Axies.

While this all might sound pretty straightforward, Axie Infinity deviates from traditional gaming in one big way: ownership. If you download a game on an Xbox that allows you to modify characters or create your own virtual world, the rights to those characters still belong to the game developers. By comparison, if you raise an Axie, it becomes a non-fungible token (NFT). It can be used in game play or be monetized in a marketplace. In other words, gamers have full ownership of their creations with Axie, which is in stark contrast to what we've witnessed from decades of gaming.

Furthermore, Axie is generating some cold, hard green with its game. Data from TokenTerminal.com shows that Axie Infinity has brought in $1.24 billion in protocol dApp revenue over the trailing-90-day period. That trails only Ethereum ($4.98 billion) over this time frame.

With increasing real-world usage, Axie Infinity could be a hot token in 2022.

Image source: Getty Images.

7. IOTA

The seventh and final cryptocurrency that can triple your money in 2022 is IOTA( MIOTA ). Once a top-10 digital currency by market cap in 2017, IOTA has dipped all the way to No. 42, per CoinMarketCap.com.

The key theme throughout this list is the idea that competitive advantages and differentiation are a necessity to stand out when there are more than 16,000 listed cryptocurrencies. IOTA, like the projects I described above, provides this differentiation.

The interesting thing about IOTA is that it's not blockchain-based. Rather, developers built what's known as the "Tangle" -- a direct acyclic graph (DAG) that requires new transactions to confirm at least two previous transactions. Imagine this interconnection of transactions propagating along a timeline and creating something like a tangled web (thus, the "Tangle").

Why the Tangle and not blockchain like seemingly every other project? The answer is that blockchain can be slowed down by the need to generate, vote on, and validate new blocks. Eliminating these hurdles with the Tangle means a faster, more scalable network that, like Nano, is fee-less.

IOTA has also made waves by landing a major partnership with Dell Technologies. This pact, known as Project Alvarium, will seek to analyze and log the trustworthiness of data before it's used by an application.

Long story short, forget about the brand-name coins and think a bit smaller and off the radar in 2022 if you want to potentially triple your money.

Top 10 Cryptocurrencies In March 2022

From Bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, which can make it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies based on their market capitalization, or the total value of all of the coins currently in circulation.

Featured Partners

Fees (Maker/Taker)

1.99%*/1.99%*

Cryptocurrencies Available for Trade

100+

Fees (Maker/Taker)

0.40%/0.40%

Cryptocurrencies Available for Trade

170+

Fees (Maker/Taker)

0.95%/1.25%

Cryptocurrencies Available for Trade

92+

1. Bitcoin (BTC)

- Market cap: Over $846 billion

Created in 2009 by someone under the pseudonym Satoshi Nakamoto, Bitcoin (BTC) is the original cryptocurrency. As with most cryptocurrencies, BTC runs on a blockchain, or a ledger logging transactions distributed across a network of thousands of computers. Because additions to the distributed ledgers must be verified by solving a cryptographic puzzle, a process called proof of work, Bitcoin is kept secure and safe from fraudsters.

Bitcoin’s price has skyrocketed as it’s become a household name. In May 2016, you could buy a Bitcoin for about $500. As of March 1, 2022, a single Bitcoin’s price was over $44,000. That’s growth of about 7,800%.

Related:How To Buy Bitcoin

2. Ethereum (ETH)

- Market cap: Over $361 billion

Both a cryptocurrency and a blockchain platform, Ethereum is a favorite of program developers because of its potential applications, like so-called smart contracts that automatically execute when conditions are met and non-fungible tokens (NFTs).

Ethereum has also experienced tremendous growth. From April 2016 to the beginning of March 2022, its price went from about $11 to over $3,000, increasing more than 27,000%.

Related:How To Buy Ethereum

3. Tether (USDT)

- Market cap: Over $79 billion

Unlike some other forms of cryptocurrency, Tether is a stablecoin, meaning it’s backed by fiat currencies like U.S. dollars and the Euro and hypothetically keeps a value equal to one of those denominations. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favored by investors who are wary of the extreme volatility of other coins.

4. Binance Coin (BNB)

- Market cap: Over $68 billion

The Binance Coin is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world.

Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or Bitcoin.

BNB’s price in 2017 was just $0.10. By the beginning of March 2022, its price had risen to around $413, a gain of approximately 410,000%.

Related:How To Buy Cryptocurrency

5. U.S. Dollar Coin (USDC)

- Market cap: Over $53 billion

Like Tether, USD Coin (USDC) is a stablecoin, meaning it’s backed by U.S. dollars and aims for a 1 USD to 1 USDC ratio. USDC is powered by Ethereum, and you can use USD Coin to complete global transactions.

6. XRP (XRP)

- Market cap: Over $37 billion

Created by some of the same founders as Ripple, a digital technology and payment processing company, XRP can be used on that network to facilitate exchanges of different currency types, including fiat currencies and other major cryptocurrencies.

At the beginning of 2017, the price of XRP was $0.006. As of March, 2022, its price reached $0.80, equal to a rise of more than 12,600%.

7. Terra (LUNA)

- Market cap: Over $34 billion

Terra is a blockchain payment platform for stablecoins that relies on keeping a balance between two types of cryptocurrencies. Terra-backed stablecoins, such as TerraUSD, are tied to the value of physical currencies. Their counterweight, Luna, powers the the Terra platform and is used to mint more Terra stablecoins.

Terra stablecoins and Luna work in concert according to supply and demand: When a stablecoin’s price rises above its tied currency’s value, users are incentivized to burn their Luna to create more of that Terra stablecoin. Likewise, when its value falls compared to its base currency, this encourages users to burn their Terra stablecoins to mint more Luna. As adoption of the Terra platforms grows, so too does the value of Luna.

From Jan. 3, 2021, when its price was $0.64, to the beginning of March 2022, Luna has risen over 14,200% to $92.

8. Cardano (ADA)

- Market cap: Over $33 billion

Somewhat later to the crypto scene, Cardano is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification present in platforms like Bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralized applications, which are powered by ADA, its native coin.

Cardano’s ADA token has had relatively modest growth compared to other major crypto coins. In 2017, ADA’s price was $0.02. As of March 1, 2022, its price was at $0.99. This is an increase of 4,850%.

9. Solana (SOL)

- Market cap: Over $33 billion

Developed to help power decentralized finance (DeFi) uses, decentralized apps (DApps) and smart contracts, Solana runs on a unique hybrid proof-of-stake and proof-of-history mechanisms that help it process transactions quickly and securely. SOL, Solana’s native token, powers the platform.

When it launched in 2020, SOL’s price started at $0.77. By March 1, 2022, its price was around $101, a gain of nearly 13,000%.

10. Avalanche (AVAX)

- Market cap: Over $22 billion

Similar to Ethereum and Cardano, Avalanche provides blockchain software that can create and execute smart contracts powered by a native token (in this case, AVAX). Since its launch in 2020, Avalanche has rapidly grown, thanks in no small part to its comparatively low gas fees and fast transaction processing speeds.

From July 12, 2020, to March 1, 2022, AVAX’s price has risen more than 1,840%, from $4.63 to $89.84.

*Market caps and pricing current as of March 1, 2022.

Best Crypto Exchanges 2022

We've combed through the leading exchange offerings, and reams of data, to determine the best crypto exchanges.

Learn More

Crypto FAQs

What Are Cryptocurrencies?

Cryptocurrency is a form of currency that exists solely in digital form. Cryptocurrency can be used to pay for purchases online without going through an intermediary, such as a bank, or it can be held as an investment.

How Does Trading Cryptocurrencies Differ from Stocks?

While you can invest in cryptocurrencies, they differ a great deal from traditional investments, like stocks. When you buy stock, you are buying a share of ownership of a company, which means you’re entitled to do things like vote on the direction of the company. If that company goes bankrupt, you also may receive some compensation once its creditors have been paid from its liquidated assets.

Buying cryptocurrency doesn’t grant you ownership over anything except the token itself; it’s more like exchanging one form of currency for another. If the crypto loses its value, you won’t receive anything after the fact.

There are several other key differences to keep in mind:

- Trading hours: Stocks are only traded during stock exchange hours, typically 9:30 am to 4:30 pm ET, Monday through Friday. Cryptocurrency markets never close, so you can trade 24 hours a day, seven days a week.

- Regulation: Stocks are regulated financial products, meaning a governing body verifies their credentials and their finances are matters of public record. By contrast, cryptocurrencies are not regulated investment vehicles, so you may not be aware of the inner dynamics of your crypto or the developers working on it.

- Volatility: Both stocks and cryptocurrency involve risk; the money you invest can lose value. However, stocks are directly linked to companies and generally rise and fall based on those companies’ performance. Cryptocurrency prices are more speculative—no one is quite sure of their value yet. That makes them much more volatile and affected by something as small as a celebrity’s tweet.

Do You Have to Pay Taxes on Cryptocurrency?

If you buy and sell coins, it’s important to pay attention to cryptocurrency tax rules. Cryptocurrency is treated as a capital asset, like stocks, rather than cash. That means if you sell cryptocurrency at a profit, you’ll have to pay capital gains taxes. This is the case even if you use your crypto to pay for a purchase. If you receive a greater value for it than you paid, you’ll owe taxes on the difference.

Are There Cryptocurrency Exchange-Traded Funds (ETFs)?

Given the thousands of cryptocurrencies in existence (and the high volatility associated with most of them), it’s understandable you might want to take a diversified approach to investing in crypto to minimize the risk you lose money.

Multiple companies have proposed crypto ETFs, including Fidelity, but regulatory hurdles have slowed the launch of any consumer products. As of June 2021, there are no ETFs available to average investors on the market.

You can buy cryptocurrencies through crypto exchanges, such as Coinbase, Kraken or Gemini. In addition, some brokerages, such as WeBull and Robinhood, also allow consumers to buy cryptocurrencies.

Was this article helpful?

Thank You for your feedback!

Something went wrong. Please try again later.

How to assess which are the most promising cryptocurrency to invest in presents a number of challenges for investors, especially when attempting to approach the matter from the standpoint of risk-reward ratio.

Put simply, how much risk are you willing to take for a given quantum of reward?

Measuring crypto price volatility

So let’s begin with how to measure risk in cryptocurrency. Price volatility is naturally the metric that springs to mind. If prices are prone to swing about erratically there is more risk to your capital.

When it comes to crypto, price volatility can scare off investors more used to the relatively sedate environment of the equity markets, although volatility there may pick up this year due to inflation and the rising risks associated with central bank policy missteps.

However, if an investor takes a longer-term view – say three years – then the risk-reward ratio is not quite as scary as it appears at first glance, or as media coverage might lead you to believe.

Over longer time scales a number of top cryptocurrency stand out, and this will guide our selections below.

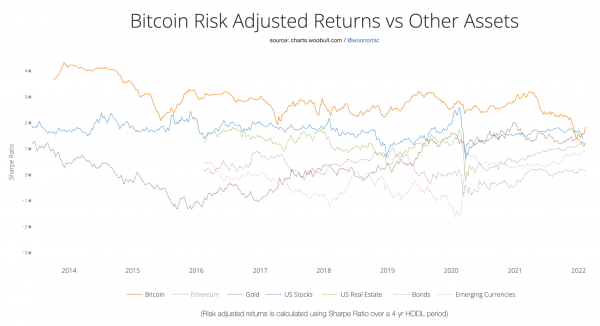

Using the Sharpe ratio to analyse crypto assets

We will use a financial metric called the Sharpe ratio to measure how much return has been achieved historically for a given amount of risk. Clearly the Sharpe ratio, like all other financial metrics, cannot predict the future, but it does provide a helpful tool for comparison between different coins and between crypto as a whole and other asset classes.

Next, we want to look at the prospects for future earnings, which is a tough call in traditional asset classes, never mind crypto.

For future earnings, let’s treat crypto like other tech start-ups

Many crypto projects have little earnings to speak of, but in that respect they are arguably no different to a tech stock of a newish company still building its product and market penetration.

In fact investors are increasingly viewing the crypto world and tech stocks as similar, certainly if the price correlation between the two is anything to go by.

When the Nasdaq does well so too does the crypto complex – the two have, over the past few months, shown very high positive correlation, meaning their prices move in the same direction.

So if we should analyse crypto projects in a manner not dissimilar to how we treat tech stocks, then their technology and prospects for securing future market share in their addressable markets are key.

Therefore our selection has a bias towards blockchains that are solving the scaling problem, such as Solana, as well as those already generating profits, namely exchange tokens like BNB; those that make good use of the special characteristics of blockchain tech such as Lucky Block.

Others of our choices are essential to the ecosystem such as Chainlink, or have well-developed technology with a lead in markets that are likely to develop strongly over the near to medium term such as Decentraland and its NFT-powered metaverse technology.

With the exception of our first selection, Lucky Block, which is a brand new coin, we used a screener, to find crypto with the best 3 year Sharpe ration and a reported market capitalisation of $5 billion of greater.

So what is the Sharpe Ratio?

Invented by Nobel prize winning economists William Sharpe, the Sharpe ratio is a measure of risk-adjusted returns. So it analyses returns based on the amount of risk that was taken to achieve the given return.

Sharpe ratio assumes that the best assets are those that combine lower risk with high returns.

Using his version of the Sharpe ratio to measure risk-adjusted return, crypto analyst Willy Woo has shown that bitcoin – the oldest of all crypto assets – beats all other assets, including stocks and government bonds. This is a good illustration of our earlier contention that investing in crypto – or specifically, investing in bitcoin – is actually not as risky as common narratives suggest.

Bitcoin returns are less risky on a risk-adjusted basis over 4-year periods than other major asset classes

The ratio is determined by comparing the returns from an asset or portfolio of assets with the return from risk-free assets such as US Treasuries, and then dividing that product by the standard deviation of returns:

Sharpe Ratio = (Rp – Rf) / σp

| p | The particular portfolio of financial assets |

| Rp | The return expected from the portfolio |

| Rf | The risk-free rate of return |

| σp | The portfolio’s risk – the variance (sigma) is expressed as the standard deviation of returns |

We ran the numbers through a crypto screener, sorting for those with the best Sharpe ratio over three years.

A good Sharpe ratio figure is 1.00 and above, with 2.0 and above seen as very good.

An uneven distribution of returns can skew the results, which perhaps explains Solana’s very good score given its shorter lifespan. But with that proviso in mind, our table shows a range of 2.46 (Solana) to 1.46 (Crypto.com), so all have a good or very good Sharpe ratio for the most recent three-year period.

| Crypto asset | Ticker | Price (USD) | Current Market Cap | ATH (USD) | % Down from ATH | Sharpe Ratio (3 years) |

| Solana | SOL | 106.05 | US$33,677,407,907 | 259 | 38 | 2.46 |

| Polygon | MATIC | 1.88 | US$14,074,253,155 | 2.9049 | 3 | 2.00 |

| Avalanche | AVAX | 90.88 | US$22,290,019,055 | 146 | 44 | 1.92 |

| NEAR Protocol | NEAR | 11.86 | US$7,521,143,487 | 20.39 | 4 | 1.87 |

| Terra | LUNA | 53.95 | US$21,710,126,319 | 103 | 5 | 1.86 |

| Fantom | FTM | 2.14 | US$5,443,126,540 | 3.4708 | 63 | 1.68 |

| BNB | BNB | 415.57 | US$68,581,281,864 | 690 | 30 | 1.63 |

| Decentraland | MANA | 3.20 | US$5,858,671,840 | 5.84 | 46 | 1.59 |

| Chainlink | LINK | 17.66 | US$8,245,958,401 | 52.68 | 50 | 1.53 |

| FTX Token | FTT | 45.17 | US$6,228,183,754 | 85 | 33 | 1.48 |

| Ethereum | ETH | 3109.89 | US$371,429,419,830 | 4848 | 21 | 1.47 |

| Crypto.com Chain | CRO | 0.52 | US$13,128,401,387 | 0.9594 | 44 | 1.46 |

In the table above we find three exchange tokens. This is not too surprisingly because it is one of the best current use cases of a crypto token – to provide discounted fees to exchange users. However we have decided to exclude the exchange coin with the lowest market cap, namely FTX Token.

That leaves us with a total of 12 coins in all, including a new coin that does not feature in the Sharpe ratio table, Lucky Block.

With our parameters now set and results arrived at, let’s walk through the 12 most promising cryptocurrency to invest in 2022.

1. Lucky Block – lottery platform disrupter

Lucky Block started trading on public markets a little over two weeks ago and already commands a valuation of more than $600 million at a LBLOCK token price of $0.006108. Lucky Block is building a global lottery system that will be fairer and more transparent than the offerings from traditional incumbents.

Crypto has seen plenty of gambling products over the years – betting decentralised apps (dApps) predated the DeFi explosion as among the first to take off. But as far as lottery products goes Lucky Block is the first of a kind in a number of ways.

For one thing, the jackpot is divided in a unique way, so that 70% goes to winners, 10% is distributed to all token holders, 10% to charity and 10% back to Lucky Block for marketing and development.

Then there’s the Lucky Block transaction fee. Every time the token is sold on a decentralised exchange, a fee of 12% is incurred, of which 4% goes to the lottery pool, 4% to the liquidity pool, 3% to a NFT and gaming royalty fund and 1% burn.

The token is currently priced at around $0.005, having made its listing debut on a centralised exchange, LBank, for the first time today.

Token distribution for all token holders provides income stream

To receive the token distribution, token holders must hold in a DEX wallet such as Trust Wallet or Metamask. Trust Wallet is probably the better pick because Lucky Block is built on the Binance Smart Chain and Trust Wallet is a Binance product, hence the better integration with swaps on the chain.

The Lucky Block app is where the $5 tickets for the daily lotteries will be bought, starting on 21 March, assuming the team delivers on the announced scheduled. The first draw is on 25 March.

Lucky Block is an excellent example of a Web 3.0 product that has significant disruptive potential. Although it doesn’t have a Sharpe ratio because it only started trading two weeks ago, we think the risk-reward potential at these prices is strong. The world wide lottery market is valued at around $330 billion, according to QY Research Group.

Buy Lucky Block (LBLOCK) Now

2. Solana (SOL) – Layer 1 blockchain seen as an “Ethereum killer”

Solana is a decentralised Layer 1 blockchain that is highly scalable with transaction per second of up to 50,000. However, it is still experiencing teething problems that have led to a number of outages. Nevertheless its technology is gathering plentiful support.

The Pyth trading network supported by institutional trading houses in Chicago and New York is perhaps the most high profile success of the project. Its NFT and DeFi networks are expanding at pace too.

If you are still needing more information on how to buy cryptocurrency, then check out our guide.

Buy Solana on eToro Now

3. Polygon (MATIC) – Layer 2 blockchain for Ethereum

Polygon is designed to solve the problem of Ethereum’s lack of scalability in its current form. Its core is a composable modular system that makes it highly flexible. As such its Polygon SDK has become a favourite of blockchain developers.

It is a Layer-2 solution that has birthed infrastructures such as Plasma, Optimistic Rollups, zkRollups, and Validium as well as sidechains such as its Matic platform, that is the project’s native token..

4. Avalanche (AVAX) – DeFi and enterprise blockchain base layer

Avalanche is another platform for launching DeFi applications and enterprise blockchain deployments in an environment of interoperability with a view to scalability.

Developers can get up to speed relatively quickly because of its composable approach to creating applications and custom blockchains. The protocol went from strength to strength in 2021, leaping into the ranks of the top coins.

Buy Crypto on eToro Now

5. NEAR (NEAR) – using scalable sharding to solve scalability

NEAR uses a Proof-of-Stake consensus mechanism that features a sharding architecture to scale transaction throughput. Sharding can be though of a system that splits up the blockchain into distincy but connected parts to increase the efficiency of transaction processing.

As NEAR explains, it PoS sharding is unique in that it can “scale linearly with the number of shards, thereby having the ability to satisfy the demand for transactions as more and more users start to use NEAR”.

Buy Crypto on eToro Now

6. Terra (LUNA) – stablecoins to revolutionise payments

Terra is an algorithmically-governed, seigniorage stablecoin platform. Connected to it is a collection of fiat-pegged tokens and a stabilising asset called Luna.

Terraforma Labs in the South Korean company that developed the protocol. It has struck deals with a number of e-commerce partners in Asia to use its system, which aims at nothing less than the eradication of high costs and unnecessary friction in the payments system.

Buy Crypto on eToro Now

7. Fantom (FTM) – an under the radar Layer 1 blockchain

Fantom is another Layer-1 blockchain, but hasn’t yet received the same sort of attention as Solana. It uses a single consensus layer to underpin multiple possible execution chains.

The end goal of the project is the fashioning of an ecosystem of execution layers aimed at catering for a multitude of use cases, all the while enabling scalable and cheap transactions on its novel Lachesis Protocol.

Buy Crypto on eToro Now

8. Binance Coin (BNB) – coin of the world’s largest crypto exchange

Binance Coin is the native token of the Binance online exchange. It started llife as a way of providing exchange customers with cheap trading fees. Binance is today the largeset crypto exchange.

But is is also much more than an exchange having launched the Binance Smart Chain and the Smart Chain token which is a wrapped version of BNB. BSC is a fast-growing environment for decentralised applications.

If you want to delve a little deeper into which are the best crypto exchanges, read our guide to finding the one that fits your needs.

Buy Crypto on Binance

9. Decentraland (MANA) – NFT and metaverse pioneers

Decentraland is a decentralised, explorable, 3-D virtual reality platform, but without the need for VR goggles. It is built on the Ethereum blockchain.

The platform allows its users to take ownership of parcels of digital land, purchased with LAND tokens bought with the MANA native token. Users leverage NFT tech to create their own distinctive unique environments in a virtual world. Brands, companies and individuals have started flocking to its metaverse world.

Buy MANA on eToro Now

10. Chainlink (LINK) – secure oracle network essential for smart contracts

Chainlink is a decentralised oracle network that provides secure off-chain data feeds for smart contracts.

As such Chainlink could be described as essential middleware that brings smart contracts to life by allowing them to securely interact with external data and the changes in that data.

Buy Chainlink on eToro Now

11. Ethereum (ETH) – the king of decentralised application platforms

Ethereum is a distributed blockchain computing platform upon which smart contracts and decentralised applications (dapps) can be run. Its native token is ether (ETH). Its Ethereum Virtual Machine distributed computer means it can host applications and new coins supporting its ERC-20 standard can be layered on top of it.

The network is currently undergoing a major upgrade from proof of work to proof of stake, also known as Ethereum 2.0. Ethereum is the leading base platform of the DeFi sector.

Buy Ethereum on eToro Now

12. Crypto.com (CRO) – exchange, NFT marketplace and emergent smart contract platform

Formerly named Monaco and known for being among the first projects to introduce a crypto-linked Visa card. It has since rebranded as Crypto.com. Crypto.com Chain utilises Tendermint Core as its consensus engine.

The total supply of 100 billion has been issued, with 50% allocated to incentivising those providing services to the network to secure its integrity and transaction throughput.

Crypto.com has recently moved into the burgeoning NFT space. Crypto.com marketing is solid. Recently did a sponsorship deal with the famous Staples Center in Los Angeles, now rebranded as the Crypto.com Arena.

Buy NFTs on Crypto.com Now

Author: Gary McFarlane

Gary is the editor of business2community.com. He is also the former cryptocurrency analyst at interactive investor, the UK's second-largest investment platform. He has been active in the digital asset space since 2013, when he initiated coverage of bitcoin at respected investment monthly magazine Money Observer.… View full profile ›

Investing in Cryptocurrency Stocks

Zhiyuan Sun

Updated: March 22, 2022, 3:17 p.m.

Cryptocurrencies have quickly become the hottest investment that's gaining mainstream adoption. Markets for digital currencies such as Bitcoin (CRYPTO:BTC) were virtually unheard of back in 2012. But since then, it has grown into an industry worth more than $2 trillion and counting. This sudden surge in value and rapid evolution has created immense wealth for early crypto investors. As a result, there is huge interest in finding and investing in the next cryptocurrency unicorn.

With more than 11,000 different cryptocurrencies on the market -- and the world getting pushed further into the digital realm by COVID-19 -- investing in technologies that serve as the gateway between the blockchain cyberspace and our society could be even more lucrative than trying to guess which token will become the next Bitcoin or Ethereum (CRYPTO:ETH). And there is no shortage of innovative companies trying to bridge the gap between the two worlds.

Image source: Getty Images

Digital currency companies hold major potential

The original idea behind blockchain technology -- a digital ledger that automatically tracks transactions between parties and confirms ownership of a crypto asset -- was to create a borderless, peer-to-peer electronic cash payment system that's efficient and secure.

Investors can certainly invest in cryptos themselves, perhaps by buying small amounts of several different cryptocurrencies. But a better way to gain exposure to the sector is to invest in companies -- even bigger, more established companies -- that benefit from blockchain and crypto asset uptake. This is because the amount of revenue these crypto service providers derive from blockchain tech has seen explosive growth over the years.

Companies that adopt blockchain technology, especially those in finance, could then gain a huge edge over their traditional competitors in processing payments. Moreover, brokers that offer digital assets could also attract more customers than exchanges that only offer traditional assets such as stocks and bonds.

In keeping with that guidance, here are some of the best cryptocurrency stocks to consider:

Coinbase Global

Coinbase Global (NASDAQ:COIN), a top cryptocurrency trading exchange, made its IPO debut in April 2021. The company is a popular platform to purchase major cryptocurrencies such as Bitcoin, Ethereum (CRYPTO:ETH), and Cardano (CRYPTO:ADA), and it allows users to trade more than 50 altcoins.

To date, this crypto trading platform’s success has been contingent upon the increase in crypto prices -- which, in turn, has led to millions of new users creating accounts. Coinbase earns a small transaction fee every time someone places an order to buy or sell a cryptocurrency. But the company aspires to be more than just a place to trade. It also sponsors a debit card that allows consumers to spend from the balance in their digital wallet. What’s more, it launched a cloud platform for companies using and storing digital currencies.

Coinbase offers two game-changing innovations. The first is bringing the practice of asset loans -- which were previously only available to affluent investors -- to the masses. Users can pledge their Bitcoin or other cryptocurrencies as collateral on the platform and receive a low-interest loan to cover their everyday expenses. This way, investors don’t have to sell their assets when emergencies arise, allowing their principal to continue compounding while they deal with matters at hand.

The second is the rising adoption of Coinbase’s blockchain analytics by governments and financial institutions alike. Because most blockchains operate on a public ledger, the company can harness this data and monitor for illicit transactions and wallet addresses.

Suppose hackers managed to break through an individual's computer and demand ransom in the form of Bitcoin to unlock the machine. In that case, Coinbase could then match the hacker's wallet address with millions of know-your-customer (KYC) data points stored on its platform. This could help law enforcement track down the flow of funds and apprehend the cybercriminals -- building greater trust in the crypto space.

[Cryptocurrency] is a new asset class, but like real estate, there's only so much Earth. So it's defined, and therefore this moving price of the commodity is just how much, within this finite class of a commodity, this new asset class, how much people value it or want it.

David Gardner, co-founder, The Motley Fool

Square and PayPal Holdings

At the heart of every digital payment protocol is the absence of central intermediaries (and, therefore, lower costs for businesses and consumers). Thus, the next steps in business expansion for Square (NYSE:SQ) and PayPal Holdings (NASDAQ:PYPL) was to enable users to purchase and hold cryptocurrencies within a digital wallet.

In late 2017, Square’s Cash App consumer-facing application started allowing Bitcoin trading. In 2020 and 2021, Bitcoin was a huge revenue generator for Square, although the trading feature did little to help Square’s bottom line.

However, the company is helping to foster the use of Bitcoin among its business users (through the Square ecosystem), and it could become a top platform for transacting cryptos between companies and their customers. This is especially promising for disrupting traditional international transactions where banks often charge hefty foreign exchange fees. But for now, Cash App is mostly used for cryptocurrency trading, complete with basic banking features.

One can say similar things about PayPal’s Venmo digital wallet and peer-to-peer payments app, which unlocked crypto trading in early 2021. At the launch, Venmo supported the trading of Bitcoin, Bitcoin Cash (CRYPTO:BCH), Ethereum, and Litecoin (CRYPTO:LTC). With the most users of any peer-to-peer money movement app, Venmo could become a leading cryptocurrency platform with this new feature. It serves as a solid access point for investors who wish to buy major cryptocurrencies and then use them to purchase altcoins or access decentralized finance applications.

Canaan and Hut 8 Mining

Bitcoin mining has changed dramatically over the past few years. Nowadays, companies such as Canaan (NASDAQ:CAN) design high-powered, application-specific integrated circuit (ASIC) machines specifically for the purpose of brute force guessing the network's correct hash (passcode). Canaan's next-generation Avalon ASICs can make tens of trillions of guesses every second as to the right hash to validate blocks on the Bitcoin network, which is millions of times more powerful than AMD (NASDAQ:AMD) and Nvidia's (NASDAQ:NVDA) latest GPUs. Sales have been skyrocketing for some time due to the device's affordability and relatively low energy consumption -- meaning greater profits for miners.

Speaking of miners, one of the most popular Bitcoin mining stocks is Hut 8 Mining (NASDAQ:HUT). The company, based in Canada, commands a sizable minority stake on the overall Bitcoin network, and it generates very strong cash flows compared to revenue. Instead of selling the Bitcoins it mines on the market, Hut 8 Mining maximizes returns for shareholders by lending them out and farming yields, leading to compounded returns. Furthermore, investors can be assured that the company won't be embroiled in environmental concerns regarding the practice. Hut 8 Mining uses a mix of wind, solar, and natural gas sources for its electricity with decade-long leases, ensuring the sustainability of its operations.

Nvidia and AMD

Chipmakers Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) don’t deal with cryptocurrencies directly, but these two semiconductor companies are the leading designers of graphics processing units (GPUs). Best known for powering high-end video game graphics, GPUs now enable computing-intensive applications such as data centers, artificial intelligence, and the creation of crypto assets.

Cryptography and blockchain creation require immense computational power, and GPUs are well-suited for the job. Back in 2018, booming cryptocurrency prices were a driving force for Nvidia’s and AMD's stock price increases as digital currency miners (people using their computers to create new units of digital assets) scrambled to purchase GPUs for the task. GPUs remain a fundamental piece of hardware for the creation and management of crypto assets. Nvidia even launched a new lineup of chips specifically for crypto mining in early 2021.

Both Nvidia and AMD recently announced acquisitions that will likely further cement their positions as leaders in chip technology. Nvidia is trying to purchase ARM Holdings, a licensor of chip architecture design for data centers and smartphones, and AMD is planning to acquire field-programmable chip leader Xilinx (NASDAQ:XLNX). Both Nvidia and AMD are poised to continue taking market share of the semiconductor industry and lead the way in developing more emerging technologies such as blockchain.

Get a list of promising small caps to help shape your portfolio.

Take advantage of the changing finance industry, and invest in its most promising stocks.

FinTech companies combine two of the most talked-about investment sectors: Financials and Technology.

There's a reason Warren Buffett loves bank stocks. Learn how to make money in the banking investing.

Facebook and Shopify

Facebook (NASDAQ:FB) has long been at work developing a new cryptocurrency called Diem (formerly Libra). Diem is envisioned as a global financial payment and infrastructure platform accessible to everyone, including the nearly one-third of the global population that doesn't have bank accounts. The project has had some setbacks, including losing Visa (NYSE:V), Mastercard (NYSE:MA), and PayPal from its consortium of high-profile members. Government regulators have expressed skepticism about Diem since cryptocurrency is still largely unregulated, and some reports suggest Diem may need to be pegged to the U.S. dollar or another government-issued currency. Nevertheless, work on the project is continuing, and Facebook is reportedly revamping efforts to achieve its development goals. Diem could be released in 2021.

E-commerce infrastructure and software provider Shopify (NYSE:SHOP) allows merchants using its platform to accept cryptocurrencies as payment. It recently deepened that capability by integrating with cryptocurrency payments processor CoinPayments. In spring 2020, Facebook Shops was announced as a new offering for small business e-commerce, with Shopify as a third-party software provider powering the new online stores. Together, Facebook and Shopify are primed to benefit if the adoption of digital assets continues among small businesses and entrepreneurs.

Robinhood Markets

Robinhood Markets (NASDAQ:HOOD) is a popular discount brokerage app that allows users to buy stocks, options, rare metals, and now, cryptocurrencies. Investors can buy and sell Bitcoin, Ethereum, and Dogecoin (CRYPTO:DOGE) commission-free on the platform 24/7. The company already holds tens of billions of crypto assets under custody, with crypto trading revenue now comprising a significant portion of overall sales.

The sky is truly the limit as Robinhood can combine its commission-free model with scaling the number of cryptocurrencies on the platform, thereby gaining a massive competitive advantage over both traditional and decentralized exchanges. What's more, the company could offer the same crypto analytics services as Coinbase to further promote trust in this roaring sector and boost its adoption.

CME Group

CME Group (NASDAQ:CME) operates the world’s largest financial derivatives exchange allowing investors to trade futures, which bet on or secure the future price of an asset, and options, which grant investors the option to sell or buy an asset in the future at a predetermined price. CME Group's exchange trades a diverse assortment of assets, including agricultural and mining products, energy, stocks, and currencies. It’s the latter that makes CME Group a crypto stock.

At the end of 2017, CME established the first market for bitcoin futures, and, at the start of 2020, the company created a market for options on Bitcoin futures. As of February 2021, Ether (units of the crypto platform Ethereum) also has futures available on the exchange. Establishing an exchange for derivatives of the best-known cryptocurrencies has given Bitcoin and Ethereum some extra legitimacy and provided a way for digital currency owners (both individuals and a growing list of businesses that accept cryptocurrencies as payment) to mitigate risk from changes in cryptocurrency prices. Cryptocurrency derivatives are still a small market for CME Group, but adding more exchanges for crypto assets in the future is possible -- and even likely.

The beauty of crypto stocks

The best part about cryptocurrency stocks is that most of them are not pure plays on the industry -- giving investors the reward of ample diversification. Cryptocurrencies are quite volatile and can cause wild swings in the revenue and earnings of companies with sector exposure. However, the crypto realm is rapidly gaining mainstream adoption. In August 2021, United Wholesale Mortgage (NYSE:UWMC), the second-largest mortgage lender in the country, announced it would accept Bitcoin as mortgage payments from its customers. Expect further momentum in crypto stocks as more and more companies join in the blockchain revolution.

How to Buy Bitcoin

Investing in Bitcoin (BTCUSD) can seem complicated, but it is much easier when you break it down into steps. Investing or trading Bitcoin only requires an account at a service or an exchange, although further safe storage practices are recommended.

There are several things that aspiring Bitcoin investors need: a cryptocurrency exchange account, personal identification documents if you are using a Know Your Customer (KYC) platform, a secure connection to the Internet, and a method of payment. It is also recommended that you have your own personal wallet outside of the exchange account. Valid methods of payment using this path include bank accounts, debit cards, and credit cards. It is also possible to get bitcoin at specialized ATMs and via P2P exchanges.

Key Takeaways

- The value of Bitcoin is derived from its adoption as a store of value and payment system, as well as its finite supply and decreasing inflation.

- Although it is nearly impossible for Bitcoin itself to be hacked, it is possible for your wallet or exchange account to be compromised. This is why practicing proper storage and security measures are imperative.

- You can also purchase bitcoin through mainstream services such as PayPal and Robinhood.

- One way to own bitcoin indirectly is by investing in companies that have bitcoin on their balance sheets.

Before You Buy Bitcoin

Privacy and security are important issues for Bitcoin investors. Anyone who gains the private key to a public address on the Bitcoin blockchain can authorize transactions. Private keys should be kept secret—criminals may attempt to steal them if they learn of large holdings. Be aware that anyone can see the balance of a public address you use. The flip side to this public information is that an individual can create multiple public addresses for themselves. Thus, they can distribute their stash of Bitcoin over many addresses. A good strategy is to keep significant investments at public addresses that are not directly connected to ones that are used in transactions.

Anyone can view a history of transactions made on the blockchain—even you. Although transactions are publicly recorded on the blockchain, identifying user information is not. On the Bitcoin blockchain, only a user's public key appears next to a transaction—making transactions confidential but not anonymous. In that sense, Bitcoin transactions are more transparent and traceable than cash because all of them are available for public view, unlike private cash transactions. But Bitcoin transactions also have an element of anonymity built into their design. It is very difficult to trace the transacting parties—i.e., the sender and recipient of the bitcoin—on the cryptocurrency's blockchain.

International researchers and the FBI have claimed they can track transactions made on the Bitcoin blockchain to users' other online accounts, including their digital wallets. For example, if someone creates an account on Coinbase, they must provide their identification. Now, when that person purchases bitcoin, it is tied to their name. If they send it to another wallet, it can still be traced back to the Coinbase purchase that is connected to the account holder's identity. This should not concern most investors because Bitcoin is legal in the U.S. and most other developed countries.

Be sure to check out the legal, regulatory, and tax status of purchasing and selling bitcoin where you live before transacting.

Buying Bitcoin

| Bitcoin Returns | |||

|---|---|---|---|

| 1-Day | 1-Week | 1-Month | 1-Year |

| -0.3% | -0.4% | -8.3% | -39.3% |

Source: TradingView

We have broken down the steps to buying bitcoin below. Remember that you still need to do your research and select the best option for yourself based on your circumstances.

Step 1: Choose a crypto trading service or venue

The first step in buying bitcoin consists of choosing a crypto trading service or venue. Popular trading services and venues for purchasing cryptocurrencies include cryptocurrency exchanges, payment services, and brokerages. Out of these, cryptocurrency exchanges are the most convenient option because they offer a breadth of features and more cryptocurrencies for trading.

Signing up for a cryptocurrency exchange will enable you to buy, sell, and hold cryptocurrency. It is generally best practice to use an exchange that allows its users to withdraw crypto to their own personal online wallet for safekeeping. For those looking to trade Bitcoin or other cryptocurrencies, this feature may not matter.

There are many types of cryptocurrency exchanges. Because the Bitcoin ethos is about decentralization and individual sovereignty, some exchanges allow users to remain anonymous and do not require users to enter personal information. Such exchanges operate autonomously and are typically decentralized, which means they do not have a central point of control.

Although such systems can serve nefarious purposes, they can also provide services to the world's unbanked population. For certain categories of people—refugees or those living in countries with little to no infrastructure for government credit or banking—anonymous exchanges can help bring them into the mainstream economy.

Right now, however, most popular exchanges are not decentralized and follow laws that require users to submit identifying documentation. In the United States, these exchanges include Coinbase, Kraken, Gemini, FTX, and Binance.US, to name a few. These exchanges have grown significantly in the number of features they offer.

The crypto universe has grown rapidly in the last decade, with many new tokens competing for investor dollars. With the exception of Bitcoin and certain prominent coins, such as Ethereum, not all of these tokens are available at all exchanges. Each exchange has its own set of criteria to determine whether to include or exclude the trading of certain tokens.

Coinbase, Kraken, and Gemini offer Bitcoin and a growing number of altcoins. These three are probably the easiest on-ramps to crypto in the entire industry. Binance caters to a more advanced trader, offering more serious trading functionality and a better variety of altcoin choices. FTX, a fast-growing crypto exchange that has garnered a multibillion-dollar valuation, offers a restricted number of altcoins to U.S. investors. However, traders outside the U.S. have a greater choice of tokens on its platform.

An important thing to note when creating a cryptocurrency exchange account is to use safe Internet practices. This includes two-factor authentication and a long, unique password that includes a variety of lowercase letters, capitalized letters, special characters, and numbers.

El Salvador made Bitcoin legal tender on September 7, 2021. It was the first country to do so. The cryptocurrency can serve as currency for any transaction where the business can accept it. The U.S. dollar continues to be El Salvador's primary currency.

Step 2: Connect your exchange to a payment option

After you have chosen an exchange, you will need to gather your personal documents. Depending on the exchange, these may include pictures of a driver's license or Social Security card, as well as information about your employer and source of funds. The information you may need can depend on the region you live in and the laws within it. The process is largely the same as setting up a typical brokerage account.

After the exchange has verified your identity, you will be asked to connect a payment option. At most exchanges, you can connect your bank account directly or you can connect a debit or credit card. Although you can use a credit card to purchase cryptocurrency, it is not a good idea because cryptocurrency price volatility could inflate the overall cost of purchasing a coin.

Bitcoin is legal in the United States, but some banks may question or even stop deposits to crypto-related sites or exchanges. It is a good idea to check to make sure that your bank allows deposits at your chosen exchange.

There are varying fees for deposits via a bank account, debit, or credit card. It is important to research the fees associated with each payment option to help choose an exchange or to choose which payment option works best for you.

Exchanges also charge fees per transaction. These fees can either be a flat fee (if the trading amount is low) or a percentage of the trading amount. Credit cards incur a processing fee in addition to the transaction fees.

Step 3: Place an order

You can buy bitcoin (or other cryptocurrencies) after choosing an exchange and connecting a payment option. In recent years, cryptocurrency exchanges have slowly become more mainstream. They have grown significantly in terms of liquidity and their breadth of features. The operational changes at cryptocurrency exchanges parallel the change in the perception of cryptocurrencies. An industry that was once thought of as a scam or one with questionable practices is slowly morphing into a legitimate one that has drawn interest from all the big players in the financial services industry.

Now, cryptocurrency exchanges have gotten to a point where they have nearly the same level of features as their stock brokerage counterparts. Crypto exchanges today offer a number of order types and ways to invest. Almost all crypto exchanges offer both market and limit orders, and some also offer stop-loss orders. Of the exchanges mentioned above, Kraken offers the most order types. Kraken allows for market, limit, stop-loss, stop-limit, take-profit, and take-profit limit orders.

Aside from a variety of order types, exchanges also offer ways to set up recurring investments, allowing clients to dollar-cost average into their investments of choice. Coinbase, for example, lets users set recurring purchases for every day, week, or month.

Step 4: Safe storage

Bitcoin and cryptocurrency wallets are a place to store digital assets more securely. Having your crypto outside of the exchange and in your personal wallet ensures that only you have control over the private key to your funds. It also gives you the ability to store funds away from an exchange and avoid the risk of your exchange getting hacked and losing your funds.

Although most exchanges offer wallets for their users, security is not their primary business. We generally do not recommend using an exchange wallet for large or long-term cryptocurrency holdings.

Some wallets have more features than others. Some are Bitcoin only, and some offer the ability to store numerous types of altcoins. Some wallets also offer the ability to swap one token for another.

When it comes to choosing a Bitcoin wallet, you have a number of options. The first thing you will need to understand about crypto wallets is the concept of hot wallets (online wallets) and cold wallets (paper or hardware wallets).

Hot wallets

Online wallets are also known as hot wallets. Hot wallets are wallets that run on Internet-connected devices such as computers, phones, or tablets. This can create vulnerability because these wallets generate the private keys to your coins on these Internet-connected devices. Though a hot wallet can be very convenient in the way you are able to access and make transactions with your assets quickly, storing your private key on an Internet-connected device makes it more susceptible to a hack.

This may sound farfetched, but hot wallet holders who haven't set up enough security run the risk of losing funds to theft. This is not an infrequent occurrence, and it can happen in a number of ways. For example, boasting on a public forum such as Reddit about how much bitcoin you hold while you are using little to no security and storing it in a hot wallet would not be wise. That said, these wallets can be made secure so long as precautions are taken. Strong passwords, two-factor authentication, and safe Internet browsing should be considered minimum requirements.

These wallets are best for small amounts of cryptocurrency or cryptocurrency that you are actively trading on an exchange. You could liken a hot wallet to a checking account. Conventional financial wisdom would say to hold only spending money in a checking account while the bulk of your money is in savings accounts or other investment accounts. The same could be said for hot wallets. Hot wallets encompass mobile, desktop, web, and exchange account custody wallets.

As mentioned previously, exchange wallets are custodial accounts provided by the exchange. The user of this wallet type is not the holder of the private key to the cryptocurrency that is held in this wallet. If an event were to occur wherein the exchange is hacked or your account becomes compromised, you would lose your funds. The phrase "not your key, not your coin" is heavily repeated within cryptocurrency forums and communities.

Cold wallets

The simplest description of a cold wallet is that it is not connected to the Internet and therefore stands at a far lesser risk of being compromised. These wallets can also be referred to as offline wallets or hardware wallets. These wallets store a user's private key on something that is not connected to the internet and can come with software that works in parallel so that the user can view their portfolio without putting their private key at risk.

Perhaps the most secure way to store cryptocurrency offline is via a paper wallet. A paper wallet is a wallet that you can generate off of certain websites. It then produces both public and private keys that you print out on a piece of paper. The ability to access cryptocurrency in these addresses is only possible if you have that piece of paper with the private key. Many people laminate these paper wallets and store them in safe deposit boxes at their bank or even in a safe in their home. These wallets are meant for high-security and long-term investments because you cannot quickly sell or trade bitcoin stored this way.

A more common type of cold wallet is a hardware wallet. A hardware wallet is typically a USB drive device that stores a user's private keys securely offline. Such wallets have serious advantages over hot wallets because they are unaffected by viruses that could infect one's computer. With hardware wallets, private keys never come into contact with your network-connected computer or potentially vulnerable software. These devices are also typically open source, allowing the community to determine their safety through code audits rather than a company declaring that they are safe to use.

Cold wallets are the most secure way to store your bitcoin or other cryptocurrencies. But they require more technical knowledge to set up.

A good way to set up your wallets is to have three things: an exchange account for buying and selling, a hot wallet to hold small to medium amounts of crypto you wish to trade or sell, and a cold hardware wallet to store larger holdings for long-term durations.

How to Buy Bitcoin With PayPal

You can also buy bitcoin through payment processor PayPal Holdings, Inc. (PYPL). There are two ways to purchase bitcoin using PayPal. The first and most convenient method is to purchase cryptocurrencies using your PayPal account that is connected to a payment mechanism, such as a debit card or bank account. The second option is to use the balance of your PayPal account to purchase cryptocurrencies from a third-party provider. This option is not as convenient as the first because very few third-party sites allow users to purchase bitcoin using the PayPal button.

Four cryptocurrencies—Bitcoin, Ethereum, Litecoin, and Bitcoin Cash—can be purchased directly through PayPal. With the exception of those who live in Hawaii, residents of all states can either use their existing PayPal accounts or set up new ones. You can also use your cryptocurrencies to purchase products and services through the "Checkout With Crypto" feature.

To set up a crypto account with PayPal, the following information is required: name, physical address, date of birth, and tax identification number.

It is not possible to use a credit card to purchase Bitcoin using PayPal. During the buying process, PayPal will display a price for the cryptocurrency. But that price is subject to rapid change due to the volatility of cryptocurrency markets. It is a good idea to make sure you have more than the price you budgeted for the purchase in your bank account.

When you buy bitcoin directly from PayPal, it makes money off the crypto spread or the difference between Bitcoin's market price and its exchange rate with USD. The company also charges a transaction fee for each purchase. These fees depend on the dollar amount of the purchase. For example, a flat fee of $0.50 is charged for purchases between $100 and $200. Thereafter, the fee is a percentage of the overall dollar amount. For example, a fee of 2% of the total amount is charged for crypto purchases between $100 and $200.

One disadvantage of purchasing cryptocurrencies through PayPal is that you cannot transfer the crypto outside the payment processor's platform. Therefore, it is not possible for you to transfer your purchased bitcoin from PayPal's wallet to an external crypto wallet or your personal wallet.

The other disadvantage of using PayPal is that very few exchanges and online traders allow the use of the payment processor to purchase payment. eToro is among the few online traders that allow the use of PayPal to purchase bitcoin on its platform.

How to Buy Bitcoin With a Credit Card

The process for purchasing bitcoin with credit cards is similar to the process for buying it with debit cards or through automated clearing house (ACH) transfers. You will need to enter your credit card details with the exchange or online trading firm and authorize the transaction. In general, however, it is not a good idea to purchase bitcoin with credit cards. There are a couple of reasons for this.

First, not all exchanges allow bitcoin purchasing with credit cards due to associated processing fees and the risk of fraud. This decision may work out in the best interests of customers. This is because credit card processing can tack additional charges onto such transactions. Thus, in addition to paying transaction fees, you will end up with processing fees that the exchange may pass onto you.

The second reason is that credit card purchases can be expensive. Credit card issuers treat bitcoin purchases as cash advances and charge hefty fees and interest rates on such advances. For example, American Express and Chase both count purchases of cryptocurrencies as cash advance transactions. Thus, if you purchase $100 worth of bitcoin using an American Express card, you will pay $10 (current cash advance fee for such transactions) plus an annual percentage fee of 25%. What's more, the credit card company also limits you to $1,000 worth of bitcoin purchases per month.

An indirect method of purchasing bitcoin using a credit card is to get a Bitcoin rewards credit card. Such cards function like your typical rewards credit card except they offer rewards in the form of bitcoin. So, they invest the cash back earned from purchases into Bitcoin. One example of a Bitcoin rewards card is the BlockFi Bitcoin Rewards Credit Card. Beware, however, that the annual fees for these cards may be steep and there may be additional costs associated with the conversion of fiat currencies into crypto.

Although exchanges such as Coinbase or Binance remain among the most popular ways to purchase Bitcoin, they are not the only way.

Alternative Ways to Buy Bitcoin

Bitcoin ATMs

Bitcoin ATMs act like in-person bitcoin exchanges. Individuals can insert cash into a machine and use it to purchase bitcoin that is then transferred to online wallets for users. Bitcoin ATMs have become increasingly popular in recent years—even retail giant Walmart Inc. (WMT) is testing a pilot program that will offer its customers the option of purchasing bitcoin. Coin ATM Radar can help to track down the closest machines.

However, ATMs are an expensive option. There are two charges associated with ATM bitcoin purchases: a purchase fee and a conversion fee for converting a fiat currency to bitcoin. Both fees are fairly steep compared to those of other options. For example, the worldwide average purchase fee at Bitcoin ATMs is 8.4% (of the purchase amount) and 5.4% for sales at ATMs.

Be aware, however, that Bitcoin ATMs have increasingly required government-issued IDs as of early 2020.

P2P exchanges

Unlike decentralized exchanges, which match buyers and sellers anonymously and facilitate all aspects of the transaction, there are some peer-to-peer (P2P) exchange services that provide a more direct connection between users. LocalBitcoins is an example of such an exchange. After creating an account, users can post requests to buy or sell bitcoin, including information about payment methods and prices. Users then browse through listings of buy and sell offers, choosing the trading partners with whom they wish to transact.

LocalBitcoins facilitates some aspects of the trade. Although P2P exchanges do not offer the same anonymity as decentralized exchanges, they allow users the opportunity to shop around for the best deal. Many of these exchanges also provide rating systems so users have a way to evaluate potential trade partners before transacting.

Mainstream brokerages

Very few mainstream brokerages offer bitcoin purchase and trading capabilities due to the uncertainty surrounding the regulatory status of cryptocurrencies. Robinhood Markets, Inc. (HOOD), an app popular with retail investors, is one exchange that offers crypto trading facilities. It charges 0% commission for cryptocurrency trades and purchases and makes money from payment for order flow, passing its trading volume onto other trading platforms or brokerages.

The absence of a commission fee may be an enticing prospect for beginners, but there are a couple of catches to that offer. First, Robinhood does not have the breadth of features and coins offered by prominent crypto exchanges like Coinbase. Robinhood had enabled trading on its platform for seven cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Bitcoin SV, Dogecoin, and Ethereum Classic. In contrast, you can trade more than 100 cryptocurrencies on Coinbase. The exchange also offers various order types to minimize risk and offset losses during trading.

The Robinhood platform also does not have a hosted wallet. Therefore, if you want to purchase cryptocurrencies through Robinhood, you will have to factor in additional costs for an online wallet provider.

Bitcoin and other cryptocurrency investments are NOT protected by insurance from the Securities Investor Protection Corporation (SIPC). At regular brokerages, the agency protects against the loss of securities and cash in brokerage accounts containing up to $500,000, with a $250,000 cash limit. That facility is not available to customers of cryptocurrency exchanges. Cryptocurrency exchanges like Coinbase have crime insurance to protect their infrastructure against hacks. But that insurance does not protect individual customers from password theft.

How to Sell Bitcoin

You can sell bitcoin at the same venues where you purchased the cryptocurrency, such as cryptocurrency exchanges and P2P platforms. Typically, the process of selling bitcoin on these platforms is similar to the process for purchasing it.

For example, you may only be required to click a button and specify an order type (i.e., whether the cryptocurrency should be sold instantly at available prices or whether it should be sold to limit losses) to conduct the sale. Depending on the market composition and demand at the venue, the offering price for Bitcoin may vary. For example, exchanges in South Korea traded bitcoin at a so-called kimchi premium during the run-up in its prices back in 2018.

Cryptocurrency exchanges charge a percentage of the crypto sale amount as fees. For example, Coinbase charges 2.49% of the overall transaction amount as fees.

Exchanges generally have daily and monthly withdrawal limits. Therefore, cash from a large sale may not be immediately available to the trader. There are no limits on the amount of cryptocurrency you can sell, however.

What Are the Steps for Purchasing Bitcoin?

The process to purchase bitcoin consists of four steps: choosing a venue or exchange to place your order, selecting a payment method, and ensuring safe storage for your purchased cryptocurrency. Depending on the type of venue chosen in the first step, there might be additional steps involved in the process. For example, if you purchase the cryptocurrency through Robinhood you might need to factor in additional costs for an online wallet and custody of your bitcoin because it does not offer these services.

What Are the Most Popular Venues for Buying Bitcoin?

The most popular venues for buying bitcoins are cryptocurrency exchanges, brokerages (crypto and mainstream), and payment services like PayPal. You can also buy Bitcoin from P2P exchanges. For indirect ownership of bitcoin, you can invest in companies that hold the cryptocurrency on their balance sheets, such as Tesla, Inc. (TSLA) or MicroStrategy Incorporated (MSTR).

How Much Should I Expect to Pay to Purchase Bitcoin?

Typically, the price for purchasing bitcoin consists of a fee per trade plus the cost to convert a fiat currency (generally dollars) to bitcoin. (Cryptocurrency exchanges and payment services make money off of this conversion spread.) The fee per trade is a function of the dollar amount of the trade. A higher trade amount will carry higher fees. The overall purchase cost also depends on features offered by the venue. For example, Robinhood does not currently offer an online wallet for storing bitcoin. Therefore, you will need to budget for online wallet costs for your purchase.

Besides Cryptocurrency Exchanges, Where Else Can I Buy Bitcoin?

You can also buy bitcoin at the following locations:

- Through Bitcoin ATMs

- Through online payment services like PayPal

- At mainstream brokerages like Robinhood

Is My Bitcoin Purchase Protected by SIPC?

No, your bitcoin purchase is not protected by SIPC. At certain exchanges, like Coinbase, fiat balances in individual accounts may be FDIC-insured to the tune of $250,000 per account.

The Bottom Line

The process for purchasing bitcoin is slightly more complicated than the process to buy regular equity or stock. This is mainly because the cryptocurrency ecosystem and infrastructure are not as well developed as those of mainstream trading.

A bitcoin purchase process consists of four steps: selecting a service or venue for the purchase, connecting with a payment method, placing an order, and ensuring safe storage for your purchased cryptocurrency. Each of these steps requires research and a careful assessment of the pros and cons of each service. You can also buy bitcoin at Bitcoin ATMs or from payment services like PayPal and mainstream brokerages like Robinhood.

-